Òscar Jordà, vice president at the Federal Reserve Bank of San Francisco, states his views on the current economy and the outlook.

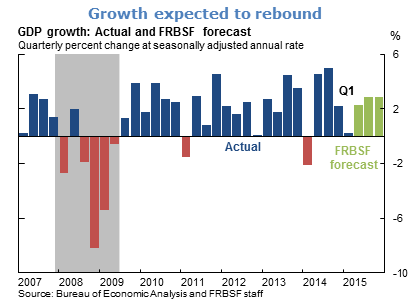

- The initial estimate of real GDP growth for the first quarter of 2015 came in at 0.2%, lower than expected and well below the 2.4% annual growth rate for 2014.

- The weakness in the first quarter is attributable to a number of factors. Unusually harsh weather at the beginning of the year in parts of the country kept consumers away from stores. Net exports fell unusually rapidly. The appreciation of the dollar over the past few months made U.S. products more expensive abroad, and sluggish economic conditions in Europe and parts of Asia reduced foreign demand for U.S. goods. In addition, the West Coast dockworkers’ labor dispute disrupted the normal flow of goods to export markets. The decline in net exports pushed real GDP growth down by more than one full percentage point.

- The massive drop in oil prices during the second half of 2014 caused domestic oil and gas extraction industries to consolidate operations significantly. In turn, spending on new equipment and exploration of new wells and mines fell nearly 50%. Although lower oil prices benefit consumers, restrained investment in the energy sector left its mark on real GDP growth.

- Because many of these factors are transitory, we remain optimistic that the economy will rebound from the first-quarter weakness. The dollar appears to be stabilizing, the outlook for our European trade partners is improving, and the West Coast port slowdown has been resolved, thus alleviating some of the conditions dampening net exports. Oil prices appear to be stabilizing, which should help investment in that sector normalize.

- In addition, monetary policy remains highly accommodative, growth in employment and real incomes is solid, and household wealth is improving as house prices revive. All of these elements suggest the economy is on surer footing than the first-quarter reading of real GDP growth indicates. In light of these conditions, we expect real GDP growth to move above its trend rate of 2% during the second half of 2015. Absent other forces, and with employment and inflation near or at mandate levels, we expect the economy to settle around trend in the second half of 2016.

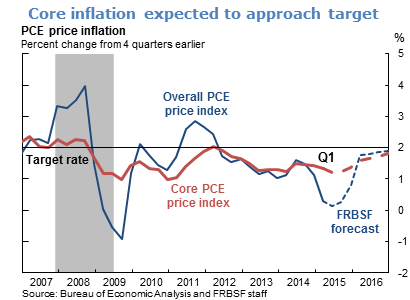

- Several factors continue to weigh down inflation, which rose only 0.3% at an annual rate as measured by the headline personal consumption expenditures (PCE) price index. These factors include the stronger dollar, which made imported products cheaper and put pressure on domestic producers to keep prices down, and gasoline prices, which remain near recent lows. Core PCE inflation, which removes volatile food and energy prices, proved more resilient, rising 1.3% percent over the past 12 months. As some of the downward forces on inflation dissipate and real GDP growth picks up, we expect core PCE price inflation to move gradually toward the Federal Open Market Committee’s 2% target.

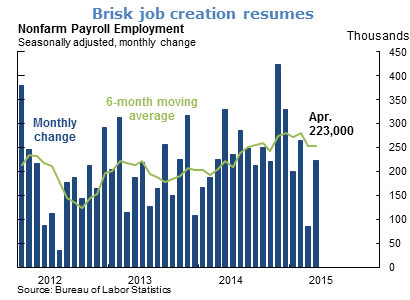

- Employment data show that 223,000 new jobs were created in April. This is close to the average rate of job creation in 2014 and marks a significant rebound from the 85,000 jobs added in March. The employment cost index shows signs that labor compensation is starting to pick up. These two factors should provide a more solid foundation for household income, which in turn should boost consumer spending.

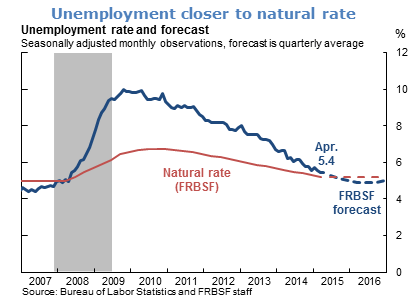

- The unemployment rate, at 5.4% in April, continues to drift toward our 5.2% estimate of the natural rate. We expect a recovery in economic growth in the second half of this year to push the unemployment rate below the natural rate around the middle of this year and keep it there for the duration of our forecast horizon.

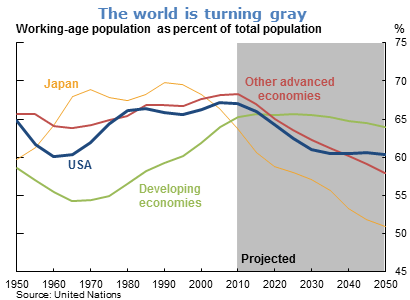

- Looking further into the future, some economists have raised concerns about how a maturing workforce will affect long-term U.S. economic growth. The rapid aging of the working population in Japan since the mid-1990s is indicative of things to come. This has become more visible in the industrialized world including the United States and eventually will also affect many developing economies.

- Aging populations are expected to consume less and save more. This, in combination with other factors such as low nominal interest rates and slower productivity growth, has led to some concern that the United States and other economies could enter a new normal of low economic growth. This phenomenon has been dubbed secular stagnation.

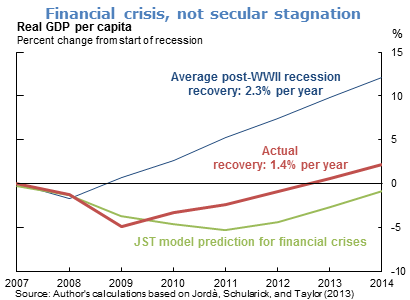

- Although the U.S. economy has grown at a lower rate than the average following all post-World War II recessions and exhibits some of the characteristics of a secular stagnation scenario—low interest rates, low inflation, and low growth—these conditions are also in line with another explanation. The recent pattern of deep recession and gradual recovery is consistent with what would be expected following a financial crisis. In fact, statistical analysis suggests that the U.S. recovery thus far has actually proceeded at a somewhat better rate than the historical experience of other countries after a severe financial crisis would predict.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.