Kevin J. Lansing, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of January 9, 2020.

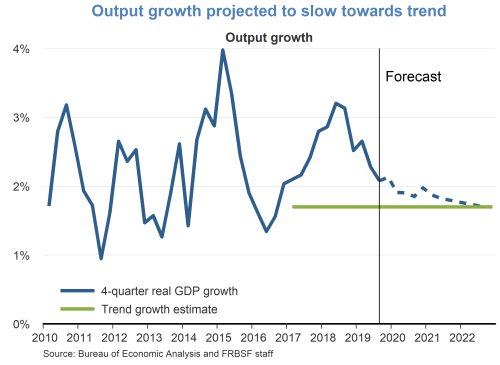

- Real GDP grew 2.1% at an annual rate in the third quarter of 2019, unrevised from the prior estimate of the Bureau of Economic Analysis. For 2019 as a whole, we expect growth of 2.3%, somewhat above our estimate of the economy’s long-run sustainable growth rate of slightly below 2%. Given the waning effects of federal fiscal policy, we project that growth will slow towards trend by 2022.

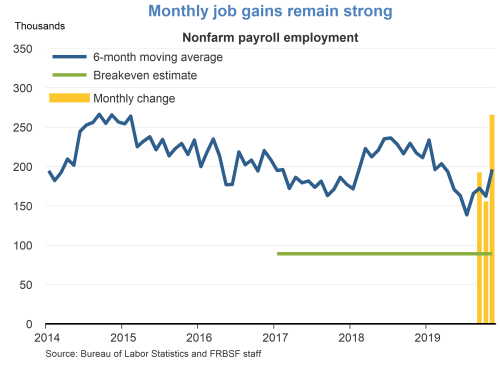

- The Bureau of Labor Statistics reported that payroll employment increased by 266,000 jobs in November. Data for the previous two months were revised upward, resulting in an average monthly gain over the past three months of 205,000 jobs. The unemployment rate ticked down to 3.5% from 3.6% in October. We expect monthly job gains to gradually trend down towards the breakeven level needed to keep pace with the growth rate of the labor force, which we estimate at around 90,000 jobs per month.

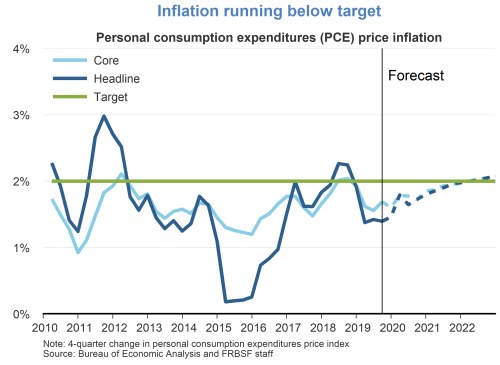

- Inflation over the past year is running slightly below the Federal Open Market Committee’s (FOMC’s) 2% target. The overall personal consumption expenditures (PCE) price index rose 1.5% over the 12 months ending in November. Core inflation, which excludes volatile food and energy prices, rose 1.6%. With unemployment below the natural rate and real GDP growth above its long-run sustainable pace, we expect some upward pressure on inflation over the medium term, causing the inflation rate to reach target by 2022.

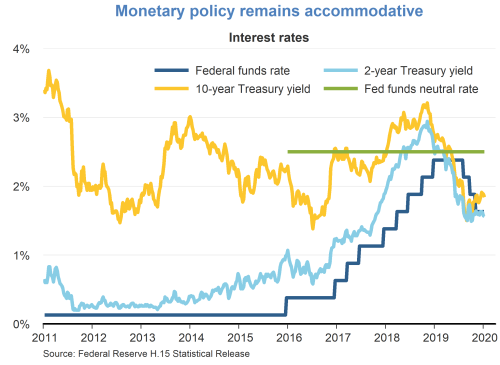

- Following the conclusion of its latest meeting on December 11, 2019, the FOMC announced its decision to maintain the target range for the federal funds rate at 1½ to 1¾%. The Committee noted that while labor market conditions and household spending remain strong, business fixed investment and exports are weak.

- The current level of the federal funds rate remains accommodative as it stands about 1 percentage point below our estimate of the “neutral” federal funds rate. Long-term Treasury yields are only slightly above short-term yields suggesting that bond market investors do not expect to see a substantial increase in short-term interest rates over the relevant forecast horizon.

