Thomas M. Mertens, senior research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of June 13, 2019.

- Despite some softness in recent employment data, fundamentals for the U.S. economy remain solid. Economic growth is expected to continue at a moderate pace. The labor market is beyond full employment, and inflation has been running below the Federal Reserve’s target rate of 2%.

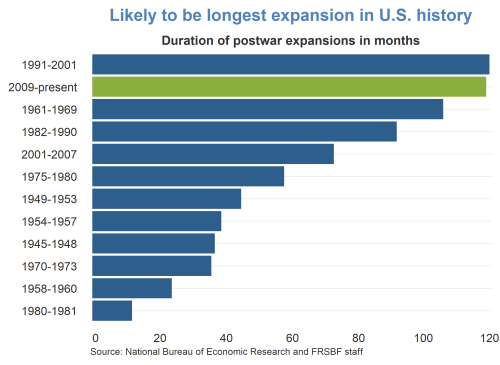

- The rebound from the Great Recession of 2007–2009 will likely become the longest period of continual economic growth recorded in U.S. history. At the end of this month, it will tie the 120-month record set by the 1991–2001 expansion. The first figure shows a bar plot of postwar economic expansions ordered by their duration. The current expansion, highlighted in green, is in second place through May.

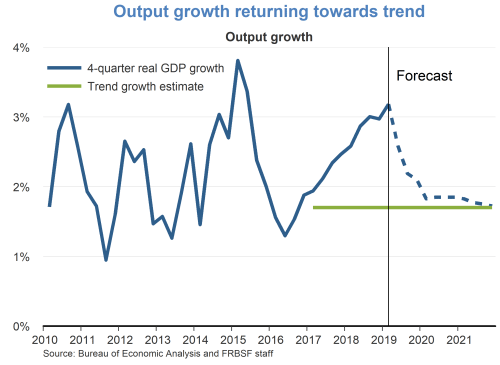

- Real GDP growth in the first quarter was 3.1% at an annualized rate, and it averaged 3.2% over the past four quarters. We expect growth to ease over the balance of this year and next, returning close to its potential pace of slightly below 2%.

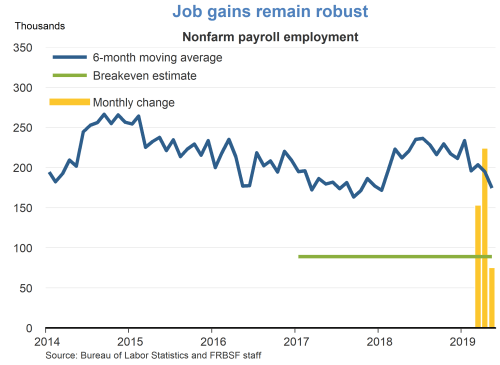

- Although nonfarm employment increased by only 75,000 jobs in May, this followed an increase of 224,000 jobs in April. The six-month average currently stands at 175,000 jobs per month. This pace of job creation is well above the rate necessary to absorb new entrants in the labor force over the longer term, which we estimate at around 90,000 jobs per month.

- Unemployment in May remained at its April rate, 3.6%, the lowest reading over a roughly five-decade period. The current rate is below the natural rate of unemployment, reflects the sustained robust pace of job creation, and supports the notion that the labor market is beyond full employment. Over the medium term, as growth slows, we expect the unemployment rate to gradually revert back toward its natural rate.

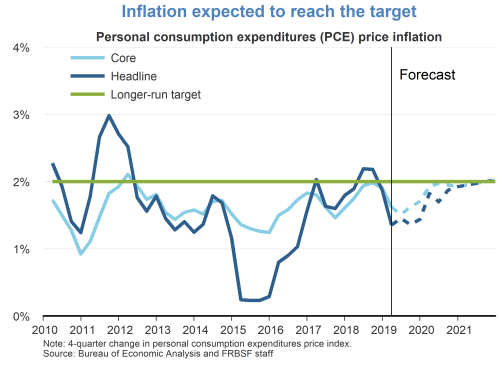

- Inflation has been running below the target rate of 2% set by the Federal Open Market Committee. The overall personal consumption expenditures (PCE) price index grew 1.5% over the previous 12 months, while core PCE rose by 1.6%. Supported by the solid fundamentals of the overall economy, we expect inflation to move back toward the target rate of 2% over the medium term.

