Òscar Jordà, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of September 13, 2018.

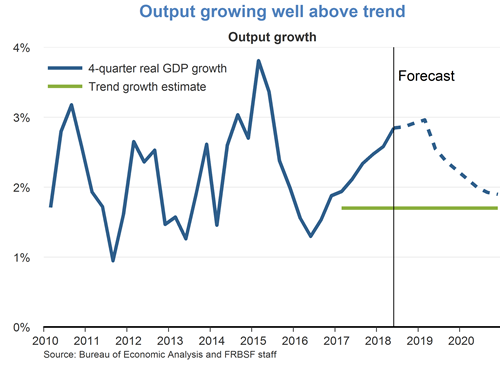

- The second estimate of real GDP growth in the second quarter of 2018 came in at 4.2%, up 0.1 percentage point from the first estimate. Consequently, we have left our forecast for the remainder of 2018 unchanged at just under 3%. This is well above our estimate of the economy’s long-run sustainable growth rate. As the effects from the federal fiscal stimulus fade and financial conditions gradually tighten, we project that growth will slow down to just under 2% by 2020.

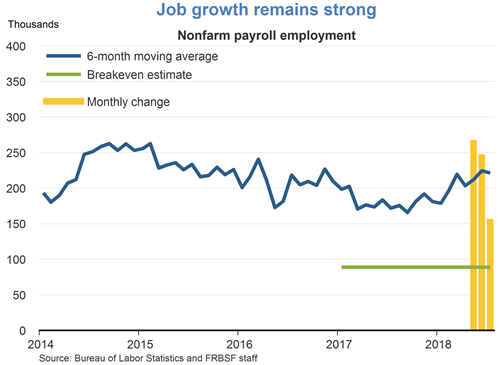

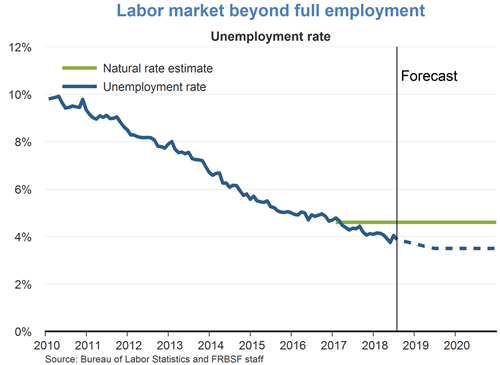

- The Bureau of Labor Statistics reported that total nonfarm employment in August increased by 201,000 jobs, although data for June and July were revised downward by a combined 50,000 jobs. That leaves the average for the past six months at under 200,000 jobs per month. Even so, this pace of monthly job growth remains well above the breakeven level needed to keep pace with the growth of the labor force. As a result, although the unemployment rate remained at 3.9% in August, we expect that it will continue to decline further below our 4.6% estimate of the natural rate of unemployment.

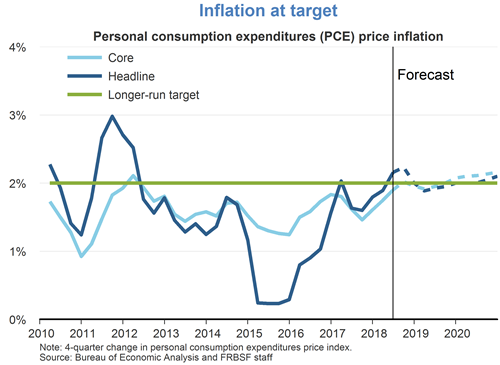

- Core PCE inflation in July came in at 2%, the Federal Open Market Committee’s (FOMC) target. With the economy expected to continue to grow above potential and the unemployment rate declining further from our estimate of the natural rate, we expect upward pressure on inflation in the medium term. We project that four-quarter inflation will slightly overshoot the 2% target in the next year or two.

- Following the conclusion of its latest meeting on August 1, the FOMC announced its decision to maintain the target range for the federal funds rate at 1¾ to 2%. The Committee noted that recent economic activity has been strong and that risks to the economic outlook appear roughly balanced. The Committee expects further gradual increases in the target range for the federal funds rate.

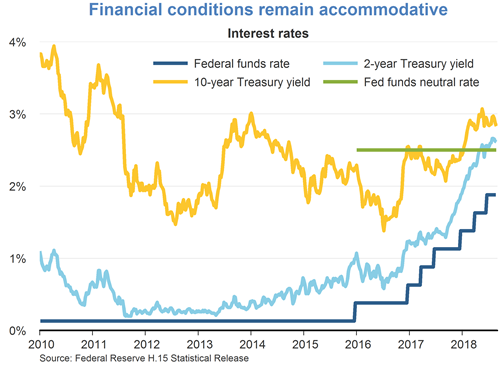

- Interest rates have continued to edge up with the gradual removal of monetary accommodation. However, the current level of the federal funds rate stands about 75 basis points below our estimate of its long-run equilibrium level.

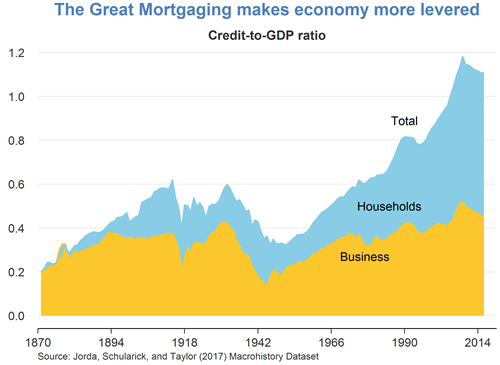

- A buildup of financial stress during good times is always a concern for the outlook. The more leveraged the financial system, the more exposed it is. Since World War II, and especially in the past 20 to 30 years, modern finance has given greater credit access to households, primarily in the form of mortgage borrowing.

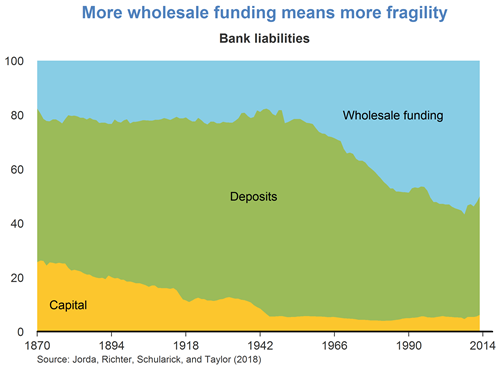

- As credit has expanded relative to the size of the economy, banks have increasingly had to rely on wholesale funding relative to their deposit base. This is a source of fragility. Wholesale funding is highly runnable, meaning that large pools of funds can vanish overnight thereby leaving banks in search of liquidity, and making the financial system more vulnerable.

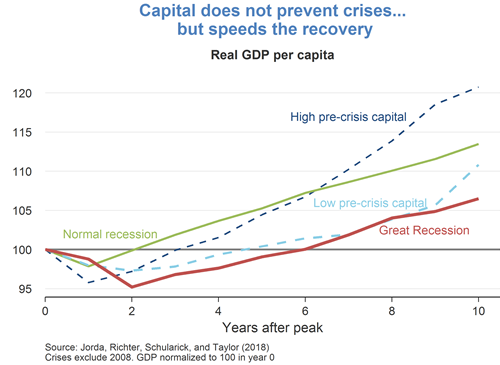

- Higher capital buffers allow banks to absorb and process losses more easily. This is particularly noticeable in a financial crisis: analysis of financial crises in advanced economies over the past one hundred fifty years shows that recoveries are visibly sped up when banks have more capital.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.