Sylvain Leduc, executive vice president and director of research at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of July 15, 2021.

- The economic recovery has strengthened recently, as increases in vaccination rates have resulted in an easing of social distancing measures. However, while roughly 50% of adults are now fully vaccinated, vaccination rates vary substantially across areas of the United States, posing a downside risk to economic activity in regions where the rates are low.

- Hiring has picked up in the past two months, following a lull at the beginning of the spring. In June, total nonfarm employment rose by 850,000 jobs, following an increase of 530,000 jobs in May. Roughly two-thirds of last month’s hiring occurred in the services sector where the pandemic has had a much greater impact. Nevertheless, total employment remains roughly 6.5% below its pre-pandemic peak reached in February 2020.

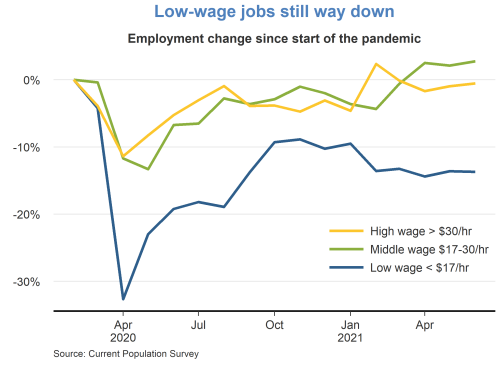

- The gap in current employment from pre-pandemic levels varies substantially across workers. While high-wage workers have recouped jobs lost during the recession, employment in low-wage occupations remains roughly 14% below the levels reached before the start of the pandemic.

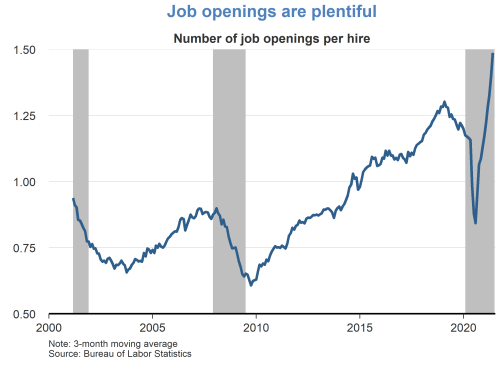

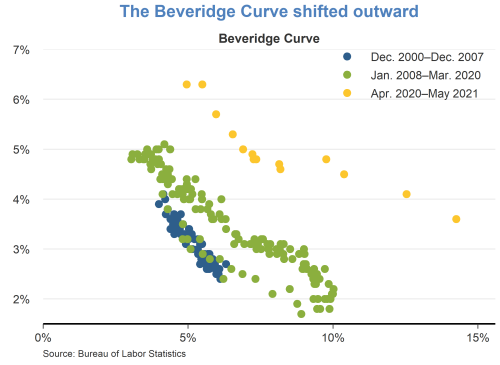

- Nevertheless, jobs remain plentiful. The ratio of job vacancies to hiring is at an all-time high, and in line with the hiring difficulties highlighted by many employers. The Beveridge Curve, which captures the negative relationship between the job opening rate and the unemployment rate, has shifted substantially outward since the start of the pandemic. As a result, a given level of the unemployment rate is now associated with a much higher level of job openings, suggesting the increased difficulties employers are encountering in matching job vacancies with unemployed workers. This shift dwarfs a similar movement in the Beveridge Curve that was observed following the Great Recession. Several factors could be underlying the current shift, including uncertainties regarding the pandemic’s evolution, health concerns, childcare responsibilities, and enhanced unemployment benefits, which may be reducing job search intensity.

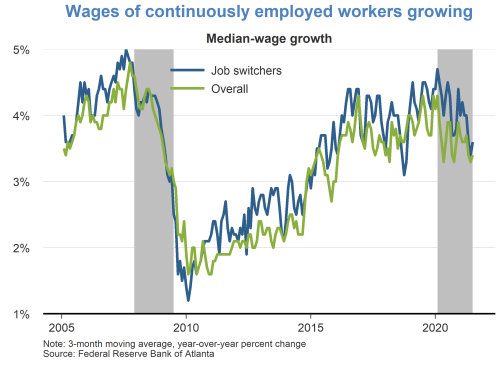

- Overall wage growth has been moderate recently. For instance, average hourly earnings rose 3.6% in June over the preceding twelve months, a slightly higher pace than from the time before the pandemic’s onset. Sectors facing greater hiring difficulties, such as the leisure and hospitality industries, have experienced higher wage growth, with average hourly earnings rising about 7% from a year ago. However, movements in average hourly earnings are affected by changes in the composition of the workforce, which makes their interpretation challenging. This has been the case since the start of the pandemic, as the workforce has experienced substantial changes with wages for jobs in some sectors falling much more than in others. The Atlanta Fed’s wage series for continuously employed workers is not subject to these composition effects and indicates that wages have been steadily rising at a 3% pace or more, although wage growth has eased somewhat since mid-2020, even for those quitting for new jobs.

