Mark Spiegel, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of July 12, 2018.

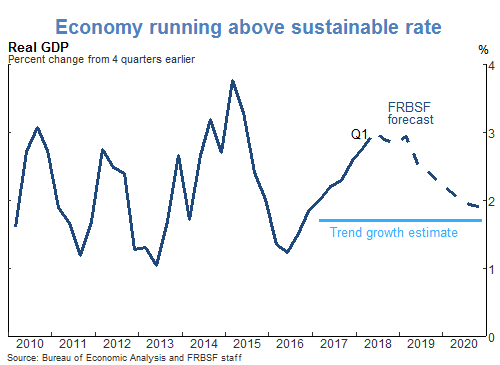

- The economy continues to grow at a solid pace. GDP growth is expected to be particularly strong in the second quarter, followed by slower growth in the second half of the year that is still expected to be above its sustainable pace. Overall, 2018 should register growth of about 2.8%, followed by gradual slowing towards our estimated sustainable pace of just under 2% by 2020.

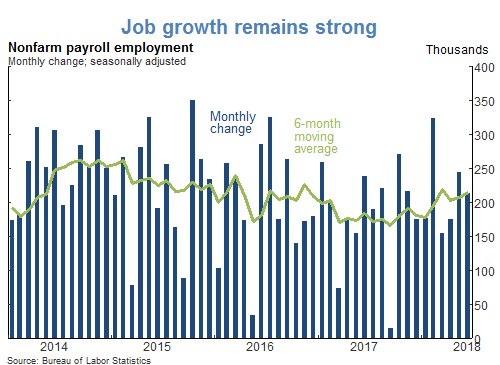

- The strong economic performance has fueled continued firming in the U.S. labor market. Nonfarm payroll employment rose by 213,000 jobs in June, exceeding expectations, and April and May figures were revised upwards.

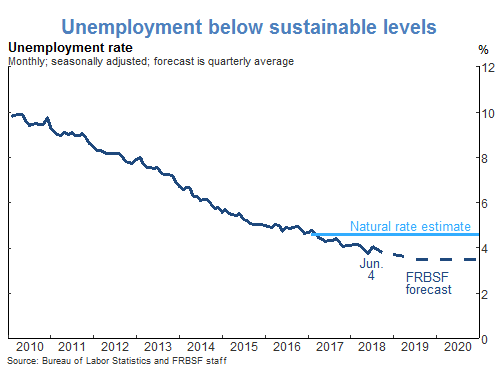

- The strong payroll growth figures were accompanied by an upward tick in the unemployment rate from 3.8% to 4.0%. This increase was in part driven by a rise in labor force participation and was generally perceived as additional evidence of labor market strength.

- Our forecast is for the unemployment rate to continue its long decline, falling further below our current estimate of the natural rate, around 4.6%.

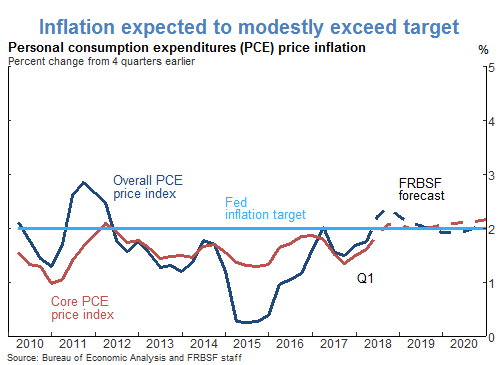

- Inflation has moved up near the Federal Open Market Committee’s (FOMC’s) 2% target. With continued tightening in labor markets and economic growth above its sustainable pace, we expect the upward trend in inflation to continue and core inflation to modestly overshoot the 2% target over the medium term.