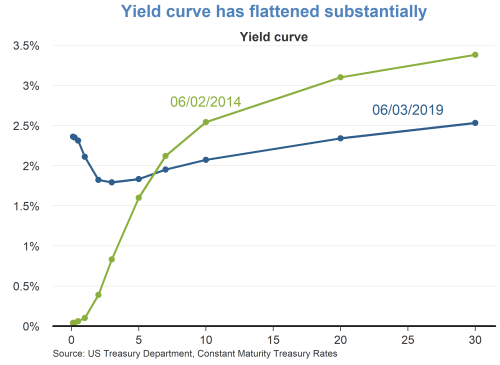

- Financial conditions remain accommodative. The 10-year Treasury yield decreased to slightly above 2% and the stock market has kept most of the gains accumulated during the expansion.

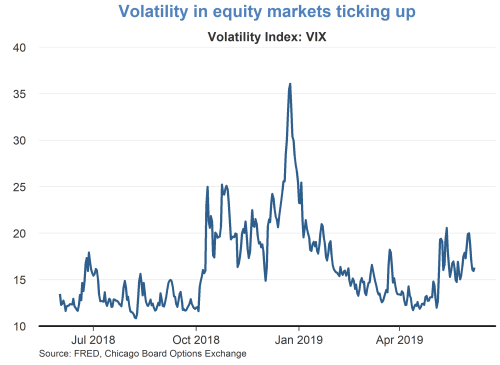

- This overall positive economic outlook is clouded somewhat by uncertainties and risks. One measure of risk in financial markets, the option-implied volatility index (VIX), ticked up from a level of 12 to about 16 over the previous two months. During the Great Recession, the VIX rose to just above 80; more recently, it peaked at 36 in December of 2018. Despite this recent increase, the current level of the index suggests only moderate concerns by investors. While there are both upside and downside risks to the outlook, I next take a deeper dive into one specific measure of downside risks.

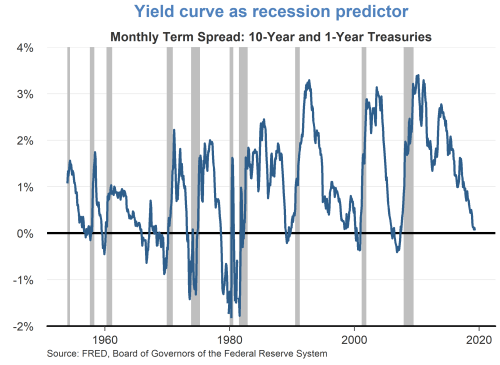

- The yield curve, a graphical representation of yields for Treasury securities with different maturities, has had an amazing track record at predicting recessions and capturing downside risks to the outlook. Since the 1950s, every recession in the United States has been preceded by an inversion of the yield curve. This inversion occurs when the slope of the yield curve, measured here by the difference between the 10-year and 1-year yields, turns negative. The only instance in which the yield curve has inverted without a subsequent near-term recession was during the mid-1960s.

- In late March and again in May, the yield curve inverted by the above-mentioned measure but then rebounded within several days. By contrast, past yield curve inversions occurring before recessions lasted much longer and were more pronounced. The question now arises as to whether an inversion of the yield curve in the current economic environment signals substantial recession risk or primarily reflects other financial influences.

- There are good arguments for both views. On the one hand, the quantitative easing (QE) programs the Federal Reserve implemented to buy long-dated Treasury securities put downward pressure on long-term yields. One argument is that current signals from the yield curve might be distorted by these QE effects.

- On the other hand, the term premium, the factor that would be affected by the Federal Reserve’s QE policy, did not affect the predictive power of the yield curve in the past. Deciding between these views is challenging because the lack of historical precedent limits a full statistical analysis of the current environment.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.