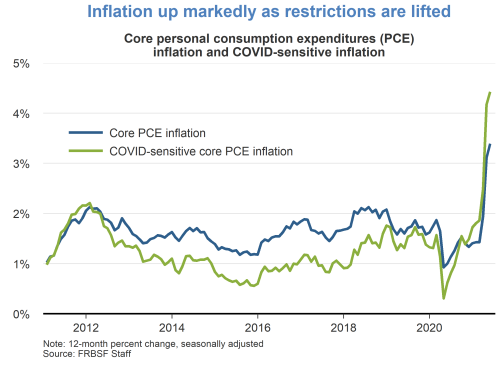

- Overall movements in core personal consumption expenditures (PCE) inflation have been strongly influenced by the path of the pandemic. Core inflation fell most heavily at the start of the pandemic in so-called “COVID-sensitive” sectors, such as leisure and hospitality, where demand fell because of changes in spending behavior related to health concerns and social distancing practices. As the economy continues to recover with more people getting vaccinated, demand has increased, and upward price pressure has returned. These pressures have been exacerbated for firms that are facing hiring difficulties and supply bottlenecks.

- Core inflation rose by 3.4% in the 12 months through May. This upward pressure is likely to abate with time, as the economy continues to adjust to the resumption of economic activity. In addition, the upward impact of the mechanical “base-year” effect arising from the year-on-year calculation of inflation, will also disappear in the months ahead as the low inflation readings of a year ago roll off the measure.

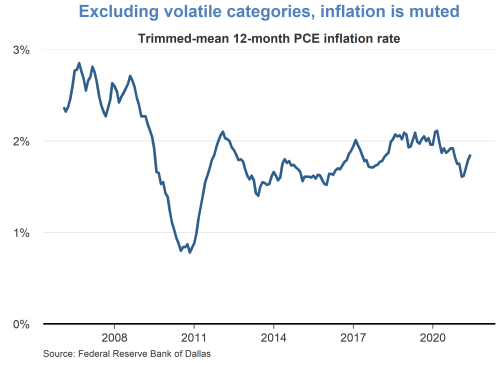

- In contrast, the twelve-month change in the Dallas Fed’s Trimmed Mean PCE inflation index, which removes a fraction of the more extreme price movements, remains slightly below 2%.

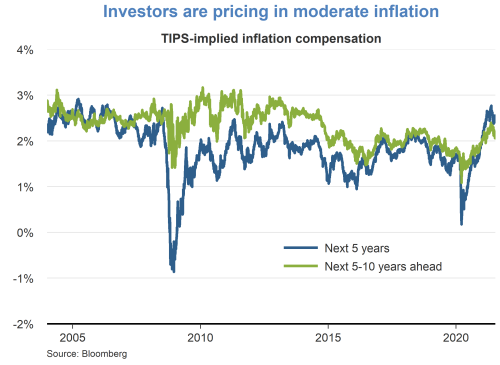

- Inflation compensation, as measured by the difference between the rates on 10-year Treasury nominal and inflation-protected securities, remains fairly moderate and consistent with the levels experienced over the past 15 years. Inflation compensation over the next 5 years has increased substantially from the pandemic-induced lows and now stands at about 2.6%. Inflation compensation over the longer term has experienced similar, though more muted, movements.

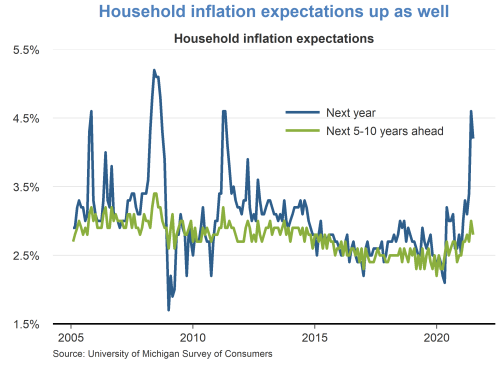

- Households’ short-term inflation expectations for the next year have jumped above 4% over the past few months, although long-term expectations have increased much less, a pattern similar to recent movements in inflation compensation. Household inflation expectations are sensitive to commodity price surges as happened over the past year, particularly those that affected salient purchases such as groceries and gasoline. Interestingly, a similar jump in household inflation expectations occurred in 2011, early in the recovery from the Great Recession, when commodity prices also surged. The increase in household inflation expectations proved temporary then, partly because commodity prices reverted to more normal levels. We are likely to experience similar declines in commodity prices and in household inflation expectations going forward. Some commodity prices, such as lumber prices, have already declined substantially over the past month.

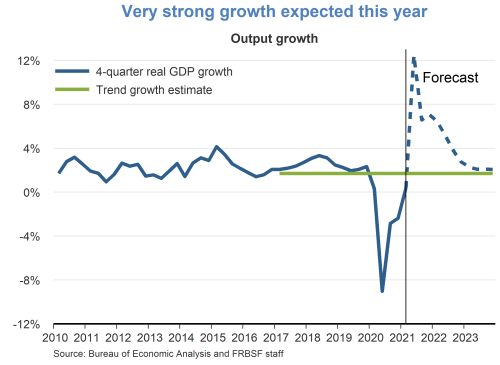

- Overall, we expect PCE inflation to remain temporarily high this year at about 3%, pulled up by higher inflation in COVID-sensitive sectors. Strong growth this year will also contribute to these price pressures. As the economy adjusts to the new environment, and supply shortages and bottlenecks ease, inflation should decline to slightly below 2% next year, in line with more moderate growth. That said, given the low vaccination rates in some regions of the United States, we are not through the pandemic yet, particularly in the presence of new and more contagious variants. In addition, the situation is worse in countries where vaccination efforts are at a much earlier stage. As such, the uncertain evolution of the pandemic still poses an important downside risk to the outlook.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.