Simon Kwan, senior research advisor at the Federal Reserve Bank of San Francisco, states his views on the current economy and the outlook.

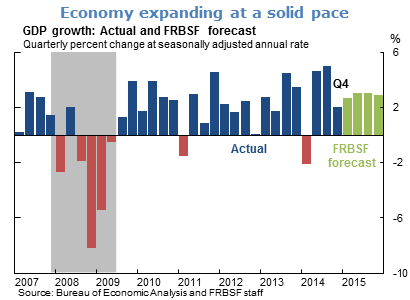

- Real GDP growth in the fourth quarter of 2014 was 2.6% according to the initial estimate from the Bureau of Economic Analysis. Inventory investment and net exports data through December were weaker than expected, suggesting the initial GDP estimate is likely to be revised downward. Nevertheless, the economy grew at a solid pace during the second half of 2014, and the underlying strength in private final demand suggests the economy entered 2015 with good momentum. With labor market conditions showing signs of further improvement, as well as the tail wind from lower energy prices, and the sizable continuing monetary stimulus, we expect growth in 2015 to average about 3% before slowing a bit in 2016.

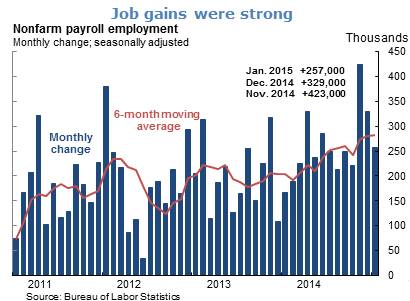

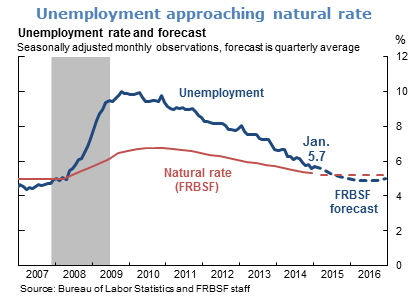

- The employment report for January showed further improvement in labor market conditions. The total number of jobs created during November through January was the largest three-month gain since 1997. Although the unemployment rate ticked up by 0.1 percentage point, the increase was due to a slightly higher labor force participation rate. We expect the unemployment rate to continue to fall, reaching our estimate of the natural rate later this year.

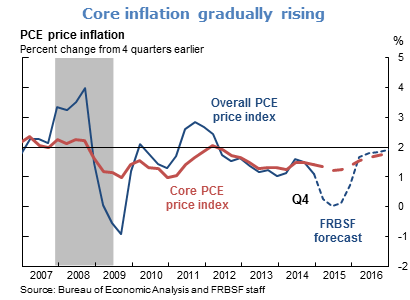

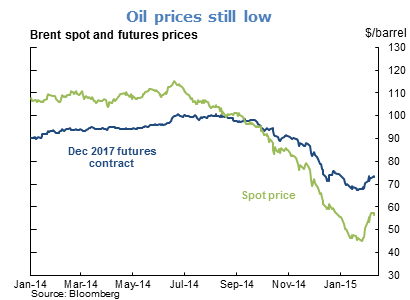

- The sizable decline in energy prices lowered headline inflation. Lower oil prices are expected to continue to work their way through the economy in the near future, and are likely to push headline inflation down further during the first half of this year. Assuming energy prices stabilize around the current level, inflation is expected to turn back up. After the transitory effects of lower energy prices subside, we expect diminishing slack in the economy to generate inflationary pressure that will gradually bring core personal consumption expenditures price inflation back closer to the Federal Open Market Committee’s longer-run objective of 2%.

- Lower oil prices are expected to boost economic growth on net, other things being equal. Lower energy prices raise household purchasing power and improve sentiment, thereby supporting consumption. Lower costs for energy inputs should lead to higher profits for most businesses, which could encourage higher capital investment and hiring. On the other hand, lower oil prices reduce the profitability of oil producers and restrain domestic extraction and investment in the oil industry.

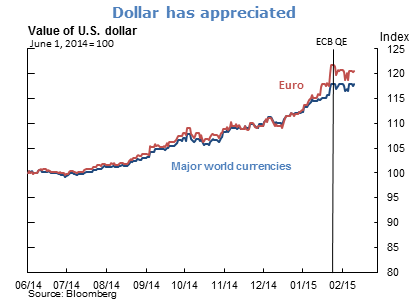

- The positive effect of lower energy prices on growth nearly offsets the negative effect of the stronger U.S. dollar, which weighs on GDP growth by making U.S. exports less competitive in the world market while boosting imports. A stronger dollar also contributes to disinflationary pressures. The dollar’s appreciation has been driven by the growing divergence in economic fundamentals between the United States and the rest of the world, as well as the anticipated expansion of asset purchases by the European Central Bank (ECB).

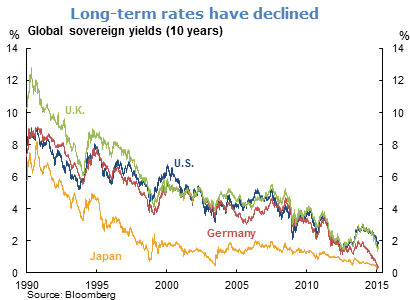

- With U.S. economic growth gaining momentum and the expectation that the Federal Reserve will start removing monetary accommodation by raising the federal funds rate sometime this year, long-term interest rates should be rising. On the contrary, the yield on 10-year Treasury bonds is currently about 0.7 to 0.8 percentage point lower than it was a year ago. To the extent that lower long-term interest rates mean looser financial conditions, this has the potential to complicate the return to a more normal monetary policy stance.

- Several advanced foreign economies are also experiencing declines in long-term interest rates. The yields on 10-year sovereign debts in both Germany and Japan are only about 0.3 percentage point. Relative to those yields, the yield on U.S. Treasury bonds, while compressed, may still look attractive.

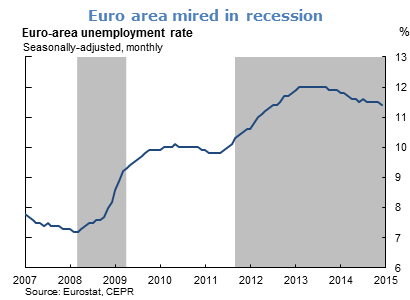

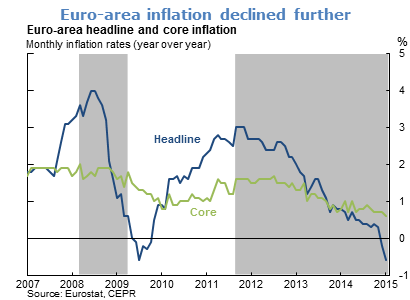

- While the economic outlook in the United States looks promising, international developments pose risks. For example, the euro area is still mired in a recession, with the double-digit unemployment rate showing few signs of abating. Both the headline and the core inflation rates in the euro area are falling dangerously close to their historic lows, and the ECB’s key policy rate is at the zero lower bound. The expansion of ECB asset purchases to include public-sector debt is expected to bolster growth and inflation in the euro area, which could ultimately benefit the world economy. Still, other risks remain, from the uncertain results of the Greek government’s renegotiation with its creditors to the economic slowdown in China.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.