Reuven Glick, group vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of October 11, 2018.

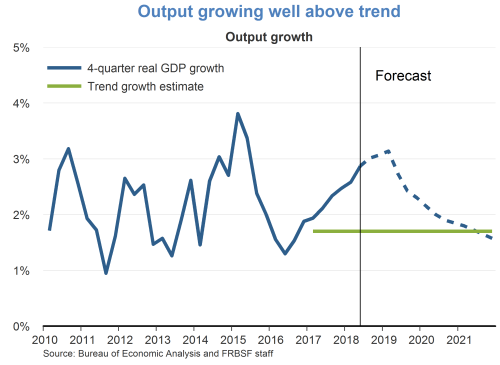

- The economy looks very strong. Real GDP will likely grow around 3% this year, well above our estimated trend growth of 1.7%. Growth is being supported by strength in household income, elevated equity prices, and high consumer confidence, as well as fiscal stimulus.

- We expect growth to slow towards trend over the next several years, as fiscal stimulus effects wane and monetary policy accommodation is gradually removed. The risks to the outlook appeared to be balanced. On the upside, there is risk that underlying momentum and inflationary pressures in the economy are stronger than expected. On the downside, there is risk that trade tensions and financial market vulnerabilities may slow the economy down.

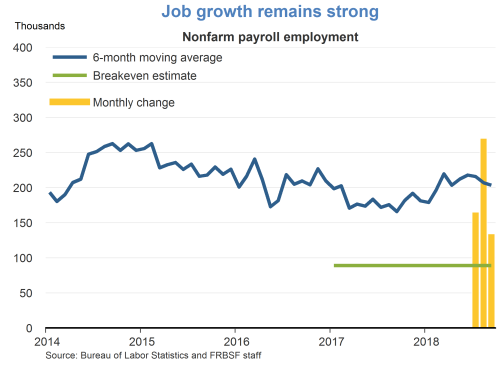

- The labor market data were solid in September. Payrolls rose by 134,000 jobs, somewhat below expectations, but most probably attributable to the effects of Hurricane Florence. For the past six months the economy has been adding about 200,000 jobs per month, well above the level regarded as necessary to absorb new workers entering the labor force and keep unemployment constant.

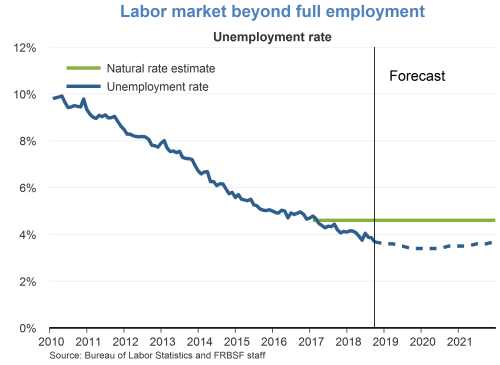

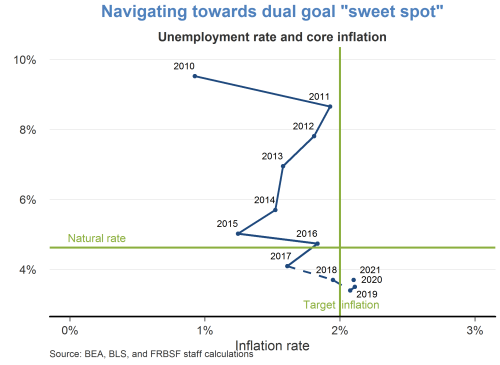

- The unemployment rate fell from 3.9% to 3.7%, the lowest level since 1969. We expect above-trend output growth to create further tightening in the labor market that will push unemployment down to as low as 3.4% next year. As the economy slows, unemployment should then increase very gradually, though it should remain for some time below our estimate of the long-run natural rate of 4.6%.

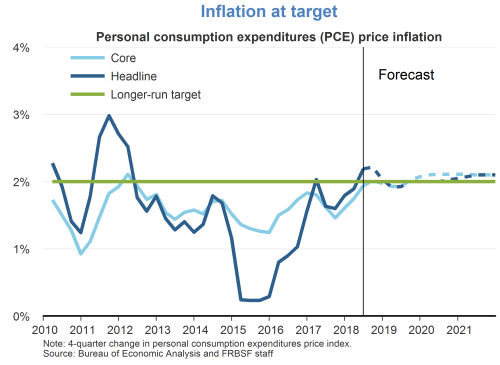

- Core PCE inflation has been rising lately and is essentially at the Federal Open Market Committee’s (FOMC’s) target level of 2%. Inflation is expected to slightly overshoot this target in the next year or two. Though the economy is strong and there appears to be limited labor market slack, there are no clear signs of accelerating inflation in the future. Inflation expectations remain anchored.

