Reuven Glick, group vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of October 8, 2020

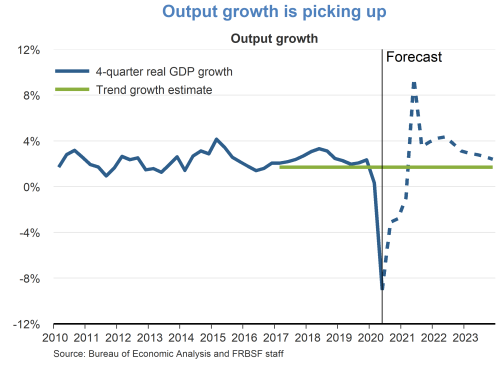

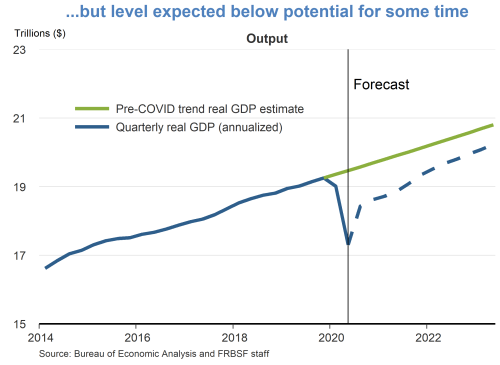

- The coronavirus (COVID-19) pandemic and associated social-distancing measures caused an unprecedented contraction in GDP, which fell 31.4% at an annual rate in the second quarter. Recent data on consumption spending, manufacturing output, purchasing manager reports, and housing construction and sales indicate the economy rebounded substantially in the third quarter, though August and September data suggest some deceleration heading into the fourth quarter. We expect continued GDP growth over the near to medium term, but it will take several years before output catches up to its potential level absent the virus. Downside risks to the current outlook include a possible resurgence of the virus and the lack of an agreement for more fiscal stimulus.

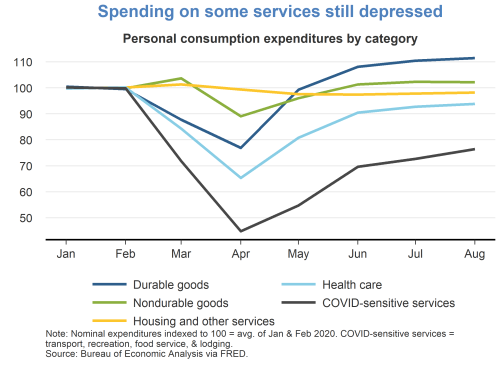

- Consumption accounts for two thirds of economic activity and is the main driver behind the economy’s plunge and recovery. In a typical recession, durable goods spending falls as consumers postpone big expenditures. In this downturn, service spending fell in March and April because of reduced outlays for “COVID-sensitive” services, such as transportation, recreation, restaurants, and hotels, which rely on extensive personal contact. Even health-care spending fell substantially, as many discretionary services were postponed in the initial phase of the pandemic.

- Since April, consumer spending has rebounded significantly, recovering most of its earlier decline, with the exception of spending on COVID-sensitive services, which is still well below normal. This disparate spending pattern reflects the two-track nature of the recovery related to the extent to which particular industries and people are directly exposed to the pandemic. The expiration of expanded unemployment insurance benefits at the end of July has caused concern that consumer spending may falter without more fiscal support or more business reopenings.

