Robert G. Valletta, group vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of September 12, 2019.

- The current U.S. economic expansion reached a milestone in July as the longest period without a recession in historical records dating back to the 1850s. However, emerging headwinds have dimmed the outlook somewhat, prompting a monetary policy pivot starting late last year.

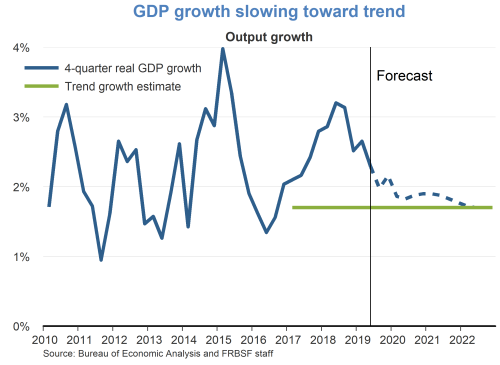

- Real GDP growth peaked at slightly above 3% in mid-2018, well beyond its estimated trend rate of about 1¾%. Growth in recent years has been largely propelled by solid gains in consumer spending and a fiscal policy tailwind. Recent data for automobile and general retail sales through August of this year indicate continued consumer strength.

- Despite healthy consumer spending, overall growth has slowed this year in the face of the waning effects of fiscal policy and intensifying headwinds from global economic developments. GDP grew slightly faster than 2% over the past four quarters, through the second quarter of 2019. We expect further slight slowing over the next few years, with growth converging toward trend. Growth at trend is consistent with continued economic health and is not troubling after a prolonged period of faster growth.

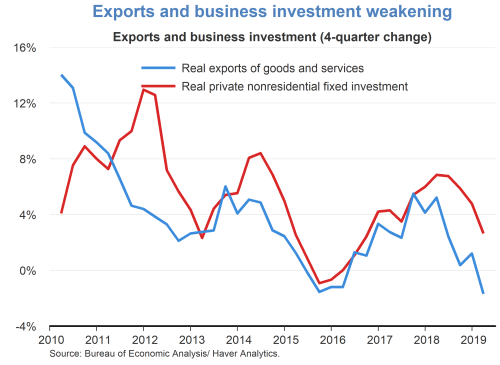

- The ongoing U.S. slowdown reflects intensifying headwinds arising from global economic developments, as trade barriers have risen and global growth prospects have dimmed. These developments have directly reduced demand for U.S. goods and also have contributed to rising business uncertainty that further restrains growth. The adverse impact of global headwinds is evidenced by a slowdown in U.S. exports to foreign economies and by reduced U.S. business investment spending.

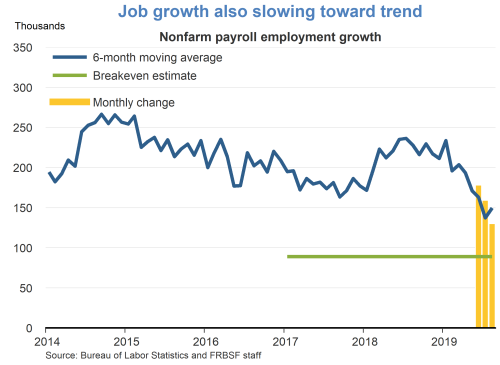

- Consistent with slower economic growth, job gains also have been easing this year. However, with past gains well above trend, this slowdown is consistent with a still healthy labor market, since by definition trend employment growth is adequate to absorb normal labor force growth and maintain a stable unemployment rate. Growth at trend will continue to support households’ favorable income prospects and financial positions, helping to sustain growth in consumer spending.

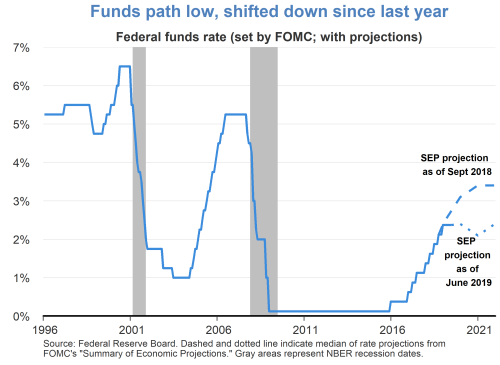

- Increased concerns about the economic outlook have prompted a pivot in monetary policy, as reflected in the Federal Open Market Committee’s (FOMC) quarterly “Summary of Economic Projections” (SEP). The SEP includes the projected path of the federal funds rate, the FOMC’s main policy tool. In the September 2018 SEP, FOMC members expected further tightening of monetary policy, with their median projection showing the funds rate rising by a full percentage point over the subsequent two years. In contrast, the June 2019 SEP showed that the projected funds path had flattened considerably. The committee’s decision the following month to reduce the funds rate by a quarter point reflects its commitment expressed in the July 2019 postmeeting statement to “act as appropriate to sustain the expansion.”