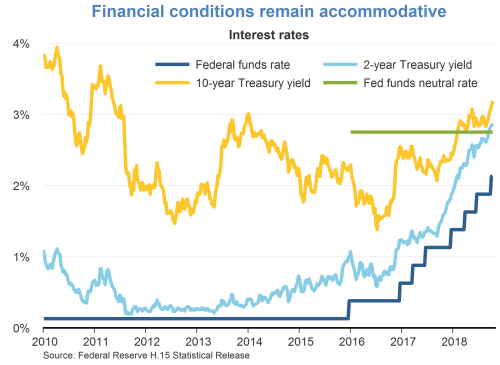

- The FOMC has been raising the federal funds rate, its main policy tool, since December 2015. After its September meeting, the Committee raised the funds target range further to 2 to 2¼%. The current federal funds rate still remains accommodative, as its level stands about 50 basis points below our estimate of its long-run “neutral” rate, i.e. the rate at which borrowing costs neither stimulate nor restrain economic growth. Recent equity price declines in part reflect a reassessment of elevated stock market valuations in an environment of higher interest rates.

- The Great Recession of 2008-2009 pushed the economy well away from the Federal Reserve’s dual mandates of maximum employment and stable inflation. In 2010, unemployment was around 10% and inflation was less than 1%. As the economy recovered with the support of expansionary monetary policy and some assistance from fiscal policy, unemployment has steadily fallen to a level now below its natural rate. During most of this period inflation has remained subdued and below target, because of remaining slack as well as headwinds from an appreciating dollar and other temporary factors. Only recently has inflation risen to the FOMC’s 2% target as labor market slack has lessened further.

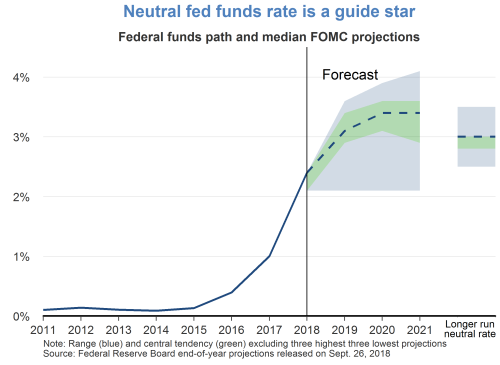

- As the economy moves closer to the Federal Reserve’s employment and inflation goals, it has normalized monetary policy by hiking the federal funds rate. How rapidly and how much further will this rate rise? The FOMC’s most recent median projections, released on September 26 suggest it will continue to raise the funds rate gradually to 3.1% at the end of 2019 and level off at 3.4% in 2020. The case for gradual rate hikes rests on balancing the twin risks of prematurely ending the expansion vs. allowing the economy to overheat excessively. The range of projections among the members of the FOMC reflects the differences in views about the relative assessment of these risks.

- The median estimate of the “longer-run” neutral rate is 3%. This implies that the projected rates for 2019 and 2020 will likely be a bit higher and hence mildly restrictive. This is consistent with the view that a tighter policy stance is warranted to return unemployment to its natural rate.

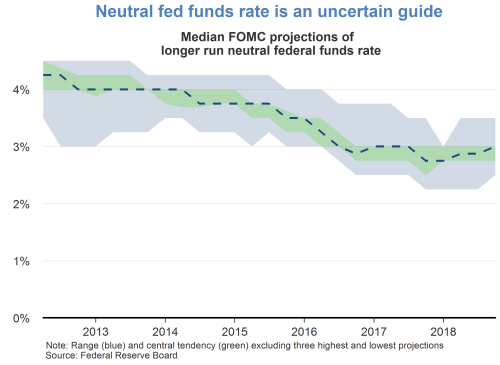

- It should be noted that estimates of the level of the neutral federal funds rate are very uncertain, as evidenced by the variations in projections across FOMC participants and across time. The FOMC’s projections of the neutral rate have been steadily falling for a long time, as a result of an aging population that increased the savings supply and lower growth that reduced investment demand. In recent years, the rate has risen a bit because fiscal deficits have reduced the supply of savings available to the rest of the economy. Because of this uncertainty about the precise level of the neutral rate, some policymakers have expressed a desire to lessen focus on the neutral rate in the near term and treat it as only one of the many factors that affect monetary policy decisions, such as labor market slack, inflation pressures, financial conditions, and global developments.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.