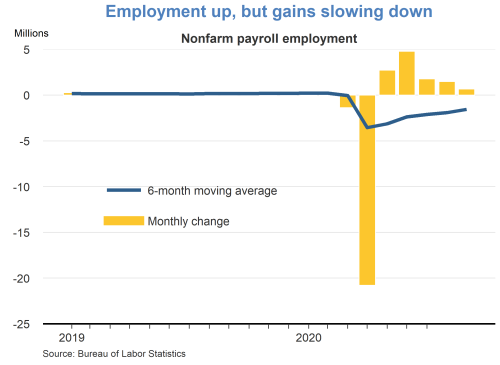

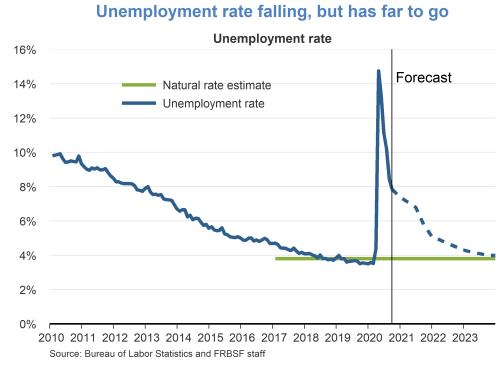

- The labor market provides more evidence that the economy is recovering. A bit more than half of the 22 million jobs lost in March and April have been added, though the rate of job gains is slowing. A disproportionate share of the job losses has occurred for service industry workers interacting with the public. Correspondingly, since spiking to 14.7% in April, unemployment has fallen almost by half, reaching 7.9% in September. There is still a long way to go, as unemployment is more than twice as high as its pre-pandemic level of near 4%.

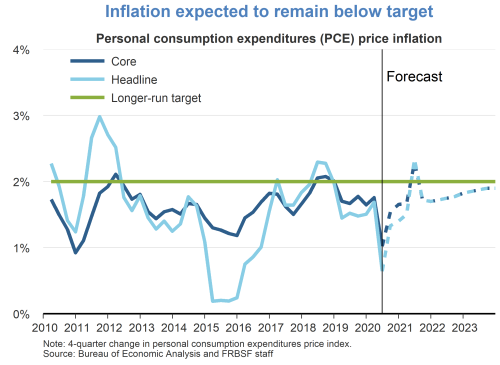

- The huge negative hit to aggregate demand in the second quarter, coupled with drops in oil prices, pushed down both headline and core inflation, where core excludes food and energy. Inflation has risen recently as economic activity has picked up. Headline inflation in August rose 1.4% on a 12-month basis, up from 1.1% in July, while core inflation rose to 1.6%, up from 1.4% in the prior month. We expect inflation to recover more going forward, but we do not expect to see a return to the 2% target for several years.

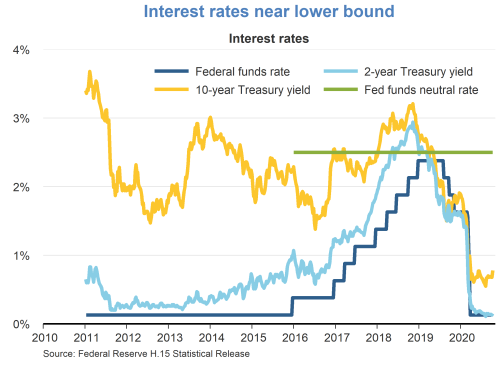

- The Federal Reserve responded very quickly to the effects of the coronavirus on the economy, lowering the federal funds target rate to essentially zero. That policy, combined with other market forces, pushed down other interest rates, especially Treasury bond yields, to near historic lows. Hence, monetary policy and financial conditions are quite accommodative and likely are contributing substantially to the economic recovery, along with fiscal stimulus.

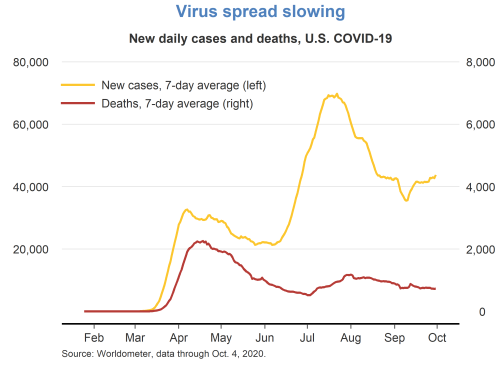

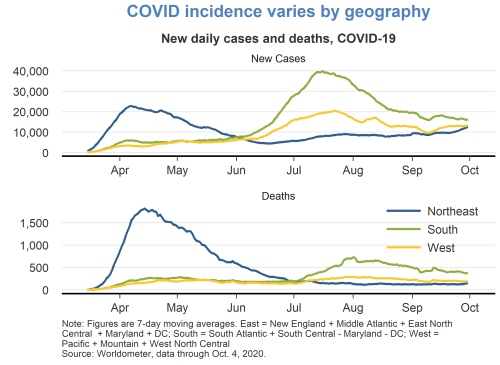

- The FOMC regularly emphasizes that “the path of the economy will depend significantly on the course of the virus.” The spread of COVID-19 has been generally slowing since July, though its uneven pattern has raised concerns that it might pick up again. Notably, the number of deaths during the summer stayed well below the spring’s elevated levels. Possible explanations for the reduced death rates include better treatment of those infected and a change in the composition of cases, with more new cases being younger with much lower fatality rates.

