Rob Valletta, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of May 12, 2016.

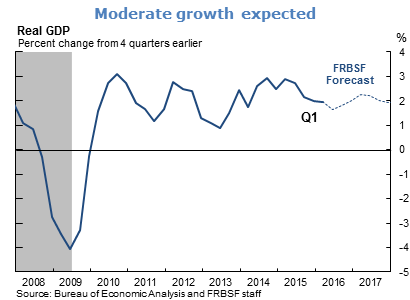

- The U.S. Bureau of Economic Analysis (BEA) reported real GDP grew at a sluggish 0.5% annual pace in the first quarter of 2016. Weak measured first-quarter growth has been a consistent pattern in recent years, and research conducted at the San Francisco Fed suggests regular seasonal fluctuations are not fully captured by the BEA’s current adjustment methodology. Using a more complete seasonal adjustment suggests that growth exceeded 2% in the first quarter and, relative to four quarters earlier, GDP growth remains in line with last year’s pace. We expect this pace to continue through 2016, spurred by further growth in household income and spending.

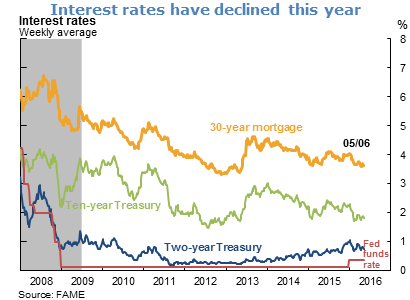

- Increasingly supportive financial conditions have bolstered the growth outlook. Interest rates have declined this year across a broad spectrum of maturities and risk classes. In addition, the U.S. dollar has retraced some of its earlier appreciation, and domestic stock market indexes are up more than 10% from their mid-February lows.

- Following a quarter-point increase in December, the Federal Open Market Committee (FOMC) has left the federal funds rate target unchanged. The accommodative stance of monetary policy aims to support further improvement in labor market conditions and a return to 2% inflation. The FOMC has emphasized that future increases in the funds rate target will be gradual, with the timing dependent on labor market data, the inflation outlook, and readings on financial and international conditions.

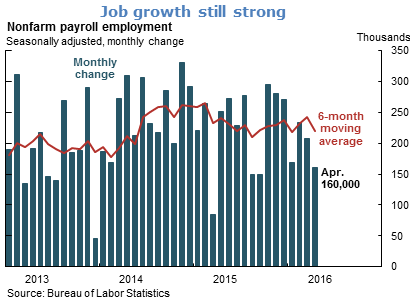

- Job growth has stayed strong, with the six-month average gains remaining above 200,000. Though the April reading of 160,000 new jobs represents a slowdown from prior months, it is well above the level needed to support further improvement in overall labor market conditions, estimated to be around 100,000 or fewer new jobs per month.

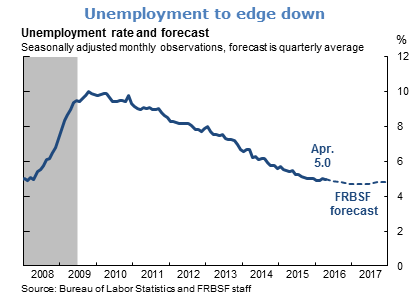

- Unemployment has been largely unchanged this year, and April’s unemployment rate of 5% equals our estimate of its natural or normal rate. This flat rate of unemployment reflects an ongoing pickup in labor force participation, consistent with improving labor market conditions. As the labor market expansion continues, we expect the unemployment rate to fall a bit further and then head back up toward the natural rate beginning in mid-2017.

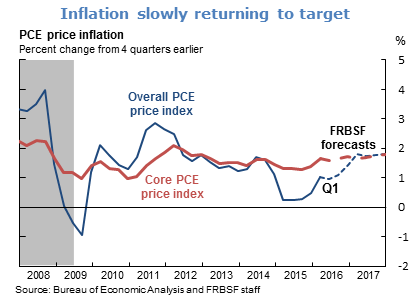

- Over the past few quarters, inflation has moved up noticeably, reflecting in part the expected waning of disinflationary effects from the prior dollar appreciation and energy price declines. We anticipate that inflation will continue to firm, with the overall and core measures converging on the FOMC’s 2% target over the next two years.

- In addition to strong job growth and the low rate of unemployment, other indicators of strength in the labor market include ample job vacancies and high rates of voluntary quitting by workers who seek improving job opportunities.

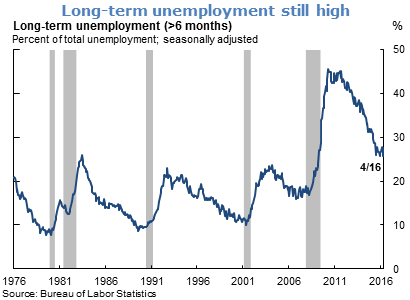

- By contrast, the elevated rate of long-term unemployment suggests labor market conditions may not have fully returned to normal. Long-term unemployment, defined as active job search for longer than six consecutive months, still remains above the historical highs observed prior to the Great Recession.

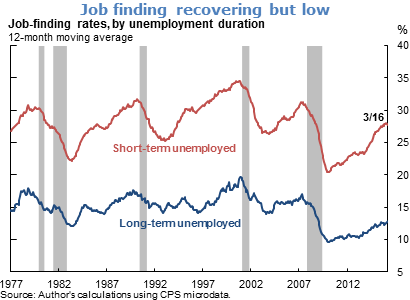

- Movement in long-term unemployment over the business cycle largely reflects changes in job-finding rates. During and immediately after the Great Recession, finding a job was difficult. As the economy improved and job opportunities increased, job-finding rates recovered, especially for those unemployed for less than six months. This in turn reduced the fraction of those who subsequently become long-term unemployed. However, job-finding rates for the long-term unemployed remain somewhat low as a result of long-term changes in the composition and behavior of the labor force.

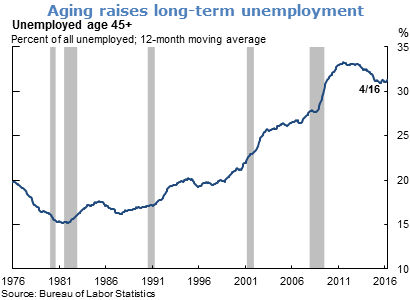

- Older workers are less likely to lose jobs than younger workers but are more likely to undertake prolonged searches when job loss occurs. As the population ages, older job seekers have comprised a rising share of the total unemployment pool, which mechanically increases long-term unemployment.

- Rising labor force attachment for women during the 1980s and 1990s has also contributed to higher long-term unemployment. Fewer labor force transitions by women has lengthened reported unemployment and contributed to a secular increase in overall long-term unemployment.

- These higher rates of long-term unemployment among both older workers and women generally reflect more dedication to sustained job searches, rather than a lack of education or other skills that would typically limit job prospects. Hence, the currently high long-term unemployment does not appear to signal broad labor market weakness.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.