Mary C. Daly, executive vice president and director of research at the Federal Reserve Bank of San Francisco, stated her views on the current economy and the outlook as of April 12, 2018.

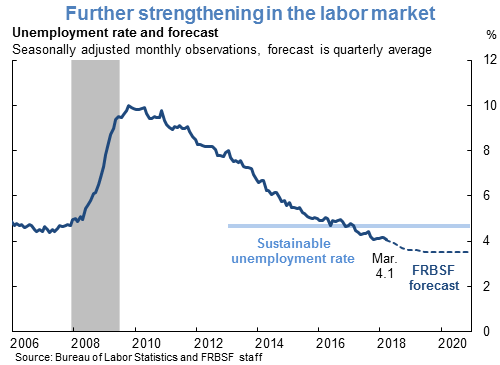

- The U.S. economy is in the second-longest expansion in its history. The labor market is booming, consumer and business spending are solid, and all other key economic indicators are flashing green. Added boosts are coming from a number of tailwinds, including supportive financial conditions, strong global growth, and the recent fiscal stimulus.

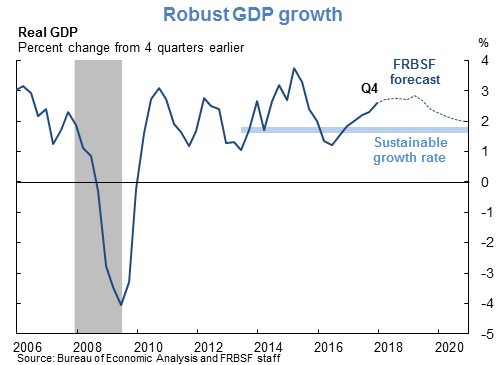

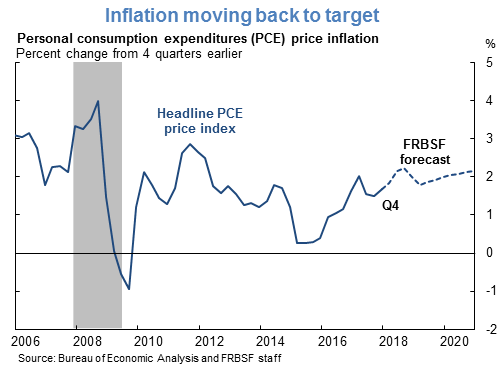

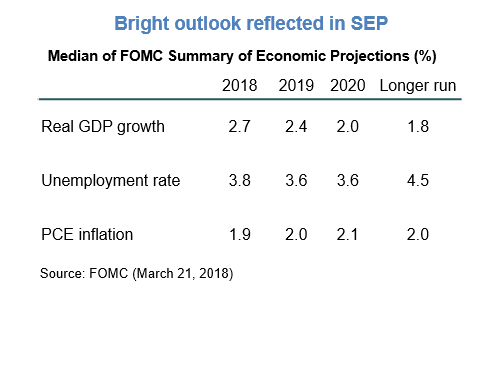

- Over the next few years, we expect real GDP growth to average around 2½%, well above its sustainable pace of 1¾%. This faster pace of growth will put further downward pressure on unemployment and contribute to the gradual rise of inflation, bringing it closer to the Fed’s 2% target.

- Our view is similar to the Federal Open Market Committee’s March 2018 median projections, which point to sustained above-trend growth, significant undershooting on unemployment, and inflation settling in near its 2% target.

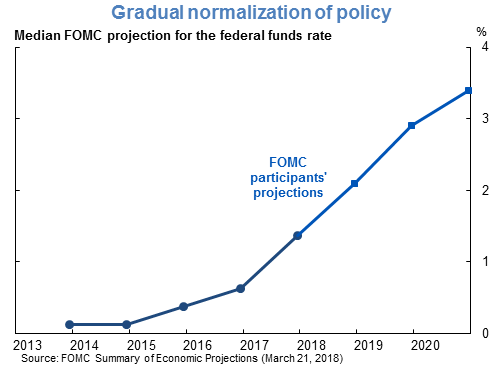

- To navigate the economy’s return to its long-run sustainable pace, the FOMC projects ongoing gradual increases in the federal funds rate through 2020. The current median path has the funds rate peaking modestly above the estimated longer-run value.

- Achieving a smooth landing in the economy requires monetary policymakers to balance the risk of letting the economy run hot, potentially triggering high inflation, with the risk of removing accommodation too quickly, leaving prospective workers waiting for job opportunities.

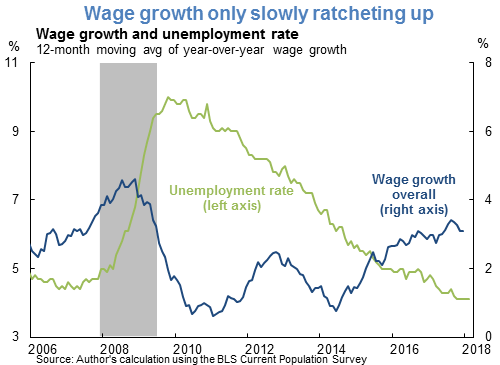

- On the “running the economy too hot” side, an ever-tightening labor market risks creating a surge in wage inflation that will lead to an unwanted pickup in price inflation. However, there is little sign of this in the data. Wage growth is ratcheting up fairly slowly. And relative to the unemployment rate, which long ago surpassed its previous low, wage inflation remains subdued, running about a percentage point below its pre-recession peak.

