Kevin J. Lansing, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of January 14, 2021.

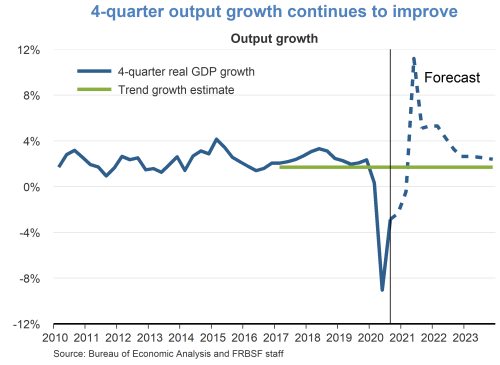

- Real GDP grew 33.4% at an annual rate in the third quarter of 2020, revised up slightly from the prior estimate of the Bureau of Economic Analysis. For 2020 as a whole, we expect the economy to have contracted significantly but forecast a strong rebound in 2021 due in part to stimulus from fiscal and monetary policy and widespread deployment of COVID-19 vaccines.

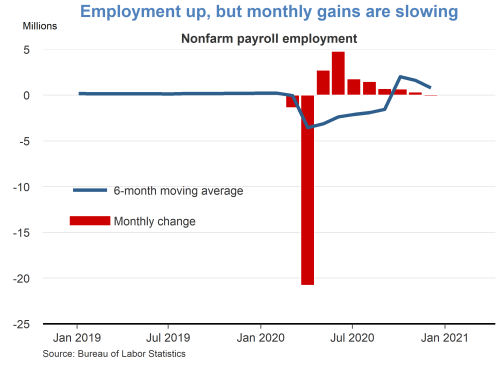

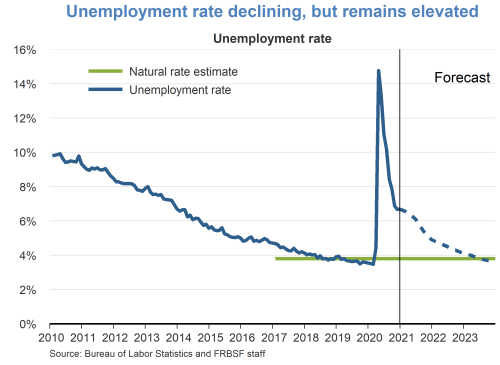

- The Bureau of Labor Statistics reported that payroll employment declined by 140,000 jobs in December, following seven consecutive monthly gains. Overall, the labor market is still down by about 10 million jobs since February 2020, just before the pandemic began. The unemployment rate was unchanged at 6.7% in December. We expect unemployment to remain elevated in the near term and decline gradually over the medium term as the economy recovers.

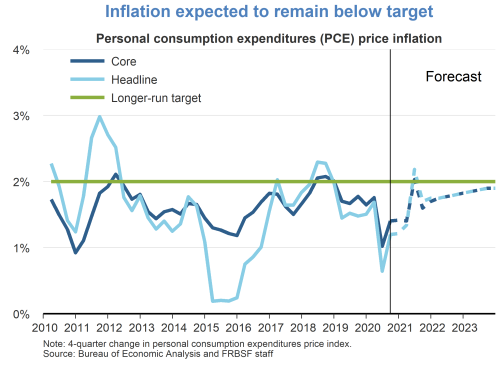

- The contraction of the economy during 2020 has kept inflation low. The overall personal consumption expenditures (PCE) price index rose by only 1.1% over the 12 months ending in November. Core inflation, which excludes volatile food and energy prices, rose 1.4%. With unemployment above the natural rate and real GDP below trend, we expect inflation to remain for the next few years below 2%, the longer-run goal of the Federal Open Market Committee (FOMC).

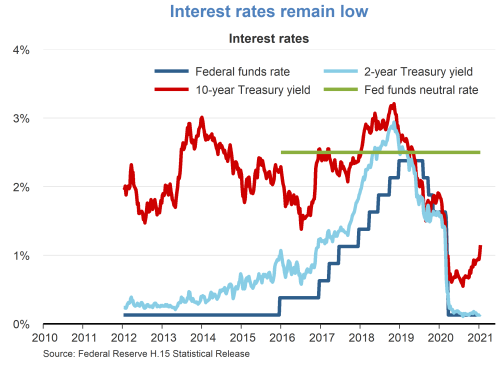

- Following the conclusion of its latest meeting on December 16, 2020, the FOMC announced its decision to maintain the target range for the federal funds rate at 0 to 1/4%. The Committee noted that it “expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessment of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.”

