Sylvain Leduc, executive vice president and director of research at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of April 2, 2020.

-

The human toll from the coronavirus disease (COVID-19) pandemic continues to

rise around the world. As authorities implement social distancing

restrictions to mitigate the spread of the coronavirus, the associated

economic costs are becoming more apparent. How the economy will fare over

the next several quarters remains highly uncertain, however. Much hinges on

how the virus spreads and evolves over time, as well as on the effectiveness

of social distancing and shelter-in-place measures. This uncertainty

necessarily clouds the economic outlook. -

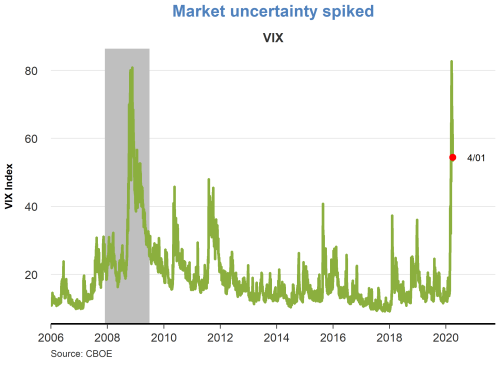

The uncertainty about the coronavirus is spreading through financial markets

as well. The Chicago Board Options Exchange Volatility Index, or VIX, is

frequently used as a measure of uncertainty based on equity market

volatility. This so-called fear index measures investors’ perceptions of the

30-day-ahead volatility of the S&P 500. The VIX shot up recently to a level

even higher than that experienced at the height of the 2008 financial

crisis. While the VIX has declined from its recent peak, it remains elevated

by historical standards. -

This uncertainty has impeded the proper functioning of the financial system.

