John Fernald, senior research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of March 14, 2019.

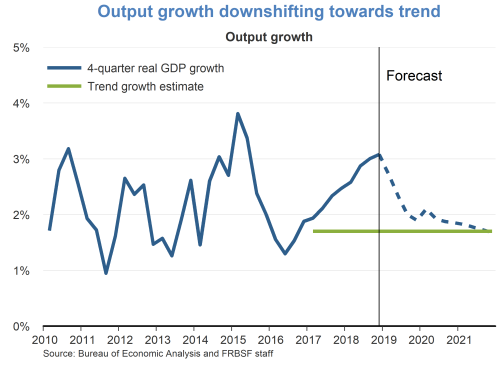

- The economy grew at a well-above-trend pace of 3.1% from Q4 2017 to Q4 2018. Since late last year, however, the data have been more mixed, suggesting that the economy has lost some momentum. Nevertheless, the labor market remains solid, financial conditions have improved since December, and consumer sentiment and business surveys, while easing from last year’s highs, suggest continuing growth.

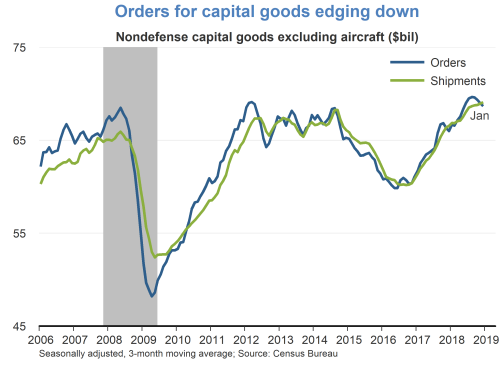

- A prominent example of a soft data release was retail sales, which fell sharply in December and only partially rebounded in January. The level of retail sales is well short of its pre-December trend. This series tells us something about the trajectory for consumer spending as we come into this year. Another example is orders for non-defense capital goods excluding aircraft—an indicator of upcoming capital spending on equipment by businesses—which eased at the end of last year and early this year. Orders have retreated a bit from their levels from last summer and fall, which suggests reduced growth in shipments of capital goods early this year.

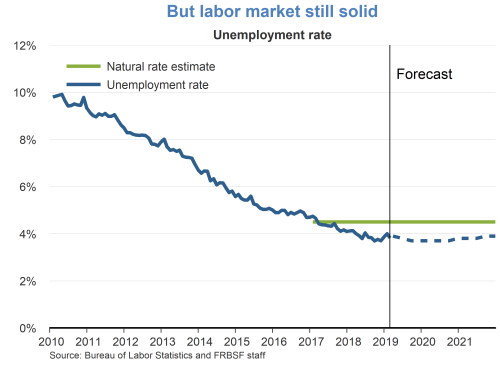

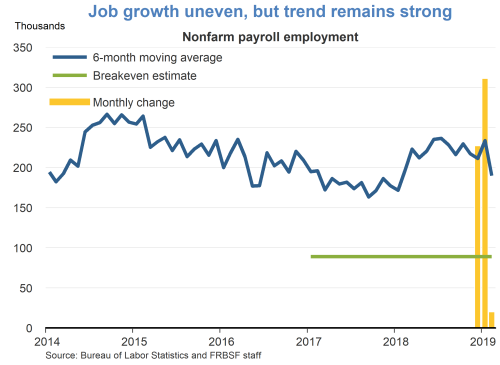

- Despite these signs of a slowing economy, economic conditions remain supportive of continued growth. For example, the labor market remains, on balance, fairly solid. The unemployment rate is very low—3.8% in February—and wage gains are gradually picking up, with average hourly earnings rising 3.4% in the past 12 months. Job gains have been choppy from month to month but, on average they have been solid. With a strong labor market, it is no surprise that surveys of consumer sentiment remain strong.

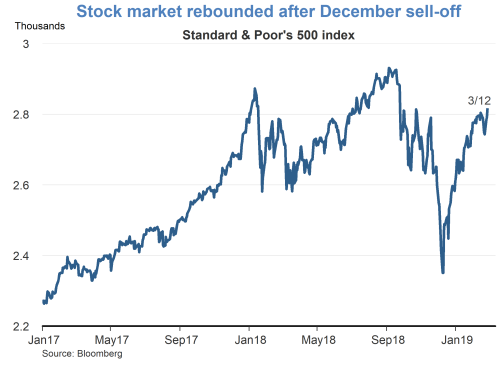

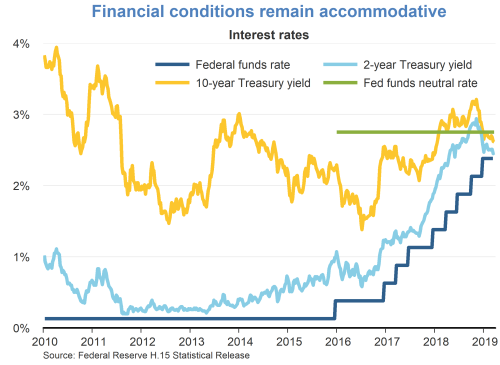

- In addition, another positive development is that financial conditions have eased considerably in 2019. For example, the stock market has rebounded from its December swoon—even if stock prices remain below their peaks from last fall. The stabilization in financial conditions was helped by the Federal Reserve’s announcement in January that it would be “patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate.” A solid labor market, favorable consumer sentiment, and improved financial conditions should help support consumer spending.

