Adam Shapiro, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of November 9, 2018.

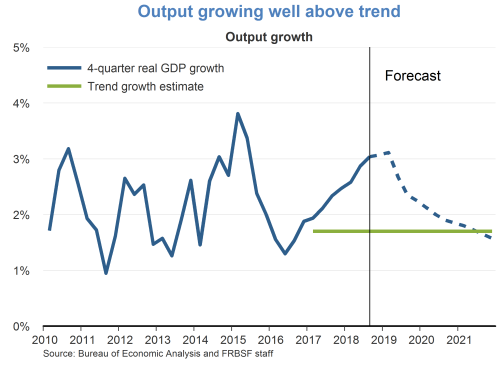

- The economy has continued to grow at a solid pace. After a strong second quarter, real GDP grew at an annual rate of 3.5% in the third quarter according to the advance estimate of the Bureau of Economic Analysis. We forecast that GDP will grow at an annual rate of 2.4% in the fourth quarter and average 3.1% for 2018. As monetary policy continues to normalize, we expect growth to gradually fall back to our long-trend estimate of 1.7%.

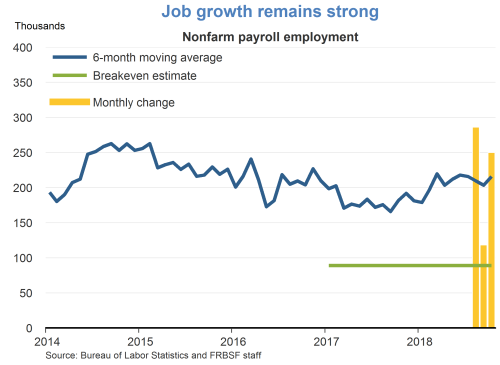

- Reflecting a very strong labor market, the economy added 250,000 jobs in October. Monthly job gains have averaged over 200,000 for the past six months, well above the amount needed to absorb the flow of new workers into the labor force.

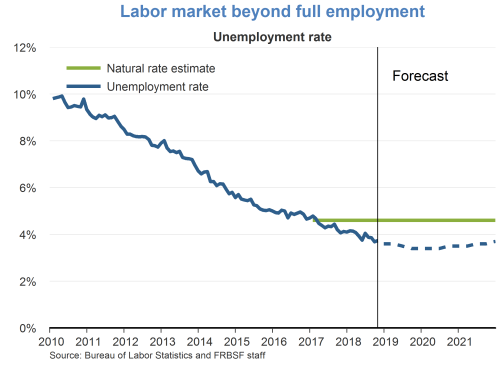

- The unemployment rate stands at 3.7% as of October. We expect it to decline to 3.4% by the end of next year as the economy continues to grow. Over the longer run, we expect the unemployment rate to gradually return back to its natural rate of 4.6% as monetary policy accommodation is removed.

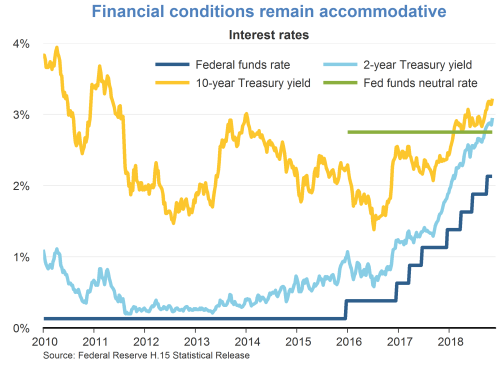

- The yield curve continues to flatten as short-term rates rise while longer-term rates have remained more steady. At the November meeting, the Federal Open Market Committee (FOMC) announced its decision to keep the target range for the federal funds rate unchanged at 2 to 2.25% and is proceeding with the balance sheet normalization process initiated last year.

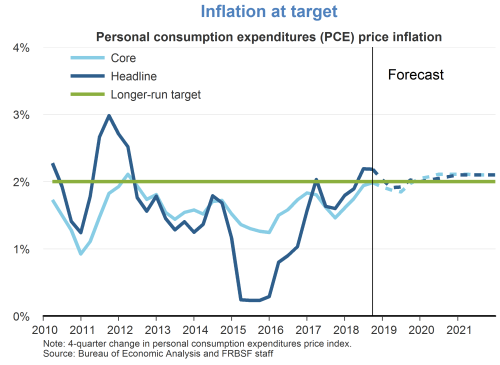

- Inflation reached the FOMC’s target of 2% this past summer. The personal consumption expenditure (PCE) price index and the core PCE index both rose 2% over the last 12 months. As the labor market continues to tighten, we expect inflation to slightly overshoot the 2% target by 2019.

