Thomas M. Mertens, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of July 9, 2020.

- The coronavirus (COVID-19) pandemic and the public health measures taken to prevent its spread have led to a severe contraction of economic activity. Data from March and April showed severe disruptions in the labor market as the number of new nationwide infections appeared to peak in late April. After a period of declining new coronavirus cases, infection rates have picked up again since mid-June. The current economic outlook is highly uncertain as it continues to depend on the path of the virus.

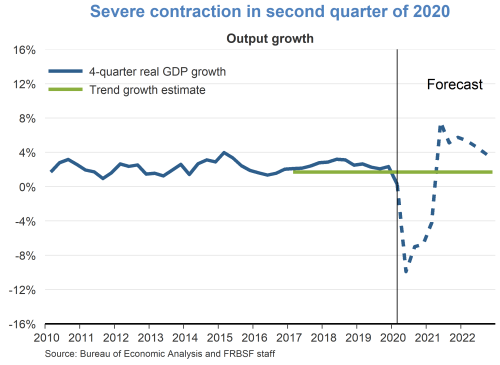

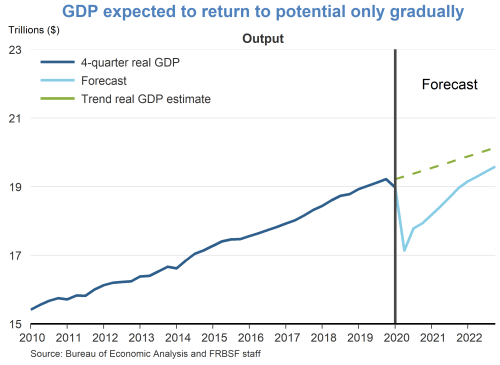

- Output contracted sharply during the first half of the year. Gross domestic product fell by 5% at an annualized rate during the first quarter of 2020, and we expect a substantially larger decline in the second quarter. Consumer spending on travel, dining, and retail, as well as industrial production fell precipitously in response to public health measures taken to reduce the virus’s transmission rate. Barring a major second wave of infections, the U.S. economy should start its recovery during the second half of the year. But it will likely take a few years until the U.S. economy has fully caught up with its potential. A pronounced second wave, however, would likely lead to a deterioration of the overall economic outlook and delay recovery. Overall risks are currently tilting towards the downside.

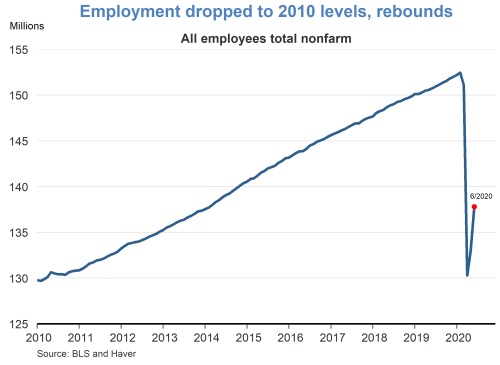

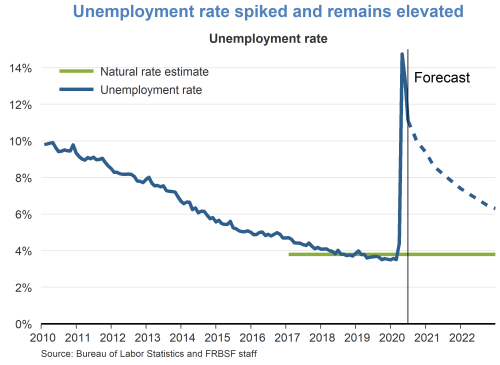

- The labor market was severely disrupted by the unfolding health crisis. Over 21 million jobs were lost in March and April, wiping out roughly ten years of job gains during the previous expansion. Consequently, the unemployment rate peaked at 14.7% in April, a level not seen since the Great Depression. These losses were partially offset by gains of 2.7 million jobs in May and 4.8 million jobs in June. As a result, the unemployment rate declined last month to 11.1%, still a highly elevated level. The impact of the recent surge in coronavirus cases on the unemployment rate remains highly uncertain. Over the next few years, we foresee a gradual decrease in unemployment, reaching a level of around 6% by the end of 2022, still well above the levels prior to the pandemic’s onset.