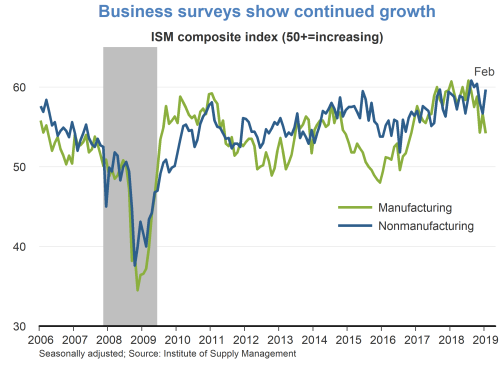

- Surveys of businesses also remain positive. This is particularly true outside of manufacturing, where surveys of purchasing managers remain close to the post-recession peaks from last fall. Manufacturing surveys have softened somewhat, but continue to signal expansion.

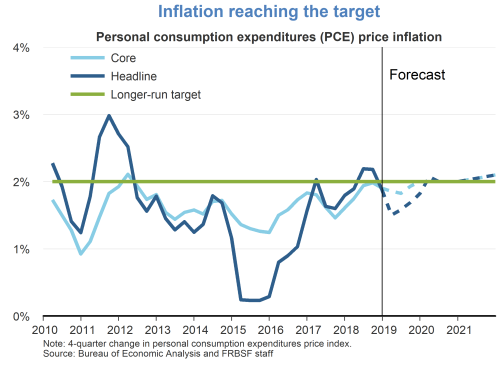

- Headline inflation of the personal consumer expenditures (PCE) price index over the past 12 months came in at 1.9% in December, slightly below the Federal Open Market Committee’s (FOMC) symmetric target of 2%. Core inflation, which excludes volatile food and energy prices, rose 1.8%. Given the tight labor market and ongoing monetary accommodation, we expect inflation to consistently achieve the 2% objective over the next few years.

- Putting it all together, real GDP is poised to continue to grow this year, but at a pace closer to its sustainable trend, which we put at 1.7%. This view about trend reflects assessments of the labor force (which determines potential hours worked) and productivity (most broadly, real GDP per hour worked).

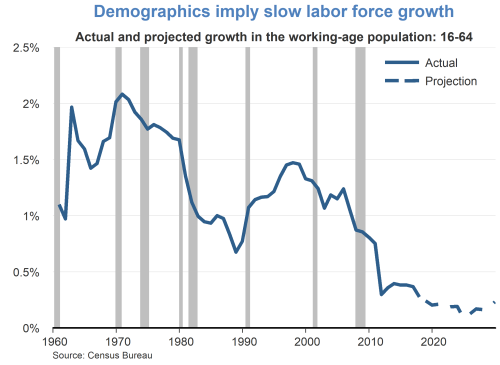

- Demographics are the most important reason to expect slow future growth relative to its historical pace. By the middle of the next decade, the working age population (16-to-64 year olds) will be growing at a historically low pace, reflecting the aging of the baby boom generation. Of course, the working-age population does not translate one-for-one into employment; for example, many people over 64 do work, and participation trends are changing for other groups. Going forward, the Congressional Budget Office projects that the potential U.S. labor force will grow at about a 0.5% pace. This is almost a percentage point below its average pace over the past half century.

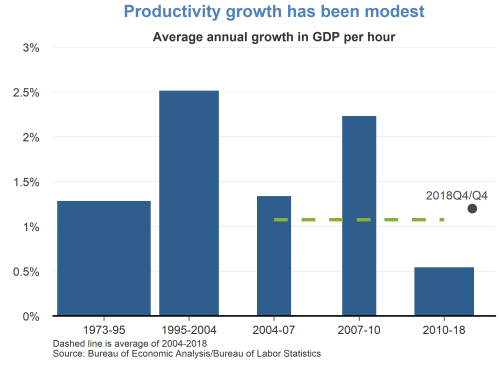

- GDP per hour has grown at varying rates over time. From 1973 to 1995, GDP per hour grew at an average pace of 1¼% per year. From 1995 to 2004, productivity accelerated to a 2½% pace, reflecting the broad-based and transformative role of IT, including the Internet. During this later period, IT-producing firms rapidly improved their equipment and software, and the use of IT allowed other firms throughout the economy to reorganize and improve their operations. After 2004, however, this exceptional pace disappeared. GDP per hour grew at only a 1.1% pace from 2004 to 2018 and has grown at an even lower pace since 2010.

- The slowdown in productivity growth after 2004 does not simply reflect the effects of the Great Recession since productivity growth slowed prior to 2007. Nor does it reflect a rising problem in the mismeasurement of growth. Mismeasurement is not new; it has always been a challenge to accurately capture the benefits of new goods and the improving quality of existing goods. Recent research finds little evidence that measurement problems have gotten worse. Rather, the post-2004 slowdown appears to reflect a return to normal after an exceptional period of IT-related business innovations and reorganizations.

- In 2018, GDP per hour grew 1.2%, well above its 2010-18 average but in line with the typical pace observed since the 1970s (with the notable exception of the 1995–2004 period). Though productivity might surprise and accelerate beyond this pace, history suggests that such accelerations occur infrequently and are hard to predict. We expect that GDP per hour will continue to grow at a similar pace of 1.2%, and that the trend labor force (and employment) grows at around 0.5% per year. Together, these imply that the new normal of real GDP growth is a little below 1¾%.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.