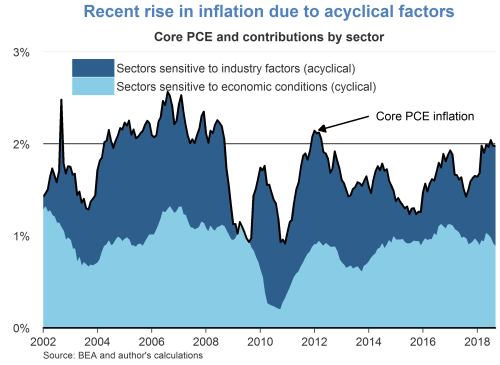

- Inflation can be driven by either aggregate or industry-specific factors. Price sensitivity varies by sector. Prices in some sectors are more sensitive to overall economic conditions, while prices in other sectors are more sensitive to industry-specific factors. For example, shelter prices tend to move with overall economic conditions, whereas prices for health care services tend to follow public payment growth rates set by the Centers for Medicare and Medicaid Services (CMS).

- The recent rise in inflation to the 2% target was attributable to the sectors that tend to be more sensitive to industry-specific factors, that is, acyclical factors. Acyclical inflation is now contributing 0.5 of a percentage point more to overall core inflation than it was a year ago. The inflation rate for prices that tend to be sensitive to the state of the economy, that is, cyclical inflation, has remained fairly steady over the past year, despite an improvement in economic conditions.

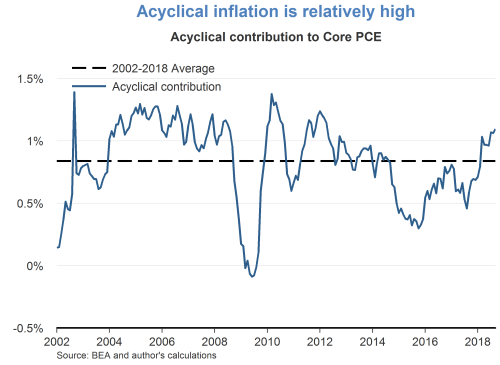

- Acyclical inflation is quite volatile, meaning it tends to move above and below its average level quite rapidly. The contribution of acyclical inflation to core PCE inflation is currently relatively high, implying some downside risk to the inflation outlook should this series revert back to its average level over the past 17 years.

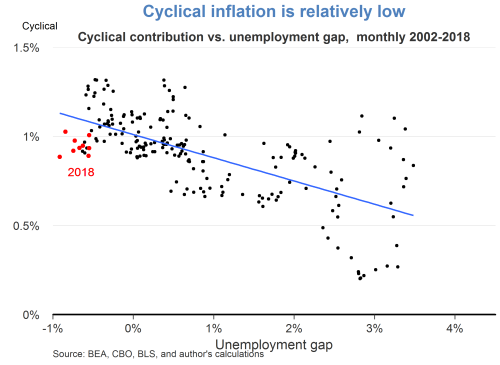

- Cyclical inflation, by construction, tends to move with overall economic conditions. The contribution of cyclical inflation to core PCE inflation is now lower than what would be expected given the current level of the unemployment gap. This implies some upside risk to the inflation outlook should cyclical inflation revert to levels historically observed in very tight labor market conditions.

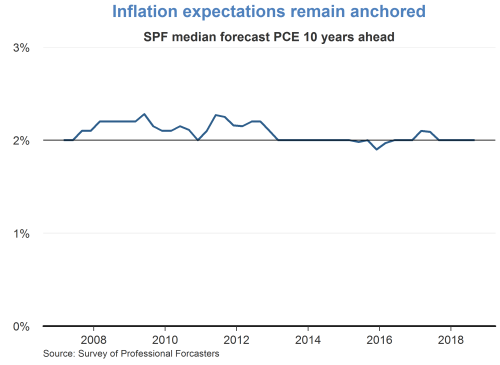

- Overall, a decomposition between acyclical and cyclical factors shows balanced risks to the inflation outlook. The median 10-year ahead personal consumption expenditure inflation forecast in the Survey of Professional Forecasters has remained at 2%, showing that market participants view the risks to the inflation outlook as balanced around the FOMC’s target.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.