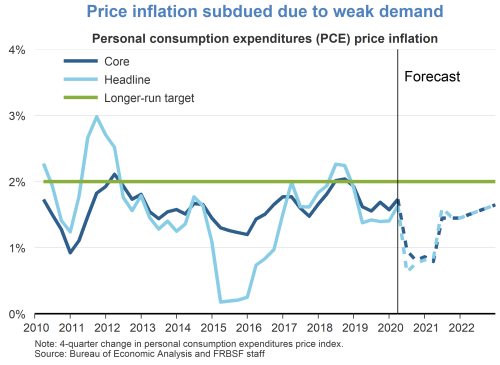

- The total personal consumption expenditures (PCE) price index rose 0.5% over the 12 months ending in April. This sluggish increase in prices resulted from weak demand and substantially lower energy prices. The core PCE price index, which excludes food and energy prices, rose by 1% over the same period. We expect inflation rates to remain below the Federal Open Market Committee’s (FOMC’s) 2% target rate in the near term and increase gradually toward the target once the recovery is under way.

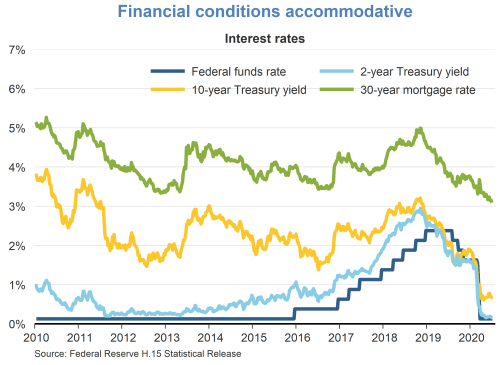

- In response to the unfolding economic crisis, the FOMC cut the federal funds rate from a target range of 1.5% to 1.75% at the beginning of the year to its effective lower bound of 0% to 0.25%. The Federal Reserve further supported the functioning of financial markets and the flow of credit to households and businesses with purchases of Treasury and agency mortgage-backed securities and targeted lending programs. As a result, total assets on the Federal Reserve’s balance sheet expanded from roughly $4.1 trillion in early 2020 to above $7 trillion by June.

- Financial conditions are overall accommodative. The pandemic led to a decrease in Treasury yields across maturities. The two-year Treasury yield is currently trading within the target range of the federal funds rate, indicating that investors expect the policy rate to stay at the lower bound for an extended period of time.

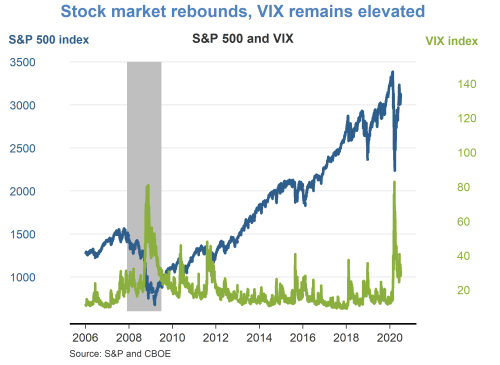

- Equity markets reacted to news of the spread of the virus with a large drop in prices. The S&P 500 index fell by 34% between late February and late March. Over the same period, volatility, as measured by the Chicago Board Options Exchange Volatility Index, or VIX, spiked to levels not seen since the Great Recession of 2007–2009. After the passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act and Fed announcements to launch new funding facilities to address strains in financial markets in March, the stock market rebounded and retraced most of its losses.

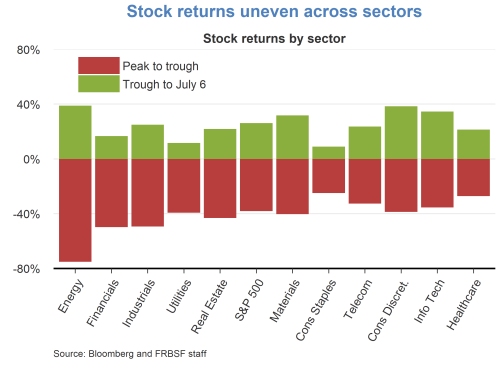

- While the aggregate stock market has recovered most of its losses since its initial fall, the impact on individual sectors has been uneven. Within the S&P 500 index, companies in the information technology and healthcare sectors suffered the smallest declines in valuations. The energy, financial, industrial, and utilities sectors, on the other hand, experienced the largest net declines. This differential impact across individual sectors is seemingly in line with differences in the effect of the coronavirus crisis on economic fundamentals.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.