Daniel Wilson, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of February 9, 2017.

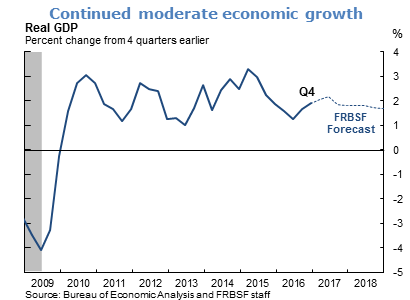

- Real GDP ended 2016 growing at an annual pace of just under 2%, consistent with an ongoing moderate expansion. Looking ahead, we expect GDP growth to continue at a similar or slightly lower rate, between 1½% and 2% over the next couple of years.

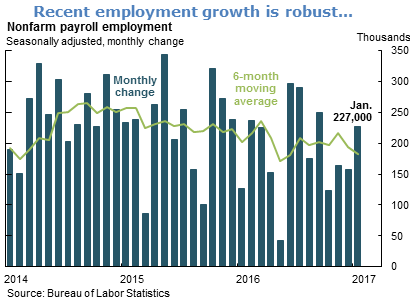

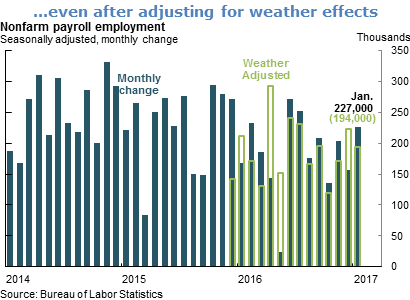

- Recent employment gains have been robust. December’s net change of 157,000 jobs in nonfarm payroll employment was somewhat below private analysts’ expectations, while January’s net change of 227,000 jobs was somewhat above expectations. Both surprises can be partly explained by the effects of weather: December was unseasonably cold and snowy on average across the nation, while January was a bit warmer than normal. The six-month moving average of employment changes indicates a recent trend of around 190,000 net new jobs created each month.

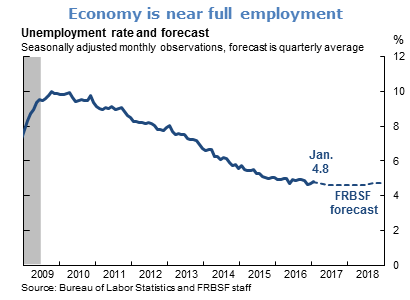

- While some indicators of labor market conditions suggest a modest degree of remaining slack, January’s unemployment rate of 4.8% is close to 5%, our estimate of the natural rate of unemployment. If economic growth and inflation continue at this pace, and monetary policy continues to normalize over the next 2 to 3 years, we expect unemployment to gradually move toward 5% over this time frame.

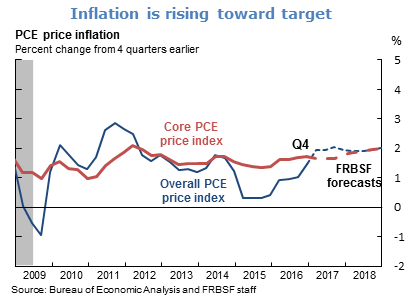

- Inflation has remained below the Federal Reserve’s 2% objective for several years, but has been gradually increasing towards the target rate since early 2016. Overall consumer prices, as measured by the price index for personal consumption expenditures, grew at 1.5% over the course of 2016. The pace of overall inflation accelerated toward the end of the year as energy prices rose. Last year, core inflation, which excludes changes in food and energy prices, accelerated more gradually. The price index of core personal consumption expenditures rose 1.7% over the course of the year. Given the robust labor market conditions, we expect overall and core consumer price inflation to rise gradually to 2% over the next couple years.

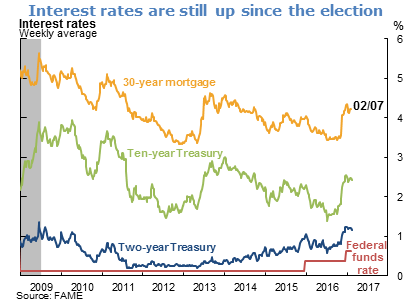

- Interest rates rose sharply in the weeks after the November 2016 election, but have stabilized more recently. The Federal Reserve raised its Federal funds target rate by ¼ percentage point in December. Based on futures markets, financial market participants expect two or three more quarter-point increases in the target rate in 2017.

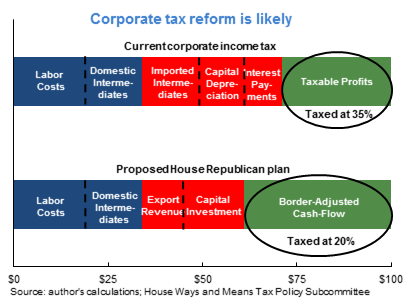

- An important factor for our near-term economic outlook is possible changes to fiscal policy. In particular, a tax reform plan has been put forward by the House Republican leadership and many of its features appear to have support from the new Administration. The reform plan calls for changes to both the corporate and individual income tax system, generally aimed at reducing statutory tax rates while broadening the tax base. On the corporate side, the tax base would be based on domestic cash flow, adjusted for imports and exports, instead of global profits.

- An example helps illustrate the corporate tax reform proposal. Consider a corporation with $100 of global revenues. Under the current tax system, the company deducts from that $100 its labor costs, domestic and imported intermediate expenses (such raw materials, contractor services, and domestic and imported goods for resale), depreciation of capital assets, and net interest payments to arrive at its taxable profits, with a 35% tax rate. Under the proposed reform plan, the company deducts labor costs and domestic intermediate expenses as under the current system, but would no longer be able to deduct the cost of imported intermediates, while getting a new deduction for export revenues. Companies also would be able to fully deduct capital investment up front but could no longer deduct interest payments. The remainder, “border-adjusted” cash-flow, would be taxed at a lower rate, of 20% in the House plan.

- The border-adjustment feature has received much attention and raised concerns among import-intensive industries that it could raise their relative tax burden and reduce their competitiveness. The effects of border-adjustment on imports and exports would largely depend on how quickly and fully the value of the dollar would adjust to offset this change in the tax treatment of imports and exports.

- Changes to the taxation of personal income have also been proposed. These changes include flattening the tax schedule, lowering the top rate, reducing or capping itemized deductions, and eliminating the Alternative Minimum Tax (AMT) and estate taxes.

- There is a great deal of uncertainty about whether a tax reform package will be enacted and about its size, timing, and details. That said, our baseline expectation is that a tax reform plan aimed at base broadening and rate reductions will be enacted later this year. We have penciled in a modest boost from tax reform of 0.1% to 0.2% per year to real GDP growth through boosts to consumer spending and corporate investment over the next few years.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.