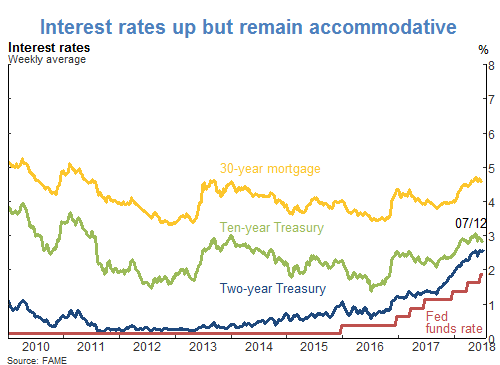

- Interest rates have increased with ongoing policy normalization, and the majority of FOMC participants in the June meeting forecast further gradual increases in the federal funds rate. Policy rates remain accommodative and are still below estimates of the long-run “neutral” federal funds rate of around 2.5%.

- The U.S. economy faces several potential global risks.

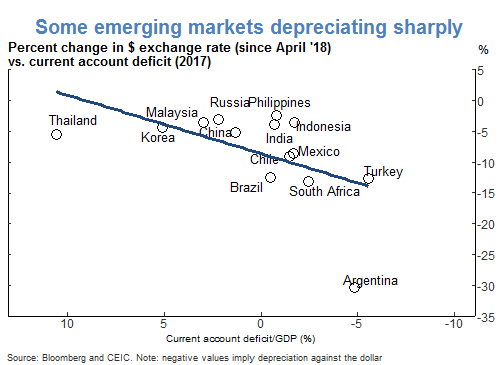

- First, ongoing policy normalization and higher interest rates in the United States have contributed to an appreciation of the dollar, creating potential difficulties for foreign borrowers with dollar-denominated debt obligations and local currency revenue. This has recently resulted in a modest general selloff of emerging market assets and depreciation of emerging market currencies.

- However, the extent of recent foreign currency depreciation also has reflected prevailing domestic macroeconomic conditions in these countries. Countries that ran larger current account deficits in 2017 experienced relatively larger currency depreciations.

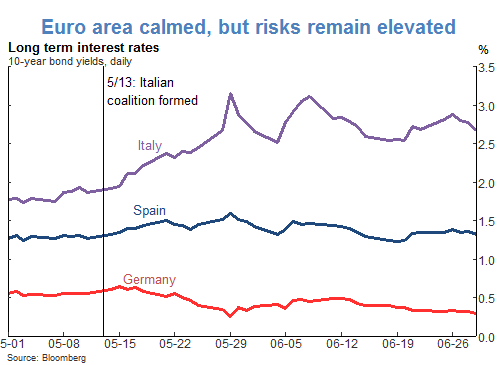

- Another source of global risk concerns recent events in the euro area, particularly those associated with political developments in Italy. A new government coalition formed in May resulted in higher yields on long-term Italian sovereign debt. Subsequent statements confirming the government’s commitment to remaining in the euro area, as well as changes in the new government cabinet, halted the deterioration in financial conditions. Nevertheless, long-term Italian yields remain elevated relative to their German counterparts. Notably, long-term yields of other euro-area “periphery” countries, such as Spain, were relatively unaffected by the Italian developments.

- Finally, recent changes in U.S. trade policies and countervailing measures by our primary trading partners also pose a risk for the outlook. On the U.S. side, these include tariffs imposed on imports of steel and aluminum, as well as a range of other goods from China, and ongoing negotiations with NAFTA partners Mexico and Canada. Foreign trading partners have announced countervailing restrictions on U.S. exports.

- It is premature to assess the ultimate impact of recent trade policy developments on the U.S. economy and its primary foreign trading partners. Most analysts have suggested that, although some specific industries are likely to be substantively affected, the overall impact of policies announced to date on the U.S. economy should be relatively contained.

- However, the minutes of the June FOMC meeting noted that meeting participants expressed concerns about the potential for adverse effects of tariffs and other proposed trade restrictions, both domestically and abroad, as well as the uncertainty surrounding future trade policy on business sentiment and investment activity.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.