Reuven Glick, group vice president at the Federal Reserve Bank of San Francisco, states his views on the current economy and the outlook.

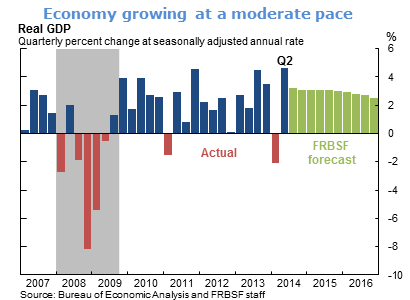

- Real GDP grew at an annual rate of 4.6% in the second quarter, according to the latest release from the Bureau of Economic Analysis. This represented an upward revision from the prior estimates of 4.2% in late August and 4.0% in July.

- The second-quarter growth rate indicates a significant rebound from the first-quarter dip of –2.1%, which was attributable to transitory factors, including bad weather, weak exports, and inventory cutbacks. Contributions from greater consumption, stronger exports, and inventory buildups boosted activity in the second quarter. After taking away the inventory bounceback effect, our forecast is for continued moderate growth at a pace of about 3%.

- The most recent economic data for the third quarter have been largely in line with expectations. Retail sales and consumer spending in August were healthy. The manufacturing sector continues to expand. However, housing data remain somewhat soft. Construction spending and existing home sales eased in August, although new home sales were up.

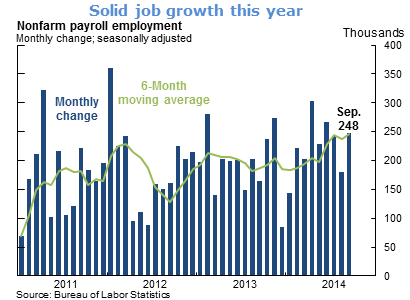

- Labor market conditions have continued to improve. Nonfarm payrolls rose by 248,000 in September, and total payroll employment in July and August were revised upward. The recent data are consistent with the view that the relatively weak August figures resulted from temporary factors such as a grocers strike in New England. Over the past six months, the economy has added an average of 245,000 jobs per month, the strongest stretch of gains since before the recession.

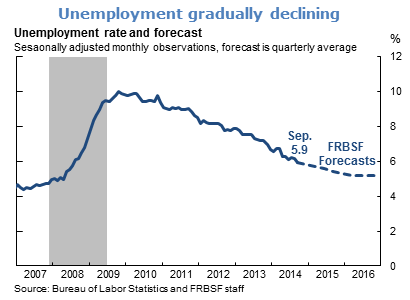

- Employment growth this year has helped lower the unemployment rate, which edged down from 6.1% in August to 5.9% in September. However, after remaining steady in recent months, labor force participation declined in September to 62.7%, the lowest rate in several decades. We expect the unemployment rate to continue to fall.

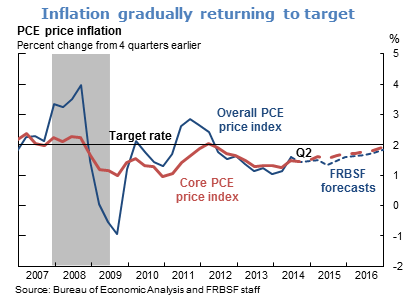

- Inflation remains subdued. Overall and core consumer prices, as measured by the price index for personal consumption expenditures, rose just 1.5% in August compared with a year earlier. This is below the Federal Open Market Committee’s long-run objective of 2%. We forecast that inflation will slowly increase toward the 2% objective.

- There are several risks to the outlook, particularly from abroad. These include the prospect of weaker foreign demand from abroad. Japan is growing more slowly after its consumption sales tax increase in April. Although Japan’s monetary policy has been highly accommodative, concerns exist about its ability to achieve its goal of 2% inflation and whether another tax increase scheduled for next year will derail the economy further.

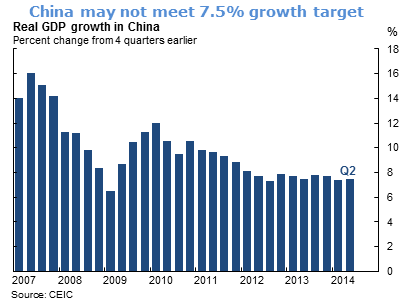

- Since 2011, China’s growth has been declining due to slower world growth, as well as efforts by Chinese policymakers to rely less on investment and exports and more on domestic consumption as an engine of growth. More recently, falling nationwide property and home sales have become an increasing drag on the economy, raising concerns about whether the country will meet its official target growth rate of 7.5%.

