Nicolas Petrosky-Nadeau, senior research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of May 10, 2018.

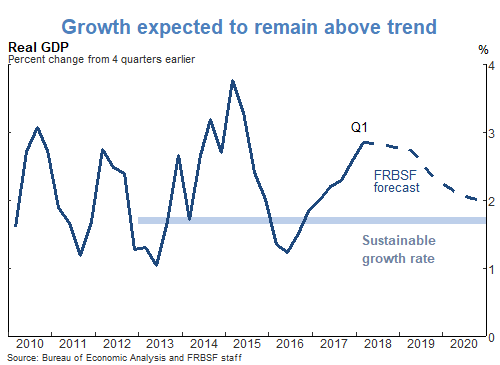

- Gross domestic product in the first quarter of 2018 increased 2.3% at an annual rate according to the latest estimate from the Bureau of Economic Analysis. This follows the strong pace of 2.9% in the fourth quarter of 2017. While consumer spending was softer than expected, we view this change as transitory and expect a rebound in the second quarter of this year. We estimate 2.8% GDP growth in 2018, a full percentage point above our estimate of the long-run sustainable growth rate.

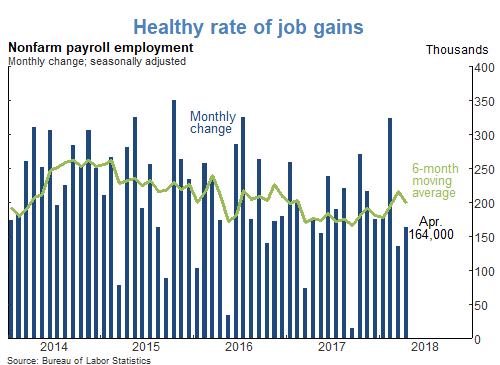

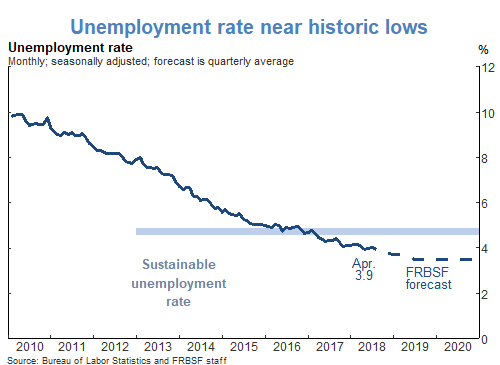

- This faster pace of growth is supporting a robust labor market. The economy added 164,000 jobs in April, and the unemployment rate fell to 3.9%. We expect unemployment to decline further this year and through 2019, and remain below our estimate of the long-run rate of 4.7% for some time.

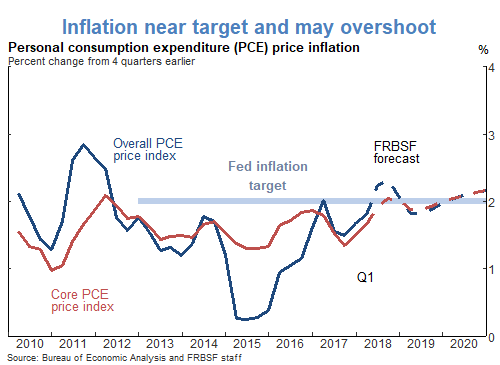

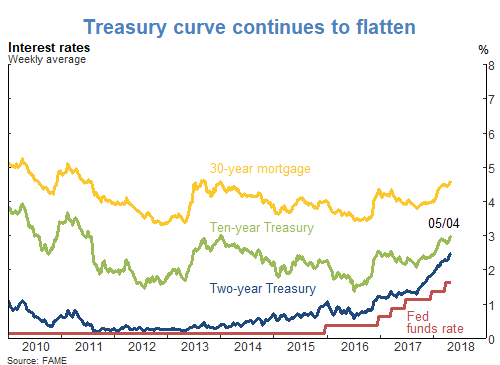

- Although interest rates have increased as the Federal Open Market Committee (FOMC) gradually raises its target rate, financial conditions remain supportive of continued growth. These increases also reflect inflation moving close to the FOMC’s 2% target. We expect core personal consumption expenditure price inflation to end 2018 at 2%.

