Mark Spiegel, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of July 11, 2019.

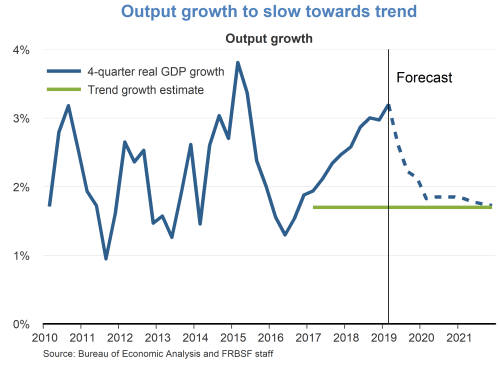

- Current economic growth is above trend, but is projected to slow over the coming year towards our estimated long-run potential pace of slightly below 2%. This expected slowdown was noted in the recent Congressional testimony by Chair Powell, who paid particular attention to cooling business investment, subdued inflation data, and crosscurrents associated with slow global growth and trade tensions.

- In contrast to the weakening investment picture, consumption appears to be picking up. Recent reports on automobile and retail sales have been strong, and measures of consumer sentiment remain quite elevated. Many of the other sources of strength in the first quarter, such as inventory adjustment and improvements in net exports, are expected to be transitory.

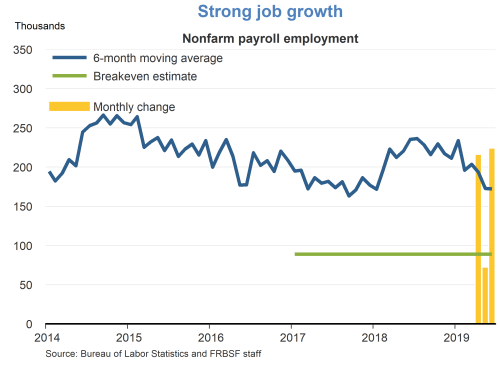

- The labor market continues to display strength. Payroll employment grew by 224,000 jobs in June; monthly gains over the past six months have averaged 172,000, far above the level estimated to be consistent with absorbing new entrants to the labor force. The strong job picture continues to draw more searchers into the labor market, resulting in the measured unemployment rate rising up a notch to 3.7%. However, unemployment still remains substantively lower than the estimated long-run natural rate of 4.2%.

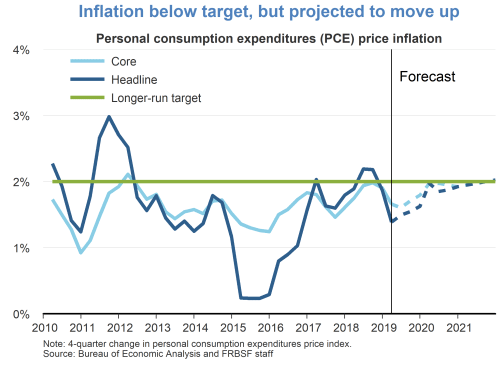

- Over the past ten years, inflation has been below the FOMC’s symmetric 2% target far more often than it has met or exceeded that target. Recent inflation figures remain discouraging, with the personal consumption expenditures (PCE) price index in May only increasing at a 1.5% annualized pace over the previous 12 months. Core PCE inflation rose 1.6% over the same period. The slow increase in wages is one factor keeping inflation below its target level. Despite the continued strength of the labor market, upward pressure on wages remains rather tepid, increasing only 3.1% for the year ending in June.

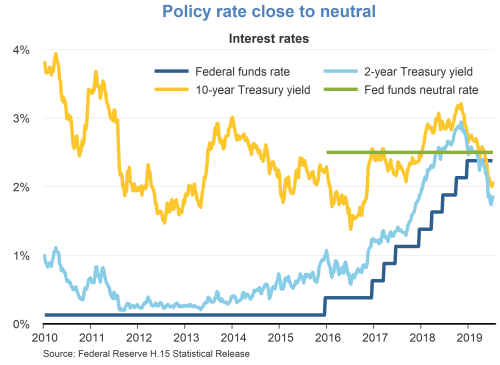

- The federal funds rate, the monetary policy rate, is currently close to the level that we consider consistent with a neutral monetary policy stance.

