Marianna Kudlyak, research advisor at the Federal Reserve Bank of San Francisco, stated her views on the current economy and the outlook as of June 3, 2021.

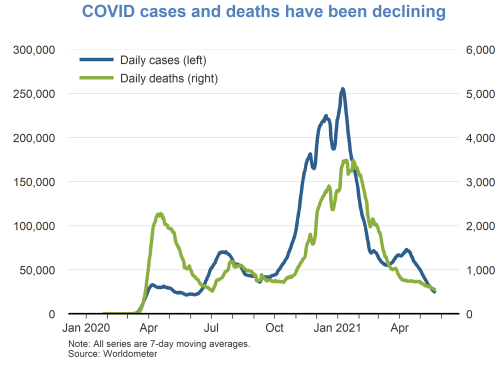

- There are indications of continued improvement in the containment of the COVID-19 pandemic. The number of new cases and deaths associated with the virus in the United States has declined rapidly since the January peaks.

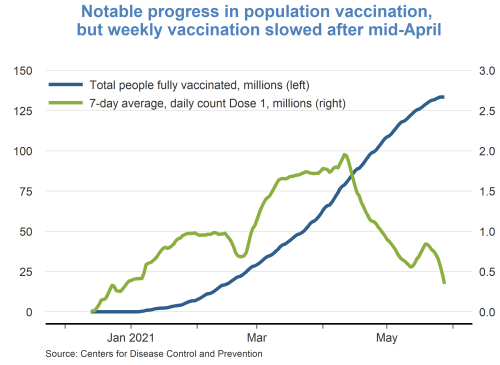

- Timely uptake of available vaccines is crucial for continuing to make progress in the slowdown of infections. According to the Centers for Disease Control and Prevention, as of May 24, 2021, 62.6% of the U.S. population 18 years or older had received at least one vaccination shot, while 51.5% are now fully vaccinated. Weekly vaccinations peaked in mid-April, but subsequently slowed. Nevertheless, more than 128 million American adults are now fully vaccinated, and the prospects for immunizing the majority of the population by the end of the year remain good.

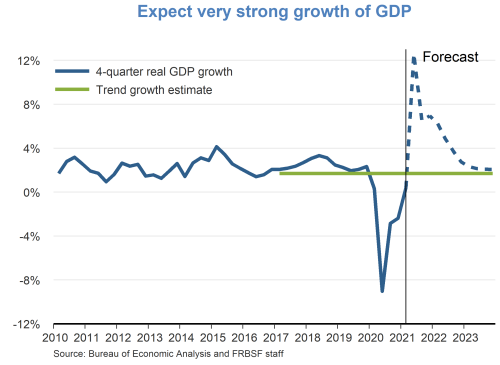

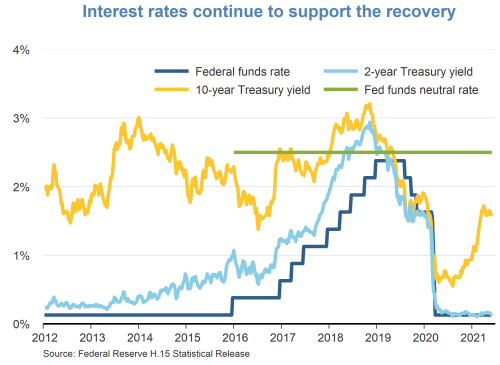

- Along with the improving health conditions, GDP growth is being supported by accommodative fiscal and monetary policy. We expect very strong year-over-year GDP growth of 12.5% in the second quarter of 2021, followed by 6.9% in the fourth quarter. We project real GDP to gradually return to its pre-pandemic trend over 2022 and 2023.

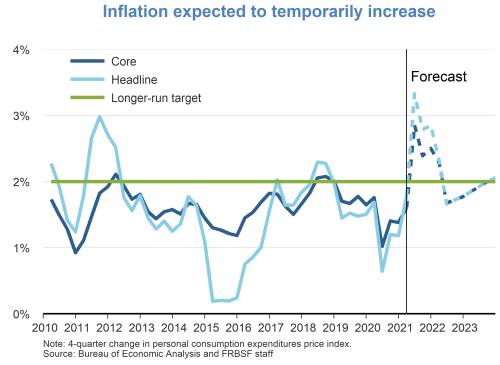

- Inflation has rebounded somewhat due to a roll-off of the pandemic shock’s initial downward effect on prices, demand pressures, and supply-side bottlenecks. In April 2021, headline personal consumption expenditures (PCE) inflation was 0.6% and 3.6% on a 12-month basis, while core PCE inflation was 0.7% on a monthly basis and 3.1% on a 12-month basis. We expect these effects to be transitory and for inflation to return to the Federal Reserve’s 2% target in 2022.

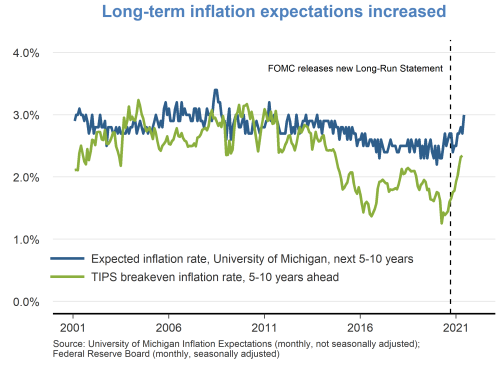

- Long-term inflation expectations, as measured by the University of Michigan household survey, or the TIPS break-even inflation rates, have increased recently, but are subdued by historical standards.

