Mark Spiegel, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of January 14, 2016.

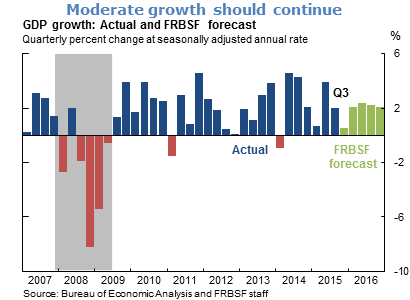

- Real GDP has grown at an average annual rate of 2.2% over the first three quarters of 2015. However, a number of recent indicators suggest weaker growth in the fourth quarter, including declines in construction and existing home sales, as well as weaker manufacturing data and a sharp decline in inventory buildup.

- Despite the fourth quarter weakness, we expect real GDP to rebound in the first quarter of 2016, due to inventory payback and continued consumption strengths, and grow at an average annual rate of around 2¼% over the year as a whole.

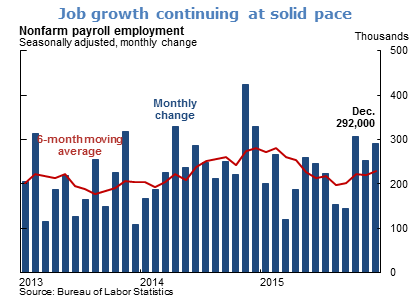

- The labor market continues to surprise on the upside. The December payroll report was very strong, as the U.S. economy added 292,000 jobs and figures for October and November were revised upwards sharply. The six-month moving average remains well above 200,000 jobs per month, portending continued labor market tightening.

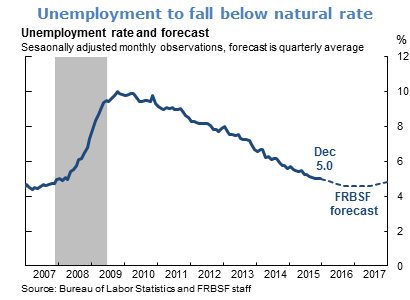

- The unemployment rate held steady in December at 5.0%, as increased labor force participation accompanied the growth in payroll employment. This suggests that some workers who were classified as out of the labor force have resumed searching for jobs, presumably due to improved expectations about chances for finding employment. As a result of the strong pace of job creation, we expect the unemployment rate to decline later this year to levels below the long-run natural rate of about 5%.

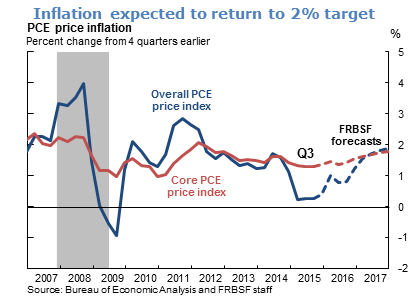

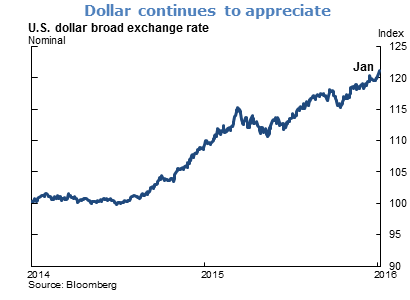

- Inflation remains substantially below the Federal Open Market Committee’s stated 2% target. Oil prices have decreased dramatically, with West Texas Intermediate oil falling below $30 a barrel. Other commodity prices have fallen sharply as well. In addition, the broad trade-weighted value of the dollar has continued to rise, also putting downward pressure on import prices and inflation.

- We project that headline inflation in 2016 will come in between 1% and 1¼% and rise gradually towards the 2% target as the effects of transitory shocks to energy prices and the exchange rate dissipate and as improving labor market conditions strengthen wage growth.

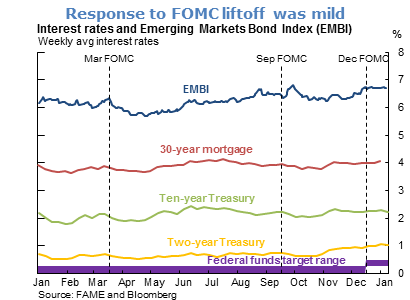

- The FOMC “lifted off” after its December 2015 meeting, raising the federal funds rate target range from 0–25 to 25–50 basis points. This policy change was accompanied by only mild financial market volatility, with muted movements in market yields before and after the announcement date. This suggests that the Federal Reserve successfully prepared financial markets for the liftoff announcement through its prior statements and communications.

- Yields on emerging market securities, as measured by the Emerging Market Bond Index (EMBI), also demonstrated little volatility immediately after the FOMC announcement.

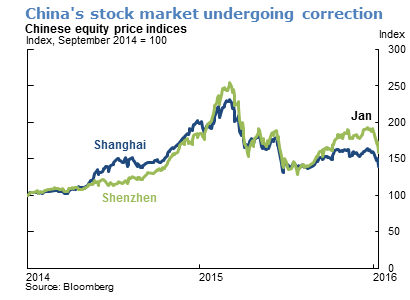

- More recently, U.S. financial market volatility as measured by the VIX rate has turned up, largely because of concerns about financial volatility overseas, particularly in China. Chinese equity markets enjoyed a strong rally between the fall of 2014 and the summer of 2015, with values more than doubling. However, after a sharp selloff in the latter half of 2015, the Chinese government intervened in a variety of forms to stabilize equity prices. These efforts appeared to be temporarily successful, but prices resumed their downturn near the end of 2015 in response to additional weak news about Chinese economic fundamentals, particularly in its manufacturing sector. Technical factors, such as the on-off use of “circuit breakers” to limit sharp price changes, also appear to have exacerbated equity market volatility. Since the beginning of 2016, China’s stock market is down around 15%, more than erasing the overall gains in 2015.

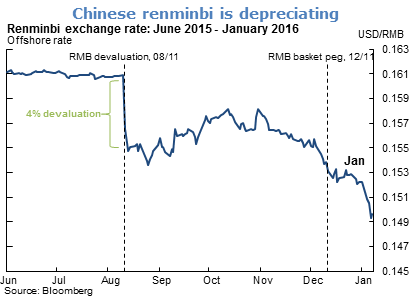

- Another source of concern for Chinese investors has been the value of the renminbi. In August 2015, Chinese policymakers surprised markets with a devaluation of the renminbi against the dollar of approximately 4% and allowed greater flexibility in the exchange rate. The currency subsequently stabilized, but renewed depreciation of the renminbi occurred with the December 11 announcement that China would begin pegging its currency to a broad basket of currencies.

- The continued appreciation of the dollar against the renminbi and other currencies poses a downside risk to the U.S. inflation outlook.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.