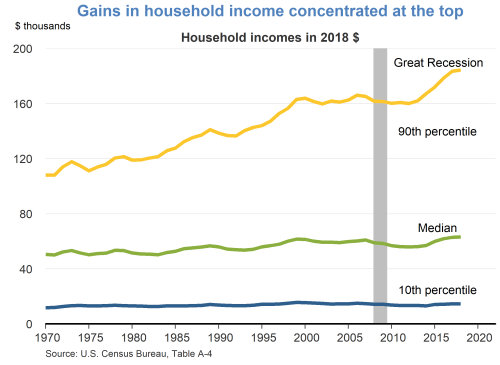

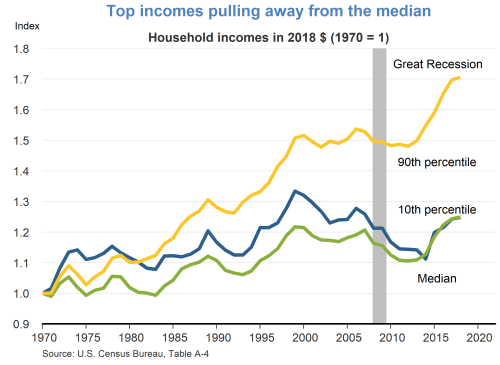

- Income inequality in the U.S. economy has increased markedly over the past 50 years, particularly in the decade since the end of the Great Recession. At the end of 2018, the median (50th percentile) pretax and pretransfer household income stood at $63,179. By comparison, the 90th percentile household income was $184,292, and the 10th percentile household income was $14,629. The 90th percentile income level is now well above its pre-recession level in 2007, whereas the median and 10th percentile income levels are little changed from their 2007 levels. This pattern shows that the income gains from the economic recovery have not been evenly distributed, thus presenting a challenge to the goal of shared prosperity.

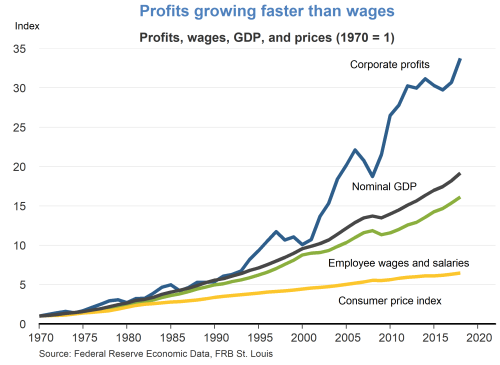

- From 1970 to 2000, the average growth rate of corporate profits was not much different than the average growth rate of employee wages and salaries or the average growth rate of nominal GDP. However, since the year 2000, gains in corporate profits have far outpaced increases in wages and GDP. Given that the ownership of corporate stock is highly concentrated in the upper tiers of the U.S. income distribution, the disproportionate increase in corporate profits has served to exacerbate the trend of rising income inequality between the top 10% and the remaining 90% of households.

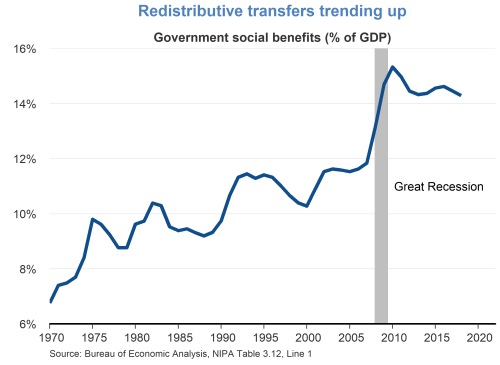

- Federal, state, and local government social benefits as share of GDP have approximately doubled in the past 50 or so years, from 6.7% in 1970 to 14.2% in 2018. These forms of assistance include Medicare, Medicaid, Supplemental Security Income, Family Assistance, Food Stamps, Unemployment Insurance, and Old Age, Survivors, and Disability Insurance, among other programs. Payments from these programs go disproportionately to households and individuals in the lower tiers of the U.S. income distribution. The trend of rising government social benefits can be viewed as an imperfect, but nevertheless mitigating, factor against the trend of rising income inequality.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.