- The current level of the federal funds rate is significantly accommodative as it stands about 2.5 percentage points below our estimate of the “neutral” federal funds rate. Long-term Treasury yields have risen from around 0.5% during August 2020 to around 1% in January 2021.

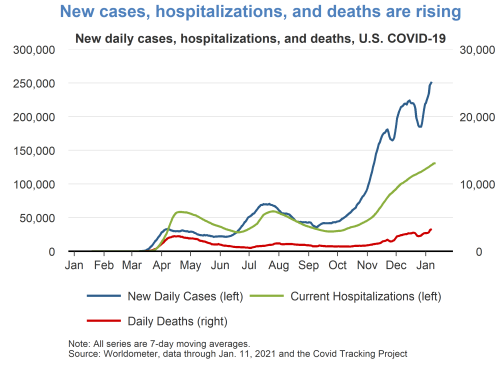

- As noted by the FOMC in its December statement, the future path of the economy depends significantly on the course of COVID-19. The 7-day moving average of daily new COVID-19 cases in the United States is around 254,000. The 7-day moving average of daily new deaths from COVID-19 is around 3,300. The number of people currently hospitalized for COVID-19 is around 131,000. All of these statistics have surged in recent months and are now at all-time highs.

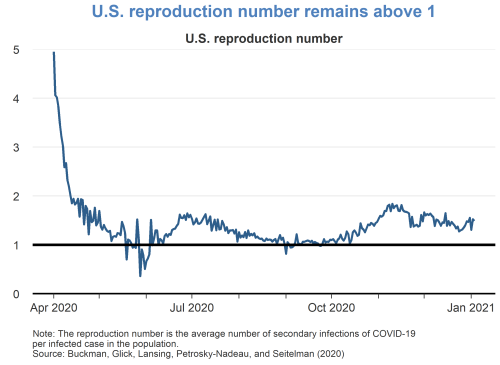

- A key concept in the study of infectious diseases like COVID-19 is the “reproduction number,” which measures the average number of secondary infections per infected case in the population. When the reproduction number is above 1.0, the number of infected people continues to grow, with higher reproduction numbers implying faster growth. The goal of public health responses, including the distribution of vaccines, is to push the reproduction number below 1.0 for a sustained period so that the disease eventually dies out.

- Using daily data for the number of people currently infected with COVID-19 in the United States, a standard epidemiology model implies that the reproduction number is currently around 1.5 and trending upwards. Reversal of this trend requires successful mitigation measures to limit the spread of the virus along with timely distribution and uptake of available vaccines.

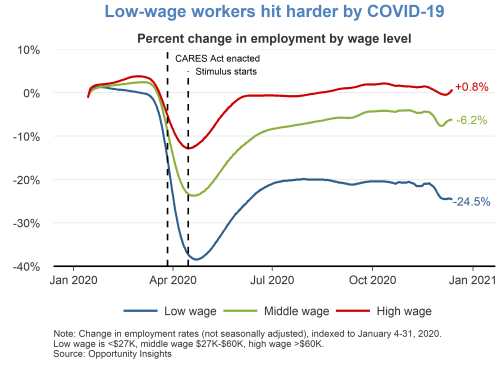

- The negative economic consequences of COVID-19 have fallen disproportionately upon low-wage workers. The employment rate for low-wage workers (those making less than $27,000 per year) is down by about 25% compared with January 2020. In contrast, the employment rate for high-wage workers (those making more than $60,000 per year) has fully recovered and now stands about 1% higher compared with January 2020. The employment rate for middle-wage workers (those making between $27,000 and $60,000 per year) is down by about 6% compared with January 2020.

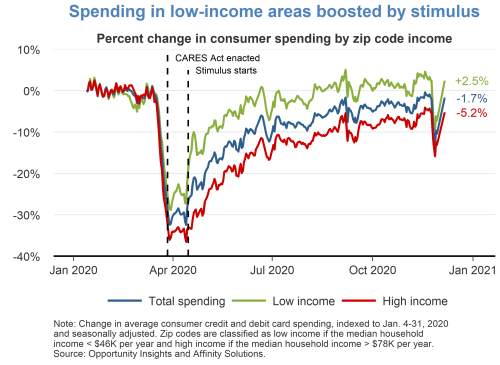

- Consumer spending in low-income zip codes (those with a median household income below $46,000 per year) jumped sharply in response to the stimulus payments received in April 2020 as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. In contrast, consumer spending in high-income zip codes (those with a median household income above $78,000 per year) showed a much smaller increase during April. Many high-income households were not eligible for stimulus payments. Moreover, the share of spending devoted to necessities is lower for high-income households than for low-income households.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.