Dan Wilson, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of March 8, 2018.

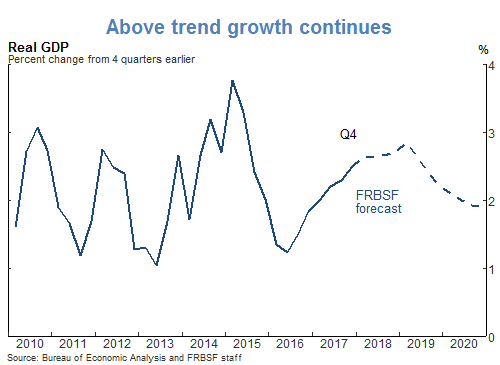

- Driven largely by robust consumer spending, real GDP grew at an annual rate of 2.5% in the fourth quarter of 2017, according to the latest Bureau of Economic Analysis estimate. We expect similar growth in 2018, bolstered in part by recent tax cut legislation. Growth is likely to moderate over the following few years toward our estimate of sustainable potential output growth of around 1.7%.

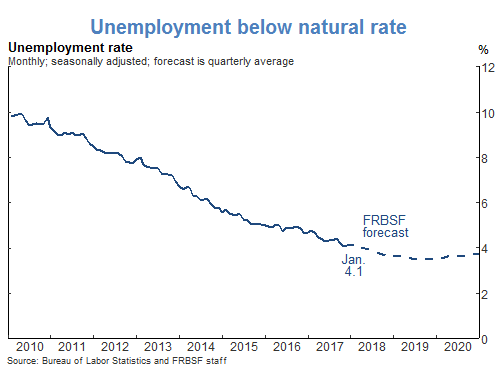

- The labor market remains strong. The January unemployment rate remained at 4.1%, below our estimate of its natural level of 4.75%. Going forward, we expect the rate to fall to around 3.5% in late 2019 before gradually returning to its natural level.

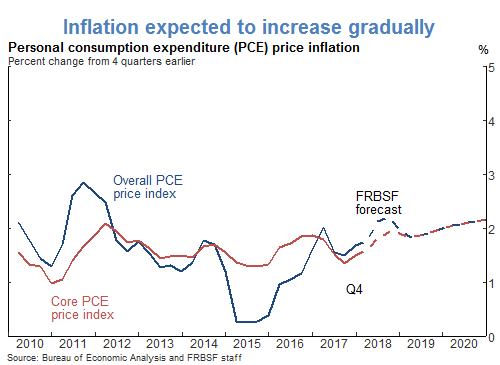

- Inflation recently moved up gradually toward the Federal Open Market Committee’s 2% target, consistent with the strengthening of the labor market. We expect year-over-year core personal consumption expenditures price inflation, which excludes volatile food and energy prices, to reach 2% by the end of 2019.

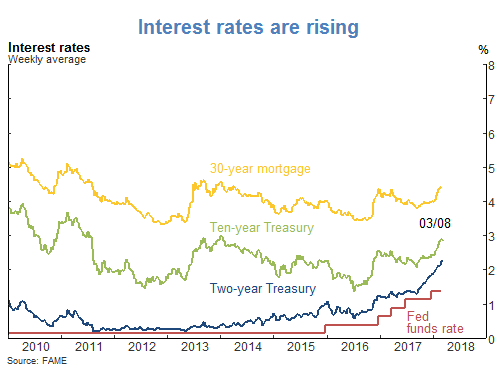

- Interest rates have increased notably in recent months, consistent with the gradual removal of monetary policy accommodation. Interest rates may also be responding to expected increases in the federal budget deficit and recent data pointing to higher inflation.

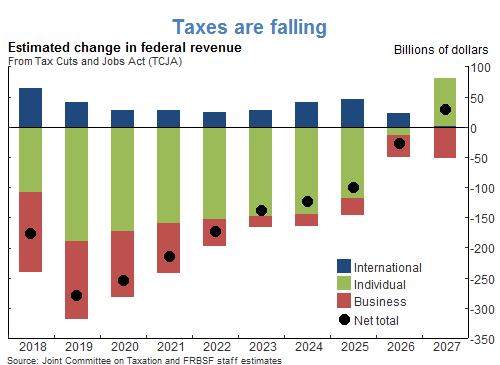

- The recently passed Tax Cuts and Jobs Act (TCJA) represents a major fiscal expansion. The Joint Committee on Taxation estimates that the Act will reduce federal budget revenues over the next decade by $1.5 trillion before accounting for any macroeconomic feedback effects. More than half of this cost, and the associated stimulus to the economy, will occur in the first three years.

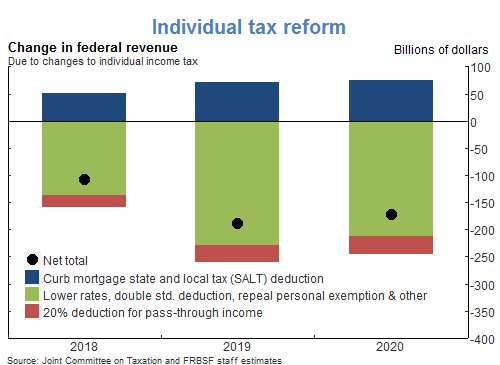

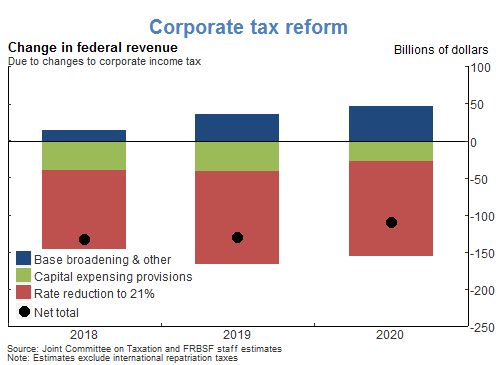

- The TCJA made significant changes to individual taxes, introducing new brackets and rates, repealing the personal exemption, and doubling the standard deduction. The TCJA also places limits on the deductibility of mortgage interest and state and local tax payments and introduces a deduction of up to 20% of income derived from so-called pass-through businesses. The TCJA makes other large changes to the corporate tax system, most significantly by reducing the corporate tax rate from 35% to 21%. Another notable change is the temporary allowance of full capital expensing, which is likely to boost capital spending over the next few years.

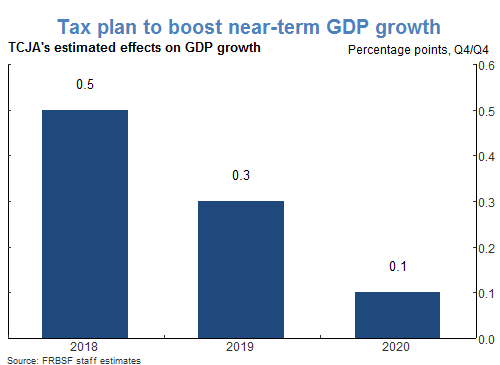

- We expect these changes to individual and corporate taxes to provide a temporary boost to GDP growth over the next three years. Based on the particular features of the Act and our reading of the empirical research on past major tax reforms, we forecast that the TCJA will boost real GDP cumulatively by about 0.9 percentage point by 2020, with most of the boost occurring this year.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.