Michael Bauer, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of June 8, 2017.

- The U.S. economy appears to have completed its long recovery and is now proceeding along a sustainable growth path, characterized by output growth, inflation and unemployment close to their long-run levels.

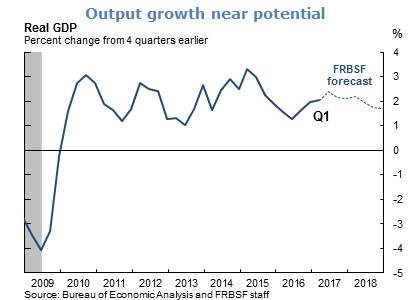

- The most recent data indicate that output growth is continuing at a healthy pace. While real GDP in the first quarter rose only 1.2% at an annualized rate, this slowdown is largely due to transitory factors as well as the tendency of seasonal adjustment of first quarter growth figures to be somewhat biased downward. Recent monthly readings of a number of economic indicators, including those on retail sales, purchase orders, capacity utilization, industrial production, and capital expenditure, suggest continued strong momentum for spending and output. Consumer spending will continue to benefit from robust fundamentals including a strong labor market, rising incomes, and wealth, as well as buoyant consumer sentiment. We anticipate GDP growth to bounce back in the second quarter to an annualized growth rate close to 3%, and in 2017 average to about 2%. Based on our estimate of potential output growth of around 1½ to 1¾%, output is growing modestly faster than its underlying trend.

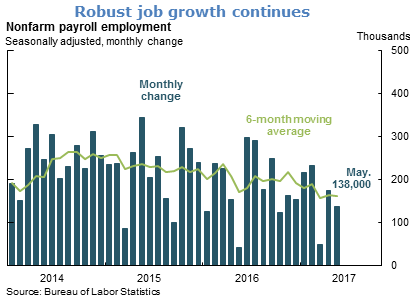

- The labor market has further strengthened and appears to be at or even beyond full employment. Job growth continues at a robust pace, with the average increase per month substantially above the breakeven rate that is needed to keep unemployment stable, which we put at around 80,000 to 100,000 jobs. While the pace of job growth has slowed somewhat relative to recent years, a record number of job vacancies suggests that this is due to increasing difficulties in filling open positions, and not due to slowing labor demand.

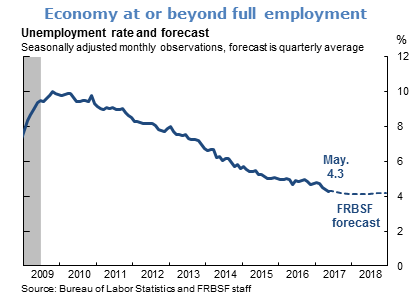

- The unemployment rate fell in May to 4.3%, its lowest level since May 2001 and markedly below our estimate of the natural rate of unemployment—the rate consistent with full employment—which we estimate to be 4.8%. Other labor market indicators support our view of an increasingly tight labor market.

- Wage growth, largely missing from this recovery, remains below pre-recession levels, partially due to lower productivity growth. But over the last year, a broad-based acceleration of wage growth has materialized in a number of wage and compensation indicators, confirming the notion that there is little if any slack left in the labor market.

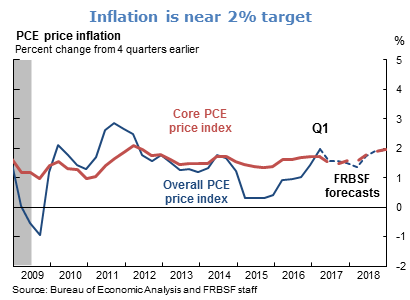

- Inflation numbers, particularly for core inflation, have surprised on the downside in recent months. Inflation in the price index for core personal consumption expenditures (PCE) slowed to 1.5% over the one-year period ending in April. We view this slowdown in core inflation primarily as a transitory phenomenon, due to the effects of one-off factors such as changes in the pricing of cell phone services, temporary drag from low health care services inflation, and low import inflation due to exchange rate effects. We anticipate that declining slack and accelerating wage growth will raise inflation gradually, reaching the FOMC’s target of 2% PCE inflation over the course of next year.

- Financial conditions have eased further and are highly accommodative, supporting growth in aggregate demand. The yield curve has flattened, with long-term Treasury yields declining and short-term rates rising due to the normalization of monetary policy. Furthermore, equity prices have continued to climb, credit spreads have tightened, and volatility remains historically low.

- In order to learn about the underlying trajectories and predict future changes, forecasters are tasked with separating the signal from the noise in macroeconomic and financial data. Successful forecasting requires convincing answers to three fundamental questions: (1) Where are we now (nowcast)? (2) Where are we going (long-run trend)? (3) How quickly are we going to get there (transition)? Of particular relevance is the question about the trend component in the data, i.e., the equilibrium or long-run level that the economy will reach after all transitory effects and cyclical factors have dissipated. Examples include the trend or potential growth rate of GDP (g*) or the natural rate of unemployment (u*).

- This same perspective is useful for interpreting interest rates, where the relevant trend component consists of the trend rate of inflation (π*) and the equilibrium real, or inflation-adjusted, interest rate (r*). Trend inflation is relatively easy to measure based on long-range surveys, and exhibited pronounced swings in the 1970s and 1980s, but stabilized in the late 1990s at around 2%, now the explicit inflation target of the FOMC. The equilibrium real rate is much more difficult to measure, and estimates are surrounded by a large degree of uncertainty. However, most measures agree on the fact that trend inflation has declined markedly since the late 1990s, driven by a number of factors that increased savings and reduced investment over the long run, including lower productivity growth and population aging. Taken together, the trend component of interest rates has declined steadily for more than three decades, first due to declining trend inflation, and later due to a declining equilibrium real rate. The implication is that current interest rate forecasts should not assume a long-run level based on post-war historical averages, but instead need to take into account changes in these macroeconomic trends. The evolution of the trend in interest rates suggests a new normal which is much lower than in the past. One important implication is that there will be less room to reduce monetary policy interest rates in response to negative shocks to the economy.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.