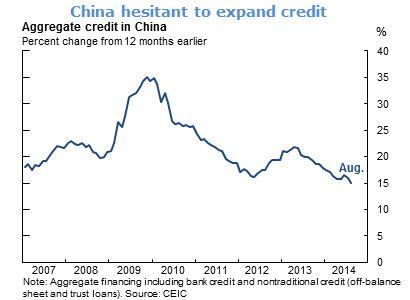

- The overhang of the massive expansion of credit China created to engineer its recovery from the global recession of 2008–09 has created concerns about credit risk. This is particularly true in local government infrastructure projects and the property sector where much of the money flowed.

- China now faces the challenge of whether to expand credit again, implement more targeted accommodative policies, or accept lower growth.

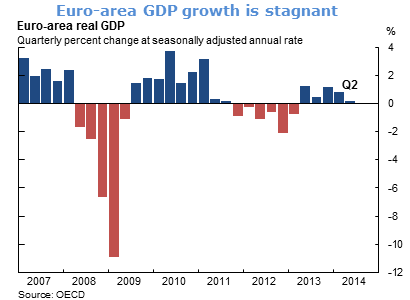

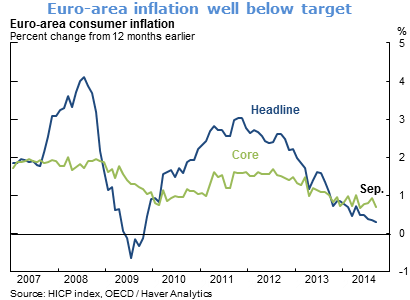

- After emerging from its most recent recession in mid-2013, euro-area GDP growth has stalled. Low growth has been accompanied by extremely low inflation. Headline inflation slowed to 0.3% in September over the 12 months prior. This is well below the European Central Bank’s (ECB) target of “below, but close to,” 2%. The euro area’s disappointing performance has fueled uncertainty about its economic recovery and fears about the threat of deflation.

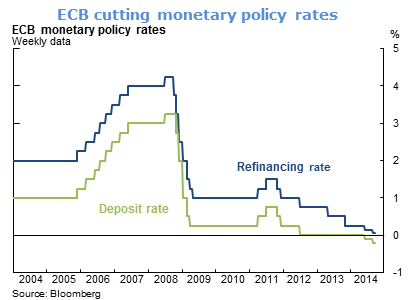

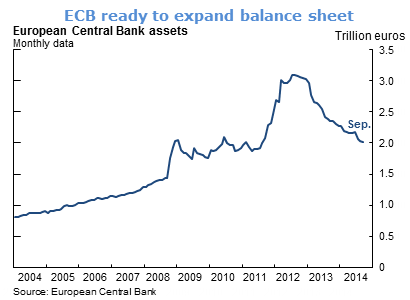

- These concerns have prompted efforts by the ECB to further stimulate the economy by cutting its main policy rates further. Since June, it has lowered its refinancing rate by 20 basis points to 0.05% and its deposit rate by 20 basis points to –0.2%. In addition, the ECB announced efforts to expand its balance sheet by extending more credit to commercial banks through targeted long-term refinancing operations and by purchasing asset-backed securities and covered bonds. However, the extent to which these measures will add to the balance sheet and stimulate the economy are unclear.

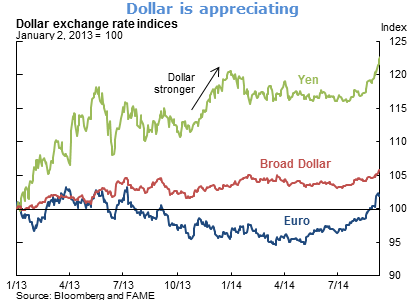

- The recent appreciation of the dollar poses another risk to the U.S. outlook. Demand for the dollar has been spurred by weaker conditions abroad, global geopolitical tensions, and by expectations that U.S. interest rates will rise in the next year. The appreciation of the dollar is likely to be a drag on U.S. net exports and growth, as well as dampen import costs and U.S. inflation.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.