Adam Shapiro, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of November 14, 2019.

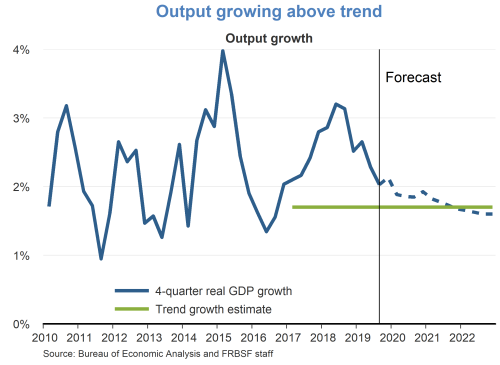

- After a strong first half, real GDP grew at an annual rate of 1.9% in the third quarter according to the advance estimate of the Bureau of Economic Analysis. We forecast that GDP will grow at an annual rate of 2.1% for 2019. As the effects from fiscal policy continue to wane, we expect growth to gradually fall back to our long-trend estimate of 1.7%.

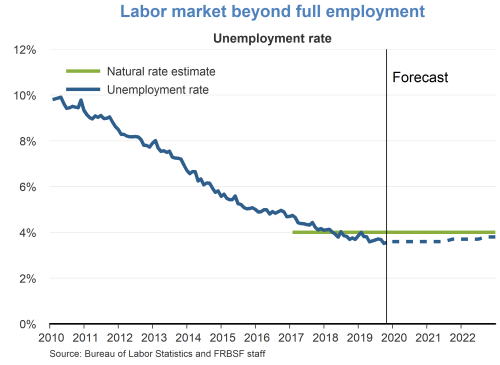

- The labor market remains strong. The unemployment rate stood at 3.6% as of October, where we expect it to remain over the medium run. Over the longer run, as growth slows towards its trend level, we project the unemployment rate will gradually return to its natural rate of 4.0%.

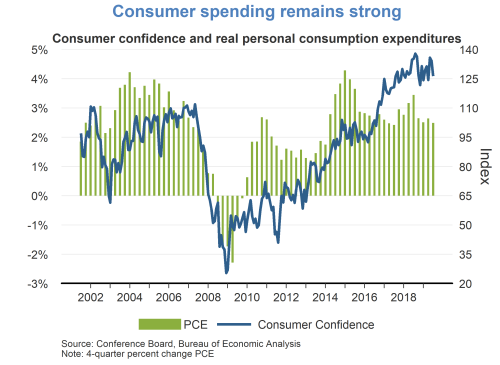

- The strong labor market has translated into a high degree of confidence among households. The consumer confidence index remains at historically high levels, coinciding with solid consumer spending growth. Real personal consumption expenditures grew at a 12-month rate of 2.6% in September, slightly above its average growth rate since the end of the recession.

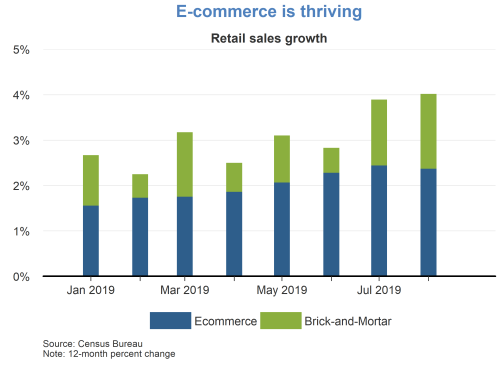

- Bolstering consumer spending is the ease with which consumers can purchase products online. While representing only 10% of retail sales, online purchases have made up the bulk of retail sales growth over the course of 2019. The sector is growing at a rapid rate, roughly doubling in size over the last five years.

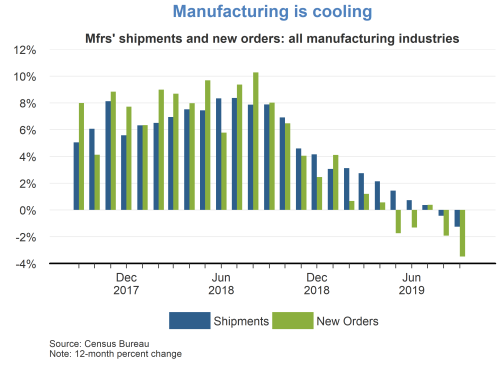

- Owing to tariff increases, softening global growth, and a strong dollar, the manufacturing sector has been cooling. In September, shipments and new orders were down 1.3% and 3.5%, respectively, from a year ago. Although the manufacturing sector makes up a relatively small share of GDP, its connectedness to other sectors poses some risk that its weakness could spread.

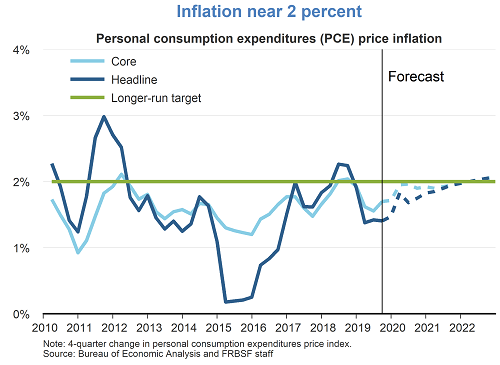

- Inflation remains below the FOMC’s target of 2%. The personal consumption expenditure (PCE) price index and the core PCE index both rose 1.3% and 1.7%, respectively, over the last 12 months. As the unemployment rate remains below the natural rate, we expect inflation to gradually reach the 2% target by 2021.

- In 1977, Congress amended the Federal Reserve Act to incorporate what is commonly referred to as the “dual mandate” in that the FOMC “promote effectively the goals of maximum employment and stable prices.” Inferring what stable prices means in practice is something the FOMC members have discussed and debated in public and in internal discussions.

- According to publicly released FOMC transcripts, the first instance in which price stability came up for discussion was in July 1996 when then Governor Janet Yellen suggested that price stability could be consistent with an inflation rate above zero under certain conditions. In particular, allowing for some inflation would be desirable because prices often increase due to improvements in product quality, which are not necessarily indicative of inflation. Other reasons for allowing for some positive inflation include allowing for a cushion against deflation and allowing for greater policy space given the effective zero lower bound. Nominal interest rates tend to be higher when inflation is higher, which leaves more room for the FOMC to cut the federal funds rate, the FOMC’s primary monetary policy tool rate, in a downturn.

- Over the last two decades, FOMC members have had differing views on the preferred level of inflation. On numerous occasions, members have stated their preferred inflation target at internal meetings. Before the Great Recession, the modal preference for the inflation target was 1.5%. Subsequently, as result of concerns about deflation as well as the risk of reaching the effective lower bound on the funds rate, FOMC members converged on a target rate of 2% in 2009. This ultimately led to the 2% target announcement in January 2012.

- The Federal Reserve is currently reviewing different strategies that could be effective in helping the Fed achieve its mandated goal of price stability. Two proposed strategies are price-level targeting and average inflation targeting. In contrast to the current inflation-targeting framework, price-level and average inflation targeting both embed so-called “makeup” properties whereby periods of below-target inflation must be made up in the future with above target inflation.

Correction, November 19, 2019: This revision corrects the title for figure 6.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.