Using its emergency powers, the Federal Reserve set up facilities to

increase liquidity in several segments of the financial system, including

money market mutual funds, the commercial paper market, and the corporate

bonds markets, among others. The Fed also resumed buying Treasury securities

and agency mortgage-backed securities and reduced the federal funds rate to

near zero. -

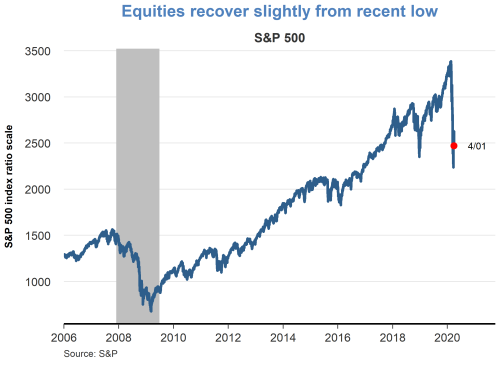

Equity prices have fallen sharply since the end of February and the market

has remained very volatile. Still, the passage of the Coronavirus Aid,

Relief, and Economic Security (CARES) Act has helped the stock market recoup

some of its losses. The $2 trillion relief package, at roughly 9% of GDP,

includes several measures targeted to alleviate the adverse economic impact

on households, businesses, and workers. This assistance should provide some

support to the economy in the months ahead. -

Spreads on riskier assets, such as low-grade corporate bonds, have remained

high. Substantially higher borrowing costs might pose challenges to highly

indebted corporations. Rollover risk is somewhat limited in the near term,

as only 2% of speculative-grade corporate bonds are expected to mature

during the second quarter. However, corporations currently in need of

funding are facing much direr financial conditions. -

The current financial conditions are also extremely challenging for small-

and medium-size businesses, particularly since roughly half of them only

have enough cash on hand to cover operating expenses for about one month,

according to a recent JPMorgan Chase Institute report. Payroll reductions at

small and medium-size businesses could have a large impact on the labor

market, as these businesses account for 47% of total employment. -

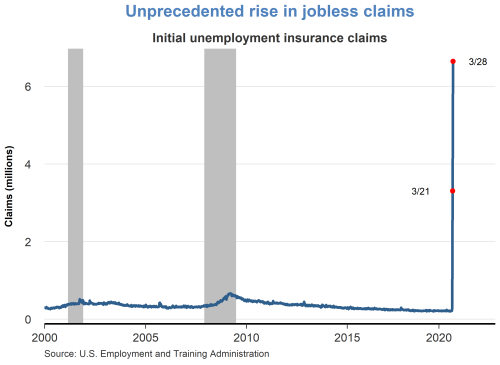

With social distancing measures and shelter-in-place orders, firms have had

to rapidly shed workers on an extraordinary scale. Payrolls contracted by

roughly 700,000 in March and the unemployment rate rose from 3.5% to 4.4%.

However, this captures only part of the worsening of labor market

conditions, since the labor market surveys use the middle of the month as a

reference point to compile the data. Thus, this snapshot for March occurs

before most social distancing measures were widely implemented. Indeed,

jobless claims surged to unprecedented levels in the last half of March,

with more than 10 million workers filing new claims. Hence, the unemployment

rate is likely to rise much more in the following months. -

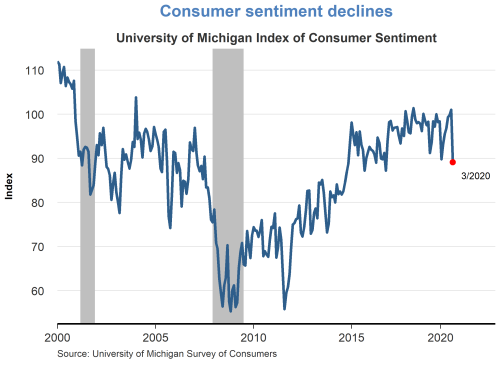

Consumer confidence also fell in March, as economic activity in several

parts of the country stalled and the economic outlook darkened. Consumer

confidence is likely to decline further in the months ahead as labor market

conditions worsen. -

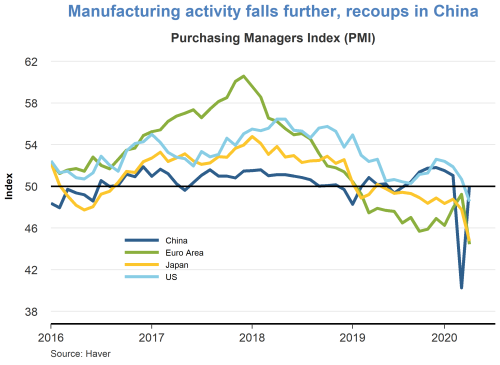

The pandemic is also adversely affecting manufacturing activity around the

world. While China’s purchasing managers index (PMI) rebounded last month as

the country’s social distancing measures were eased, the PMIs in the United

States, Japan, and the euro area fell sharply. -

The uncertainty around the evolution of the pandemic heavily clouds the

outlook. As a result of the necessary social distancing measures, the

contraction in economic activity will be deep in the second quarter,

accompanied by a steep rise in unemployment. How the economy evolves

thereafter will largely depend on the effectiveness of social distancing

measures and whether the virus weakens during the summertime or experiences

a second burst in the fall. It will also depend on whether social

interactions quickly resume once the virus abates. Given the rareness of

similar events for comparison, our understanding of these issues is too

imprecise to provide clear guidance about the evolution of the economy later

this year and the next. -

In the best scenario, the virus is sufficiently contained by the end of the

second quarter that activity can quickly resume in the second half of the

year. The strength of the rebound will depend on the effectiveness of

monetary policy accommodation and the fiscal relief package in providing

sufficient support to households and firms to avoid typical recessionary

dynamics. -

However, if the social measures last substantially longer, more firms may go

out of business and more workers may remain or become unemployed, reducing

aggregate demand further and lengthening the downturn. The rebound in

activity would be more muted in this case, as relationships between workers,

firms, and banks would need to be reestablished. -

All told, the steep decline in economic activity suggests that inflation is

likely to decline this year and remain substantially below target in the

near future.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.