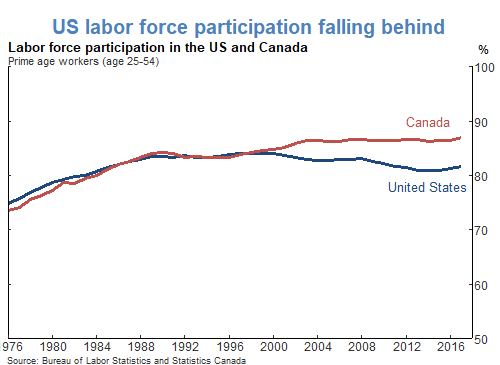

- While many indicators point to a strong and growing economy, labor force participation has remained level for the past few months and is likely to resume a downward path, driven by demographic and economic factors unrelated to the business cycle.

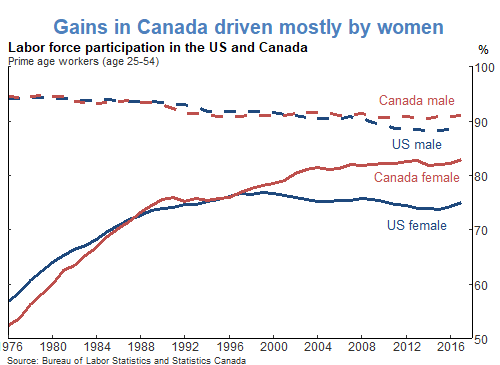

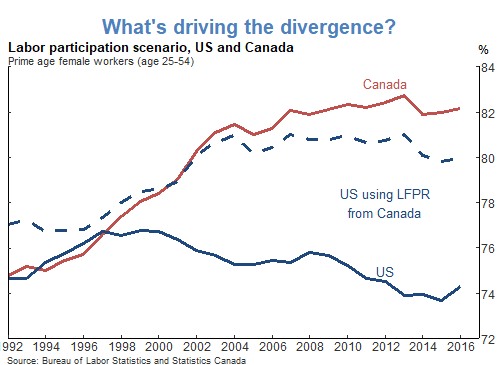

- Looking north to Canada provides some insights into the reasons for declining participation in the United States and how to raise future participation. Labor force participation rates were around 76% in both countries until 1996. Then Canada began to pull ahead principally due to strong gains by prime-age (25 to 54) Canadian women relative to their U.S. counterparts. By 2017, Canada reached 83%, a full 8 percentage points above the U.S. participation rate.

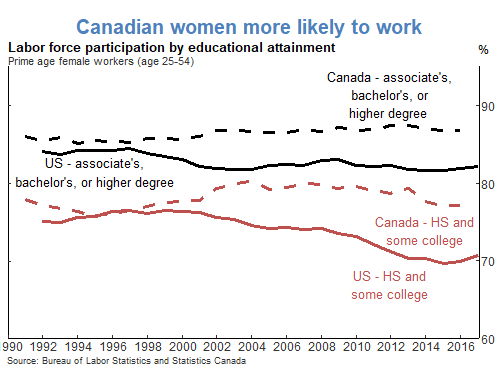

- Canada has made greater strides increasing the rate of post-secondary education relative to the United States since the 1990s. The bulk of the difference in Canada’s labor participation trends is explained by the changes in the participation rates within education groups. Over the past two decades, participation rates for Canadian women with a college degree have increased, and rates for Canadian women with a high school diploma have stayed the same. American women of both levels of educational attainment instead have reduced their rates of participation in the labor force over the same period.

- One way to understand the importance of this difference is to consider a scenario in which American women in these two educational attainment levels were participating in the labor force at the same rate as Canadian women. If this were the case, most of the gap observed between the two countries would disappear.

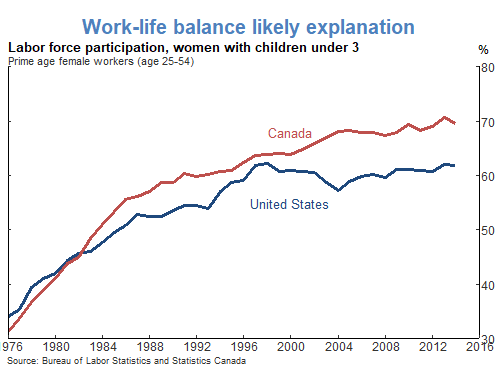

- There is certainly a mix of factors at play in explaining these trends. However, one likely key to the story is the mix of policies in Canada aimed at providing employment protection for parents, and expansions of parental leave with income support. Indeed, a large gap has developed between the participation rates for women with children in the United States and Canada over this same period, which mirrors the overall gap between prime-age women’s participation rates in both countries.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.