- Treasury yields have increased modestly since the previous FOMC meeting, with the spread between 10-year and 3-month Treasury yields remaining “inverted,” in the sense that the 3-month rate currently exceeds the 10-year rate. While such inversions have typically indicated recessions in the past, there is reason to believe that the very low long-term yields prevailing in current markets are partly attributable to special factors. These include the large holdings of long-term treasuries accumulated by the Federal Reserve through its past quantitative easing policy and elevated “safe haven” demand for long-term U.S. Treasuries due to heightened global uncertainty.

- The ongoing trade disputes between the United States and its main trading partners, particularly China, represent a prominent source of global uncertainty. The United States currently is levying a 25% tariff on $250 billion in imports from China. Markets rallied following the recent G-20 meeting, after the United States and China agreed to postpone any future tariff increases. However, much uncertainty remains about the ultimate resolution of this conflict, and measures of uncertainty about trade policy remain quite elevated.

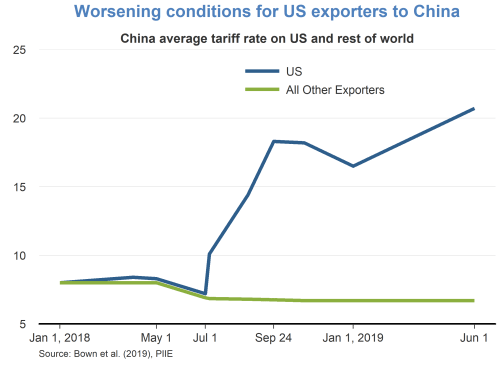

- A recent report from the Petersen Institute highlights the fact that China responded to U.S. trade restrictions by raising its tariffs on imports from the United States, while lowering them on imports from the rest of the world. These responses have left U.S. exporters at even worse competitive positions for the large Chinese market. While the United States and other exporters stood on equal footing at the start of 2018, by June of this year tariffs on U.S. products had risen to over 20%, while those on exports from other countries had fallen to 6.7% on average. The report also notes that China has been strategic in focusing its tariffs on U.S. goods that are either considered less vital or more easily sourced from other countries. For example, tariffs on agricultural products have been raised from 21% to 43%, while no tariffs are being levied on other more essential imported goods, such as pharmaceuticals.

- Many goods, particularly manufactured products, cross country borders a number of times during the production process, leading to multiple exposures to tariff duties. This is particularly true for U.S.-Mexican trade, involving goods such as automobiles and appliances. Components are produced in one country and then can travel back and forth across the border at different stages of production. With a 25% tariff on goods transported from a country to the United States, the final price of the item reflects not only the value added during production but also the added tariffs each time the product crosses the border.

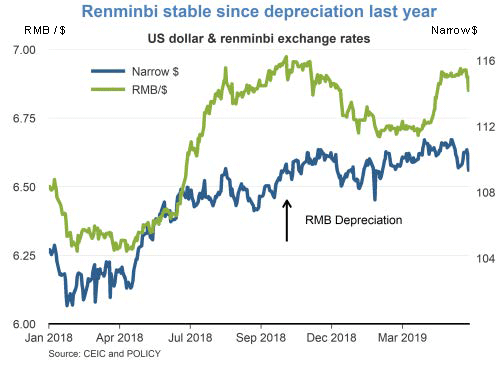

- Recent movements in China’s exchange rate have been interpreted as reflecting efforts by China to offset the effects of U.S. tariffs on demand for its exports by lowering the price of its currency. However, although the renminbi depreciated significantly against the dollar in the late spring and summer of 2018, this currency change occurred at roughly the same time as the dollar was appreciating against other currencies, as measured by the narrow dollar index. Since that time, the renminbi has basically floated within a limited trading range of between 6.75 and 7.00 to the dollar, with little notable trend.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.