- The number of COVID-19 cases and deaths has varied by region. Cases and deaths peaked in the Northeast in April, while in the rest of the country they peaked in the summer months. However, the number of daily fatalities in the South and West have remained well below those seen in the Northeast in the spring.

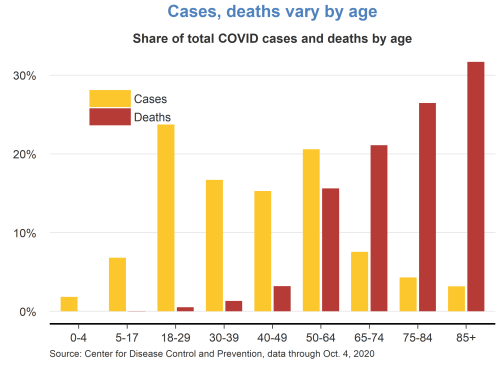

- Cases and deaths have also varied by age. According to data from the Centers for Disease Control and Prevention (CDC), most people who have died from COVID were 65 years or older and account for almost 80% of the deaths, but only 15% of the total cases to date. In contrast, people under 40 years of age account for less than 2% of deaths, but almost 50% of total cases. The CDC also reported the share of cases under age 40 has increased, which may help explain why the nationwide death total has not risen as much as the nationwide case total.

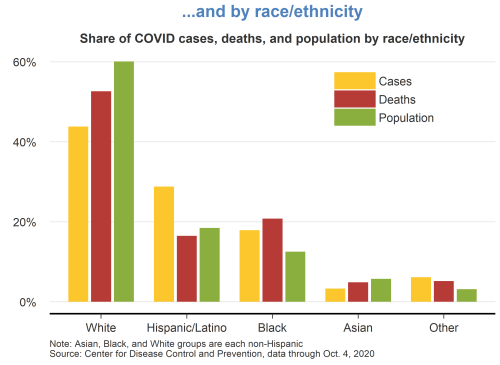

- The incidence of COVID-19 varies by race and ethnicity as well. Black and Latino people have disproportionately contracted the virus relative to their shares of the population. This possibly reflects that they are more likely to work outside the home in jobs interacting with the public, to live in cramped conditions, and to rely on public transit, all of which can increase exposure to the coronavirus.

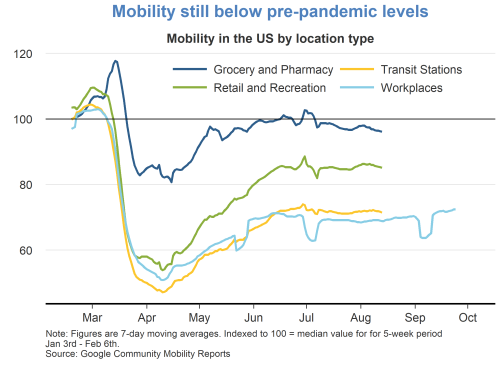

- The virus has affected the economy largely through reduced social and market interactions. Google community “mobility” indices track people’s movements through their smartphones and provide a picture of how actively people are shopping, going to work, or engaging in recreation. These measures bottomed out in early April, then rose through June, but have since plateaued below the pre-pandemic baseline of 100.

- Mobility varies across destinations. Trips for essentials like groceries or medicine are close to normal, while commuting to work is depressed because many are working remotely or businesses have not reopened. Retail and recreation-related trips are roughly 20% of baseline, which is consistent with the weakness in consumer spending on COVID-sensitive services.

- Returning to “normal” levels of economic activity depends on people’s perceptions of the risks of infection, which in turn depends on more testing and the development and distribution of a vaccine, expected next year.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.