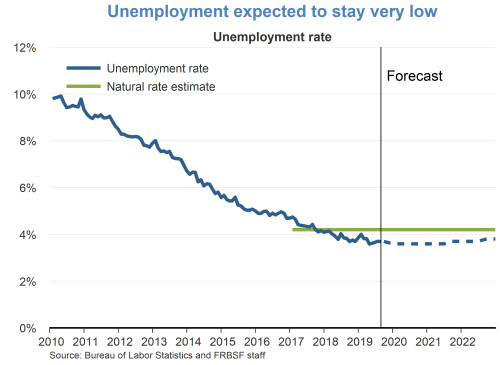

- The level of the unemployment rate reflects the favorable effects of the prolonged expansion in the U.S. labor market. The unemployment rate has been as low as 3.6% in recent months, a level not seen since the late 1960s.

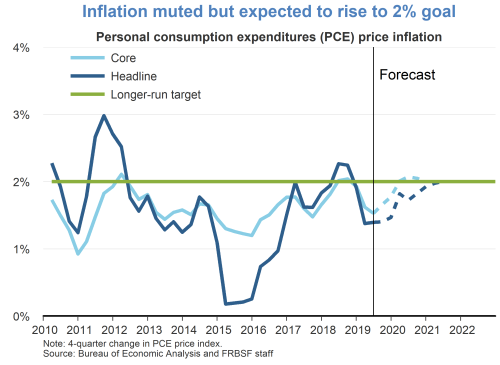

- Inflation has been below the FOMC’s 2% goal in 2019, continuing a pattern evident since 2012. We have lowered our estimate of the long-term sustainable or “natural” unemployment rate to help reconcile very low unemployment with muted inflation.

- Although we expect tight labor markets to slowly push inflation back up to 2% over the next year or two, some unusual features of the current labor market appear to have played a role in holding down inflation. In particular, the recent behavior of job seekers and employers likely has expanded the pool of potential workers and helped to sustain very low unemployment rates without the rapid wage and price growth experienced in past tight labor markets.

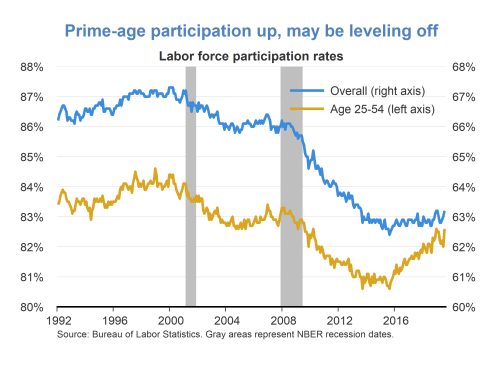

- The fraction of the adult population participating in the labor force, hence directly available for work, has been trending downward over the past few decades and fell sharply in the aftermath of the most recent recession. This recent decline largely reflects the aging and retirement of the large baby boom generation as well as declines in participation by people in their prime working years (ages 25–54). However, since 2015 the prime-age participation rate has risen substantially, providing a source of growing labor availability. Recent data suggest that this trend may be leveling off.

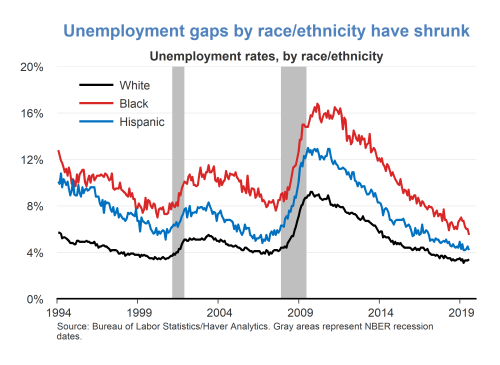

- On the employer side, widespread media reports suggest that firms have been expanding their candidate pools in response to the tight labor market, by reaching out to various groups that are often overlooked in the recruiting process. This is reflected in the shrinking gaps in unemployment rates across racial and ethnic groups. On average, blacks and Hispanics face labor market disadvantages, experiencing substantially higher unemployment rates in comparison to whites. However, these gaps have diminished to historic lows recently.

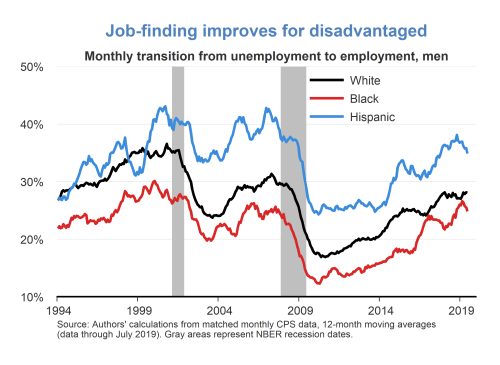

- Underlying the unemployment gaps across racial and ethnic groups are differences in the rates at which unemployed individuals from these groups lose and find jobs. Hispanics workers, who are concentrated in high turnover sectors such as construction, tend to have high job-finding rates, whereas blacks tend to have low job-finding rates. Relative to whites, job-finding rates for both groups have been unusually high since early 2018, consistent with the expansion of employers’ recruiting activities toward previously marginalized groups. This pattern may be reaching its limit, however, as job-finding rates for blacks and Hispanics have eased in recent months.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.