Nicolas Petrosky-Nadeau, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of September 14, 2017.

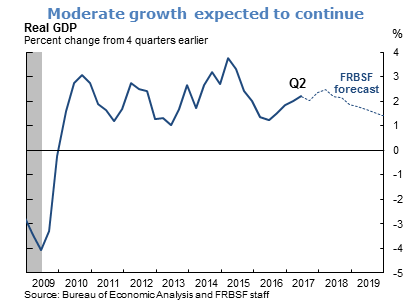

- The estimate of gross domestic product (GDP) growth in the second quarter of 2017 was revised up to 3.0% at an annualized rate, primarily due to greater consumption expenditure and nonresidential fixed investment. We forecast that GDP growth will fall to an annualized rate of 2.1% in the third quarter due to the effects of Hurricanes Harvey and Irma, but will rise to 3.0% in the fourth quarter as a result of post-hurricane rebuilding.

- Financial conditions remain supportive of moderate growth, as long-term interest rates have declined since the beginning of the year. Both ten-year Treasury bills and 30-year fixed rate mortgages, are near historic lows, at 2.14% and 3.81%, respectively. Over the longer-term, we expect annual GDP growth to fall back to our estimate of potential output growth of around 1½ to 1¾% in 2018 and 2019.

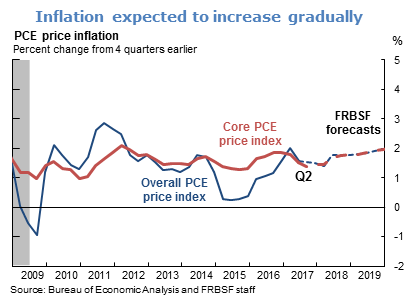

- Both the headline and core price indexes for personal consumption expenditures each rose 1.4% in July, and continue to remain below the FOMC’s 2% target. We maintain that inflation has been dampened by transitory factors and other special considerations, such as lower administered prices in the health sector. The two hurricanes are expected to have a modest positive effect on inflation through the end of the year. As the economy continues to tighten, we expect that inflation will rise further over the next two years, reaching the FOMC’s target in 2019.

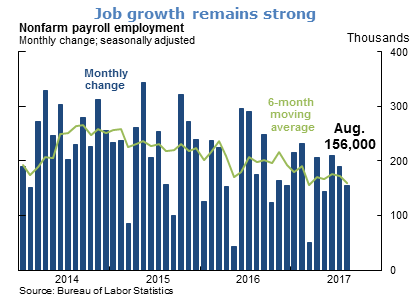

- The economy added 156,000 jobs in August, following gains in June and July of 210,000 and 189,000, respectively. The pace of hiring remains well above the estimated level of 80,000 to 100,000 new jobs that are needed to absorb new labor force entrants and to keep unemployment stable.

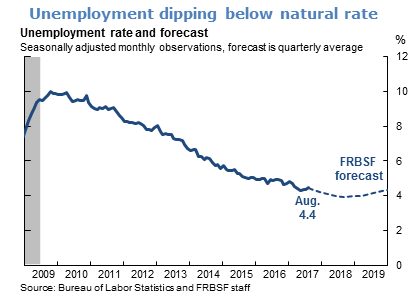

- The unemployment rate rose slightly to 4.4% in August, up from 4.3% in July. We anticipate that it will decline further, bottoming out in the latter half of 2018, before reverting upwards in 2019 towards our estimate of the natural rate of unemployment, 4.8%.

- There are many other measures indicating improving labor market conditions, including the level of job openings which continues to grow beyond its pre-recession peak. Moreover, rising voluntary quit rates are providing a clear signal of a strengthening labor market. In addition, average hourly earnings grew at 2.5% in the 12 months through August.

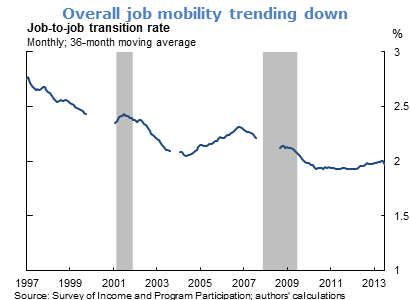

- However, over the last two decades the rate of job mobility, defined as the proportion of employed workers who were in a different job compared to the month before has steadily declined. This trend has raised concerns about whether the economy is experiencing diminishing dynamism, despite the return of many labor market conditions to their pre-recession levels.

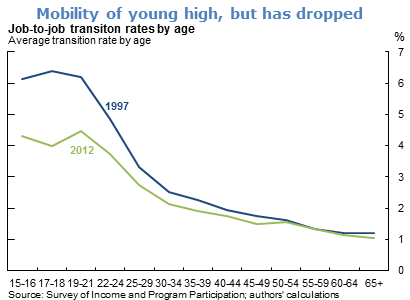

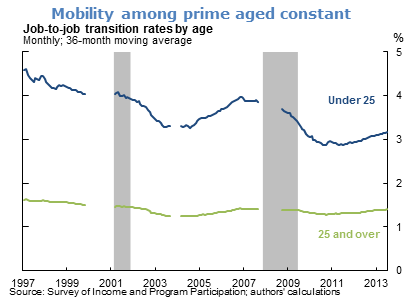

- Disaggregating the data by age reveals that job mobility is greater early in life, with transitions three times as frequent among workers in their early 20s as compared to those in their early 40s. However, over the past two decades, the high rate of job switching among the young has declined substantially. By contrast, the rate of job switching among prime age workers has remained constant.

- Thus, the decline in job mobility in the United States is mainly attributable to the changing labor market behavior of young workers. For workers aged 25 and older, the bulk of the workforce, the labor market is essentially as dynamic today as it was 20 years ago.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.