Zheng Liu, senior research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of October 13, 2016.

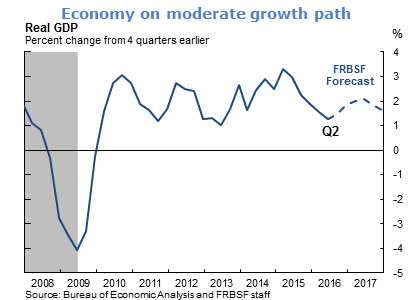

- The Bureau of Economic Analysis revised its estimate for second quarter real GDP growth to an annualized rate of 1.4%, up from the prior estimate of 1.1%, and following 0.8% growth in the first quarter. Real GDP growth has been supported by solid consumer spending but dampened by weak business investment spending and slower inventory accumulation.

- Recent data show that growth, while somewhat weaker than expected, has picked up its pace relative to the first half of the year. We expect real GDP growth to accelerate to over 2% in the second half of 2016, as households, supported by solid personal income growth, continue to spend. Although the headwinds from weak foreign growth and elevated uncertainty is likely to remain in the near term, we expect real GDP growth to be closer to trend in the 1½% to 2% range in 2017.

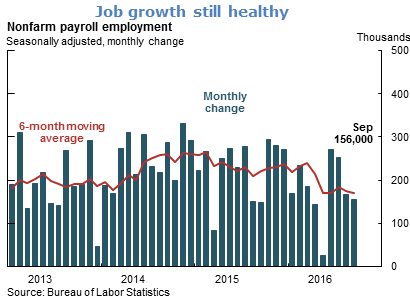

- The September employment report showed continued strength in the labor market with nonfarm payroll employment in September increasing by 156,000 jobs. Monthly job gains have averaged 169,000 over the past six months and 204,000 over the past twelve months. Although the September reading represents a slowdown from previous months, it is well above the estimated “breakeven” range of 60,000 to 100,000 new jobs per month needed to absorb new entrants in the job market.

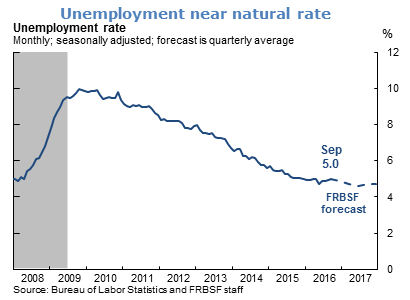

- The unemployment rate ticked up to 5% in September from 4.9% in August and remains close to our estimate of the natural rate of unemployment. Since the beginning of this year, the unemployment rate has stayed relatively flat. A broader measure of labor market utilization that includes people who want to work but have not searched recently as well as those who are working part time but would rather work full time has also flattened out since the beginning of this year. Solid payroll gains and the relatively constant measures of unemployment indicate that more people have been entering the labor force and successfully finding jobs. We anticipate modestly above-trend GDP growth will push the unemployment rate down a bit further over the next year.

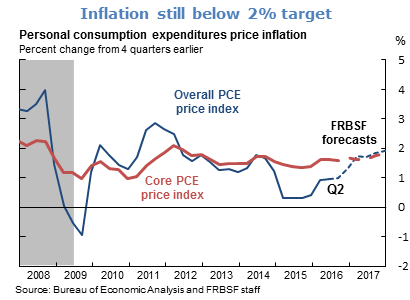

- Inflation continues to run below the Federal Reserve’s 2% target. Overall inflation, as measured by the change in the personal consumption expenditures (PCE) price index, was 1.0% in the 12 months through August. Very low overall inflation is largely attributable to lower energy prices and the strengthening of the dollar. Core inflation, which strips out movements in energy and food prices, rose to 1.7% over the past 12 months. Average hourly earnings grew slightly in August bringing the 12-month increase in wages to 2.6%. We expect that diminishing slack as well as the fading effects of the dollar’s appreciation and declining energy prices will push core and overall PCE inflation up gradually towards 2%.

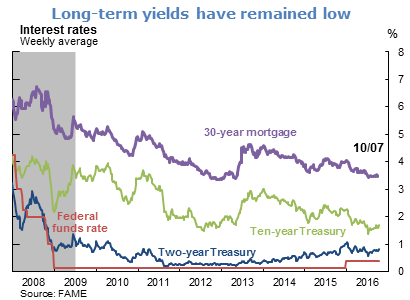

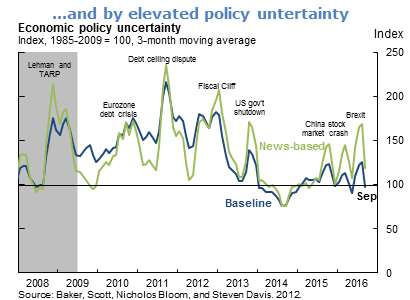

- Since the Federal Reserve raised its funds rate target range in December 2015, U.S. Treasury yields have remained at historically low levels. The lower interest rates reflect declines in the natural interest rate driven by slower trend GDP growth, aging of the population, and recent spikes in global uncertainty that have increased safe-haven demand for U.S. assets.

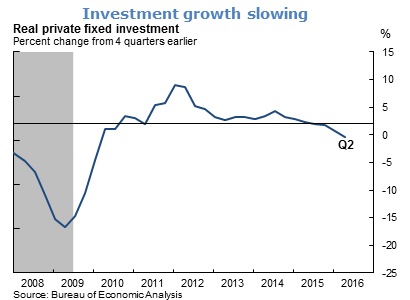

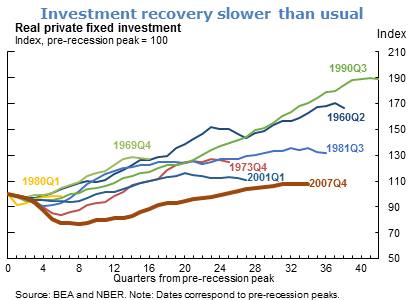

- Growth of real private fixed investment has decelerated since 2014. Much of this deceleration can be attributed to earlier dollar appreciation and energy price declines. However, investment growth has continued to slow this year even though the effects of dollar and energy price changes have generally dissipated. This observation suggests other factors are at work.

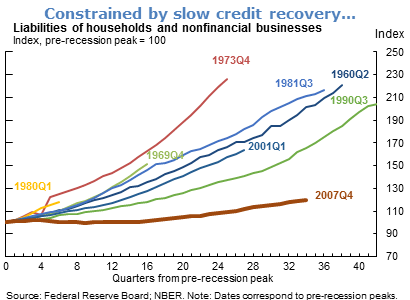

- One such factor is the slowdown in potential GDP growth that has dampened credit demand and investment. Another factor is credit supply, which has recovered more slowly than usual since the Great Recession due to tightened financial regulations such as the Dodd-Frank Act.

- A third factor that may have contributed to slow investment growth is elevated economic policy uncertainty. Recent events such as Britain’s intended exit from the European Union (Brexit) and the upcoming U.S. elections have led to spikes in measures of policy uncertainty. When uncertainty rises, firms become less willing to undertake capital spending projects, causing investment growth to slow.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.