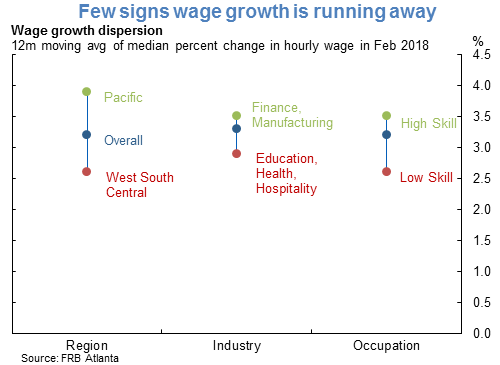

- Looking across regions, industries, and occupations, the story is similar. Wage growth is faster in the Pacific region, where labor markets are running especially hot, and for high-skilled workers, who are in short supply. But overall, there is little evidence of any outsized divergence in wage growth across groups that could lead to a sudden and unwanted surge in aggregate wage inflation.

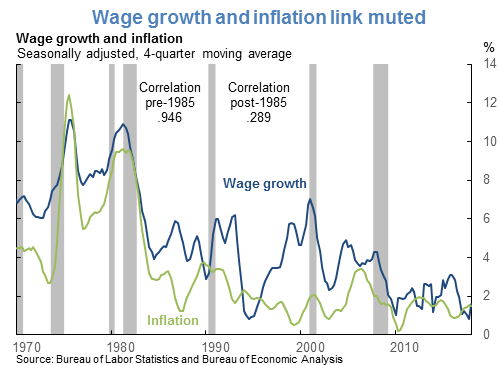

- Notably, even if such a surge were to occur, it is unlikely to show through immediately to price inflation. Over the past 50 years, the contemporaneous link between wage and price inflation has fallen. Before 1985, when inflation was high and workers’ salaries were more likely to be automatically adjusted for cost-of-living increases, the correlation between wage growth and price inflation was 0.95. Since 1985, this correlation has averaged 0.29, and since the Great Recession it has been around 0.12. This means that, should wage inflation unexpectedly pick up, the FOMC would have time to adjust policy to limit the impact on overall price inflation.

- On the “pulling accommodation away too quickly” side, the risk is that the economy may have more labor market slack than is currently measured by the unemployment rate and that Fed tightening could leave prospective workers on the sidelines and out of the labor force.

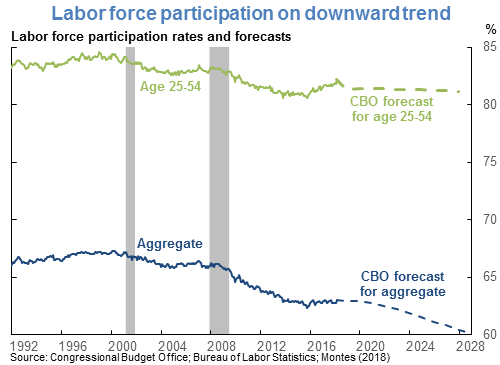

- One way to gauge whether the economy has unmeasured labor market slack is to look at the labor force participation rate, which measures the share of the working-age population that is or has been looking for a job. Although labor force participation has gone up slightly for workers ages 25-54 over the past few years, we expect few additional gains, consistent with projections from the Congressional Budget Office. This is because the factors holding back participation among these prime-age workers are more structural (lifestyle choices, job polarization, skills mismatch) than cyclical.

- Most importantly, aggregate labor force participation in the United States is on a downward trend due to the unstoppable forces of demographics. Baby boomers are retiring and the generations behind them are smaller. Together, these forces are set to pull down labor force participation for the foreseeable future.

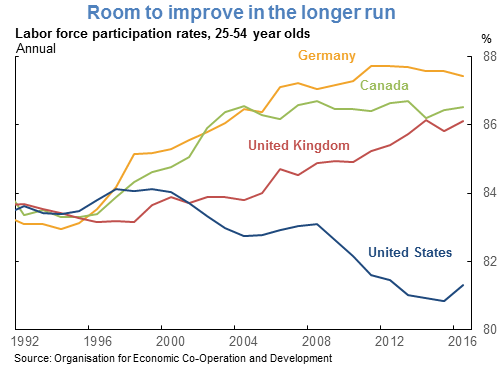

- But there is room to boost labor force participation in the longer run. Compared with our industrialized competitors, a much smaller fraction of prime-age adults ages 25-54 participates in the U.S. labor force. Some of this difference owes to lifestyle choices, but other factors also are at work, particularly cross-country gaps in educational attainment, which have left many American workers underprepared for the jobs being created. Bringing the skills and training of U.S. workers more in balance with employer demands is one way to increase the share of working-age Americans who participate in the labor market.

- In sum, the U.S. economy is very strong and the outlook is bright. There are few signs that we are in danger of runaway inflation or that the gradual pace of policy normalization the FOMC projects will leave large swaths of potential workers without jobs. That said, there is room to increase the share of adults who participate in the labor markets. This will require structural changes that bring workers’ skills in line with the demands of our changing economy.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.