Mark Spiegel, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of July 13, 2017.

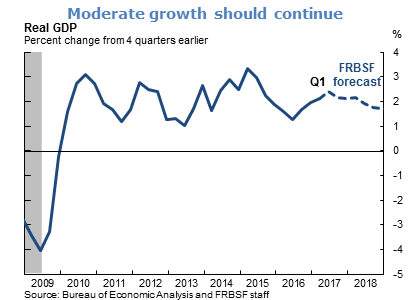

- Recent data indicate that the economy continues to grow at a moderate pace and should pick up from the relatively weak first quarter GDP growth rate of 1.4%. Stronger household spending, which had been weak earlier in the year, as well as improvements in business fixed investment and foreign economic conditions are all contributing to the economy’s current strength. We expect annual GDP growth to average about 2% overall for 2017, before falling back to our estimate of potential output growth of around 1½ to 1¾%.

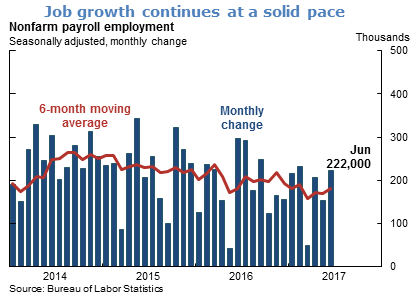

- The continued moderate economic growth has led to further labor market strengthening. Nonfarm payroll employment increased by 222,000 in June, and job gains have averaged close to 180,000 over the past six months. This pace is well above that needed to absorb new labor force entrants.

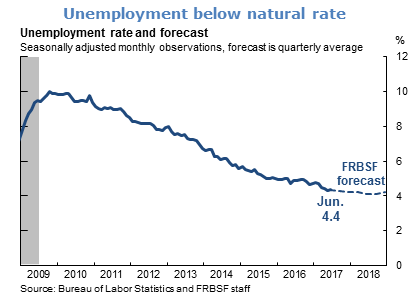

- The rapid rate of job creation has led to continued downward pressure on unemployment. Unemployment in June was 4.4%, below the level considered consistent with long-run full employment. Unemployment did tick up one-tenth of a percent from May, but this was primarily attributable to increased labor force participation. Broader unemployment measures, such as those that include marginally attached workers and people who are working part-time but would prefer full-time employment, have fallen this year as well.

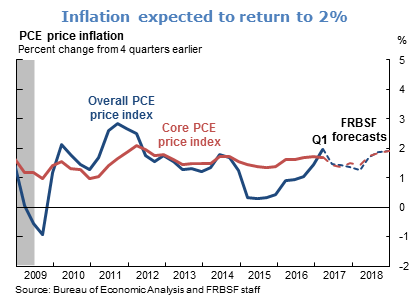

- Inflation continues to run below the 2% rate targeted by the Federal Open Market Committee (FOMC). The headline and core price indexes for personal consumption expenditures both rose 1.4% for the year ending in May. These low readings are in part attributable to transitory factors, as well as exceptional one-time price reductions for some items. These factors are expected to hold down 12-month inflation figures going forward until they fall out of the calculation.

- Continuing labor market strength leaves us expecting inflation to pick up and reach the FOMC’s 2% target by the end of 2018. However, as Chair Yellen noted in her recent congressional testimony, the timing and strength of the inflation response to tightening resource utilization remains uncertain.

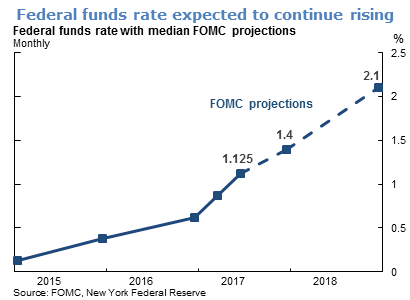

- The FOMC raised the target range for the federal funds rate at its June meeting by ¼ percentage point, to 1 to 1¼%. The Chair stated in her congressional testimony that further gradual increases in the federal funds rate are expected.

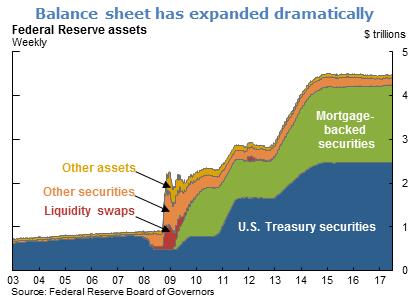

- The FOMC also provided additional details concerning the process to normalize the Federal Reserve’s balance sheet. The Committee intends to gradually reduce Federal Reserve securities holdings by decreasing its reinvestment of principal and proceeds from its System Open Market Account securities, only reinvesting proceeds when they exceed specific monthly caps. These caps will be set initially at low levels then gradually raised in a predictable manner, in order to limit the increased supply of assets to the private sector each month.

- The ultimate size of the balance sheet remains uncertain, but the FOMC anticipates that the balance sheet after the normalization process will be “appreciably below” recent levels, although larger than it was before the financial crisis.

- The Committee also reiterated that adjustments to the target range of the federal funds rate remains its primary policy instrument, anticipating that the balance sheet would not be used as an active tool in normal times. However, the Committee noted that if economic conditions warranted a more accommodative stance than could be achieved through adjustment of the federal funds rate alone, its full range of policy tools, including the size and composition of the balance sheet, could be used.

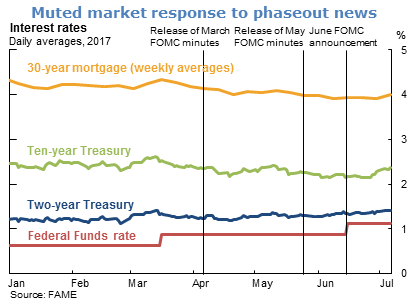

- Market responses to announcements concerning balance sheet normalization have been muted so far. Three notable news pieces were released by the FOMC this year—the March and May minutes, which mentioned phasing out balance sheet reinvestments and the plan to cap monthly balance sheet reductions, respectively, and the June meeting announcement, which announced raising the federal funds rate and detailed the balance sheet normalization. None of these dates resulted in notable moves among 2- or 10-year Treasury yields. The modest market responses to these pieces of normalization news imply that the markets were largely prepared for the onset of balance sheet normalization once economic conditions had returned to normal, and that details about the process were roughly in line with market expectations.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.