Glenn Rudebusch, executive vice president and senior policy advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of December 3, 2020.

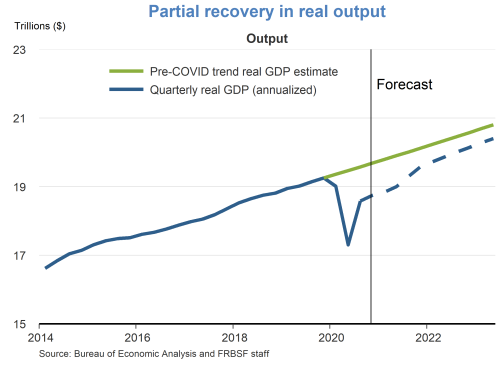

- The coronavirus (COVID-19) pandemic led to an unprecedented contraction in output last spring. Since then, the economy has staged a partial rebound—retracing a bit more than half of its earlier decline. The latest resurgence in the spread of the virus will be a substantial economic headwind this winter. By the middle of next year, the economic recovery should gain strength given prospects for a successful vaccine distribution and more fiscal stimulus. Still, the economy will be slow to return to its pre-virus trend.

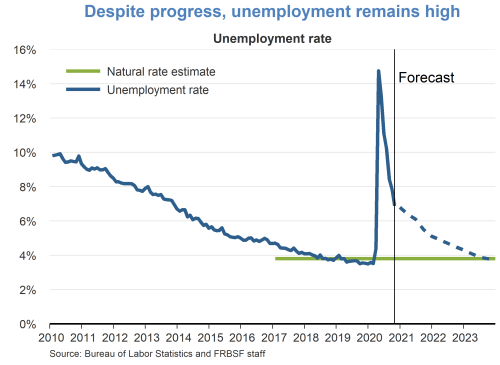

- The labor market mirrors this pattern of partial economic recovery. The unemployment rate spiked in April to 14.7% but rapidly recovered to 6.9% by October. However, further gains are likely to occur at a much slower pace given the persistent scarring caused by the economic recession. This scarring includes reduced human capital from severed employment relationships and missed educational opportunities, less physical capital given the drop in business investment, and lost organizational capital as businesses go bankrupt.

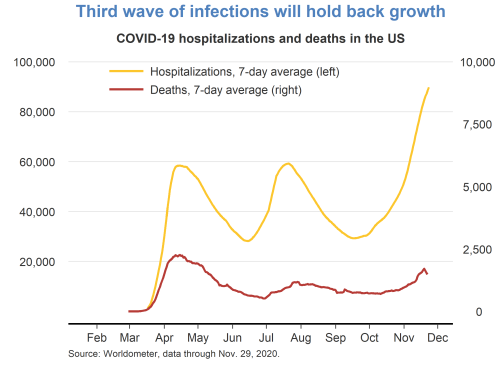

- After a first wave of COVID-19 hospitalizations concentrated in the Northeast and a second wave centered in the Sun Belt, the United States is facing a dangerous third wave, most virulent in the Midwest but effectively national in scope. Seasonal holiday gatherings, physical distancing fatigue, and colder temperatures are boosting caseloads to levels that could overwhelm parts of the healthcare system. This viral relapse is particularly unfortunate because prospects for widespread vaccine distribution in the first half of next year have improved.

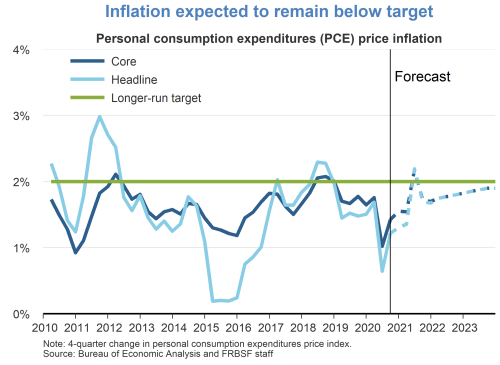

- Core personal consumption expenditure prices rose 1.4% over the 12 months ending in October. During the robust expansion prior to the pandemic, the Fed struggled to push inflation up to its longer-run 2% inflation target, and this task appears even more difficult now given a weak economy and considerable labor market slack. Under its new monetary policy framework, the Fed “seeks to achieve inflation that averages 2% over time,” which we expect will take several years to attain.