- Chair Powell, during public remarks following the April 2021 meeting of the Federal Open Market Committee, reiterated that the stance of monetary policy would remain accommodative until conditions in the labor market are consistent with the Committee’s views on full employment, and inflation has run above 2% for some time.

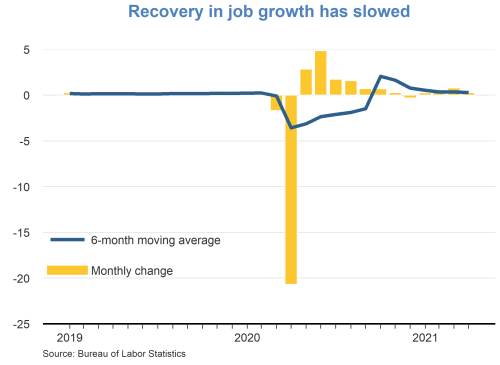

- Total nonfarm payroll employment rose by 266,000 jobs in April, which was much less than expected. In addition, the sizable job gains in leisure and hospitality, other services, and local government education were partially offset by employment declines in temporary help services and in couriers and messengers.

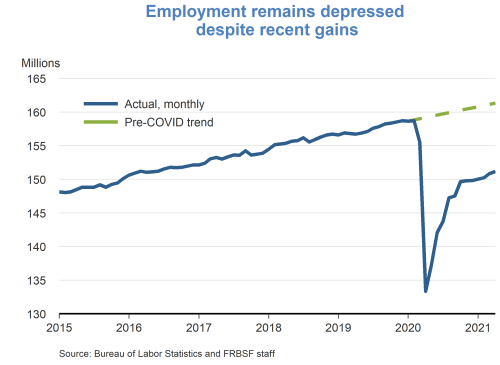

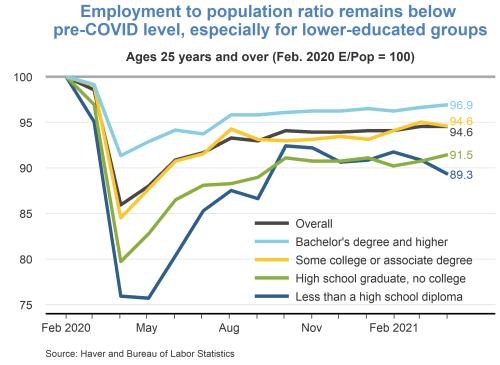

- The recovery of the employment-population ratio has been lower for those with less education as compared to higher-educated groups. In April 2021, the employment-population ratio of those with less than a high school degree was 89.3% of its level in February 2020. In contrast, the employment-population ratio of those with a bachelor’s degree or more was 96.9% of its February 2020 level. Similarly, labor force participation remains below its pre-COVID level, especially for the lower-educated group.

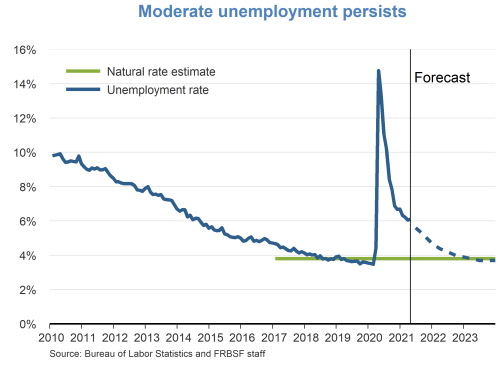

- The unemployment rate, at 6.1%, and the number of unemployed persons, at 9.8 million people, were little changed in April. Though these figures are down considerably from their recent highs in April 2020, they remain well above their pre-pandemic levels—3.5% and 5.7 million, respectively, in February 2020.

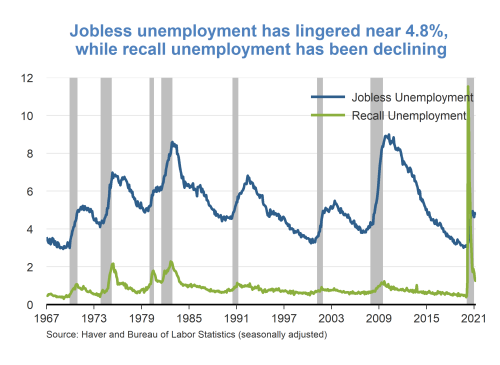

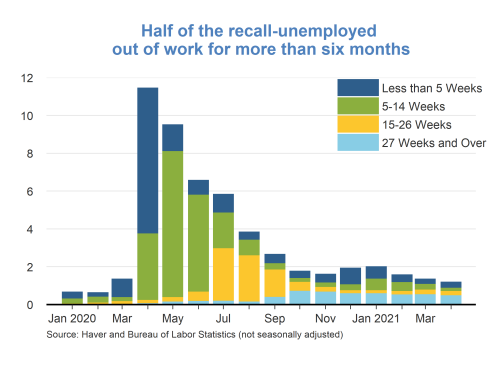

- Total unemployment can be categorized as “recall unemployment,” i.e., unemployment from temporary layoffs, and unemployment due to other reasons; or “jobless unemployment,” i.e., layoffs without expectation of recall, completed temporary jobs, quitters, labor force reentrants, and new labor force entrants. The key distinction between these two kinds of unemployment is that recall unemployment typically returns to normal much faster than does jobless unemployment. Data from the Center for Population Studies show that jobless unemployment has lingered near 4.8% even as the economy has begun to recover, while recall unemployment has declined sharply to 1.3%. Half of the remaining unemployed on recall have been unemployed for more than six months.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.