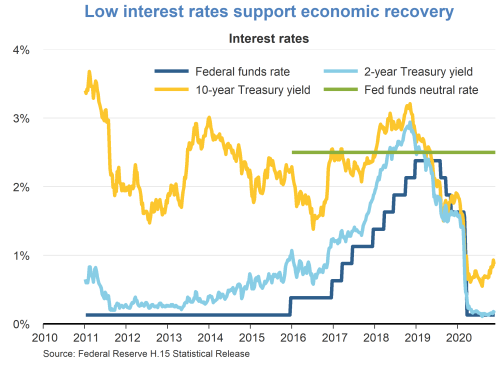

- The Fed provided a multi-pronged monetary policy stimulus to support the economic recovery. The Fed lowered the federal funds rate to essentially zero and provided forward guidance that short-term interest rates would remain low for some time. In addition, the Fed’s large-scale purchases of government securities helped push down longer-term interest rates. The minutes of the Federal Open Market Committee meeting in November described the Fed’s evolving strategy regarding asset purchases. Most participants agreed that the Fed should provide additional “qualitative outcome-based guidance” regarding the future path of the Fed’s purchases. Another option is to lengthen the duration of asset purchases—that is, purchasing longer-term securities instead of shorter ones—which would also tend to lower longer-term yields.

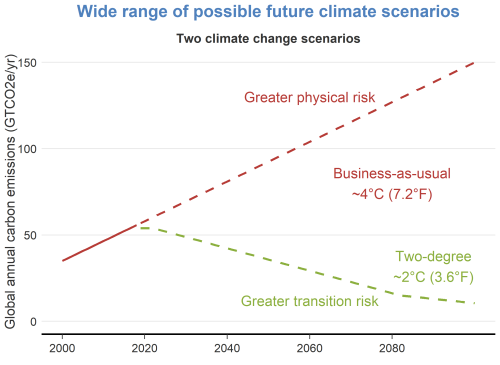

- Over the past five years, financial supervisors around the world have begun analyzing and assessing the financial risks caused by climate change. Climate change increases the likelihood of shocks, disruptions, and dislocations affecting the economy. The associated financial risk can threaten financial institutions and the stability of the financial system. There are four broad sources of climate uncertainty. First, the future path of carbon emissions is unknown. Second, for a given path of emissions, the extent of resulting climate changes is uncertain. Third, there is uncertainty about the amount of economic damage to the economy from a given climate outcome. Finally, there is an uncertain feedback loop from economic and financial outcomes back to carbon emissions.

- There are two important categories of climate risks: physical and transition. Physical risks are based on losses from climate-related extreme events and adverse climate trends. For example, storms, floods, droughts, and wildfires can disrupt operations and destroy capital. Transition risks reflect financial losses from the shift to an economy that produces fewer carbon emissions. For example, changes to climate policy and technology can lead to the reassessment of asset prices, income, and profitability in a variety of sectors.

- In a business-as-usual future climate scenario, higher carbon emissions increase physical risk from more severe climate events and adverse trends but reduce severe transition risk. In contrast, in a quick transition to a low-carbon economy, reductions in carbon emissions reduce physical risk but can produce more transition risk from significant changes in climate policy and technology.

- As a concrete example, real estate assets have potential exposure to a wide variety of climate hazards, such as storm surges, wildfires, hurricanes, rising sea levels, and increased flood risk. They may also be exposed to climate-related policy shifts, say, in building codes and insurance rules. As a result, financial institutions face potential climate-related credit/collateral losses, real estate asset price declines, and operational risks. The opacity, uncertainty, and potential nonlinearity of these climate-related losses could lead to sudden climate-related shifts in investor perceptions and abrupt repricing of financial assets such as real estate loans and mortgage-backed securities.

- Last month, the Federal Reserve published two reports—a Supervision and Regulation Report and a Financial Stability Report—that provided a two-prong official acknowledgement of the importance of climate risk for financial supervision. First, Federal Reserve supervisors expect individual financial institutions to “appropriately identify, measure, control, and monitor all of their material risks, which for many banks are likely to extend to climate risks.” Second, at a macroprudential level, the Federal Reserve “will monitor and assess the financial system for vulnerabilities related to climate change through its financial stability framework.”

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.