Huiyu Li, senior economist at the Federal Reserve Bank of San Francisco, stated her views on the current economy and the outlook as of March 4, 2021.

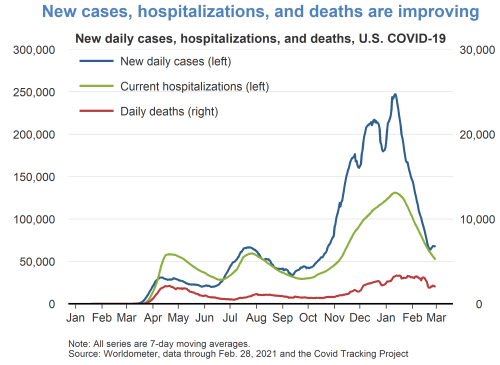

- As noted by Chair Powell in his February 23, 2021 presentation to Congress on the semiannual Monetary Policy Report, “the path of the economy continues to depend significantly on the course of the virus and the measures undertaken to control its spread.” The number of new cases, hospitalizations, and deaths in the United States due to COVID-19 surged to all-time highs in the beginning of this year but over the past few weeks has fallen or stabilized. Currently the 7-day moving average of daily new cases is around 67,000 people. The number of people hospitalized is around 52,000, and daily new deaths due to the virus is around 2,000.

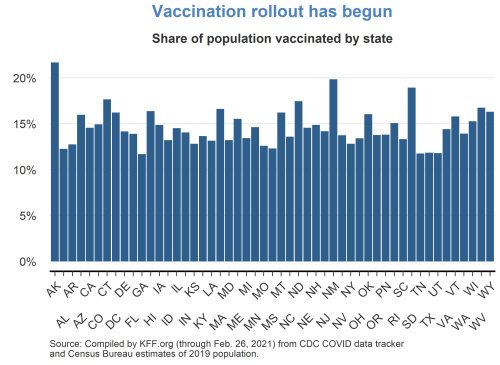

- Timely distribution and uptake of available vaccines are needed to control the spread of the virus. Across all U.S. states, from 12 to 23% of the population have received at least one vaccination shot, while from 6 to 14% have received two shots. Essential workers and older adults make up most of these early vaccine recipients. About 80% of the distributed vaccines have already been administered. The production and distribution of vaccines is expected to ramp up steadily in the coming months.

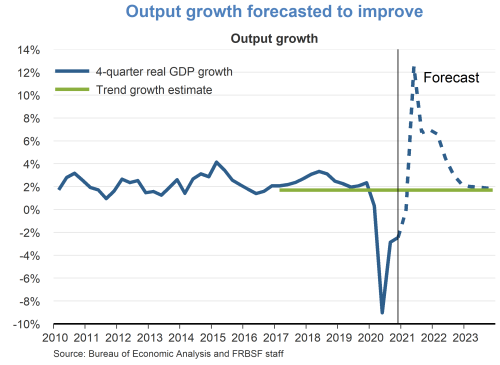

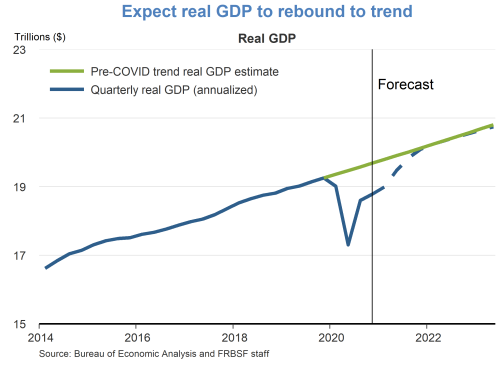

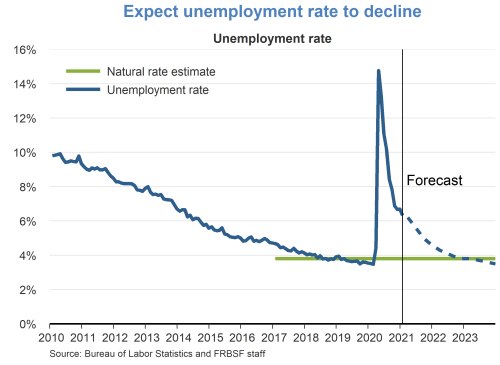

- Due in part to stimulus from fiscal and monetary policy and improvement in the country’s health situation, our outlook for the economy is more optimistic than projected in January. Real GDP grew 4.1% at an annual rate in the fourth quarter of 2020, revised up slightly from the prior estimate of the Bureau of Economic Analysis. We expect the level of real GDP to return gradually to potential between 2022 and 2023, based on its pre-pandemic trend. We also expect unemployment to remain elevated in the near term and decline to the natural rate between 2022 and 2023.

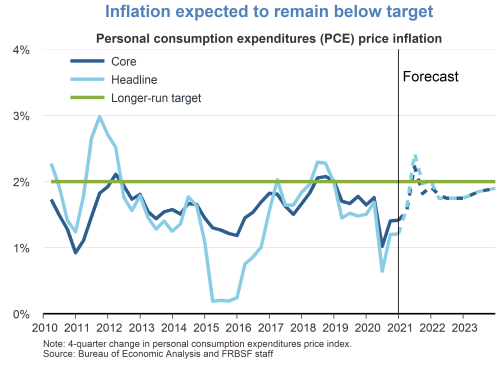

- The contraction of the economy during 2020 has kept inflation low. Inflation has partially rebounded in recent months with the overall personal consumption expenditures (PCE) price index rising by 1.2% over the 12 months ending in December. Core inflation, which excludes volatile food and energy prices, rose by 1.4%. Inflation was running below the longer-run 2% goal of the Federal Open Market Committee (FOMC) before the pandemic, even with unemployment at the natural rate, and we expect inflation to remain below 2% for the next few years.

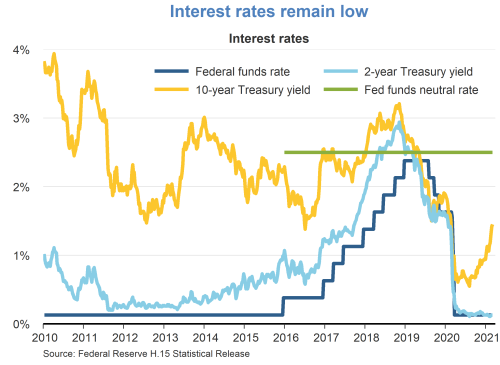

- Chair Powell in his February 23 remarks on the Monetary Policy Report also reiterated the stance announced in the January 27, 2021 FOMC policy statement that “it will be appropriate to maintain the current accommodative target range of the federal funds rate until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time. In addition, we will continue to increase our holdings of Treasury securities and agency mortgage-backed securities at least at their current pace until substantial further progress has been made toward our goal.”

- The current level of the federal funds rate is significantly accommodative as it stands about 2.5 percentage points below our estimate of the “neutral” federal funds rate. Long-term Treasury yields have risen from around 0.5% during August 2020 to around 1.5% in March 2021, possibly due to improved prospects for economic recovery and higher expected inflation.

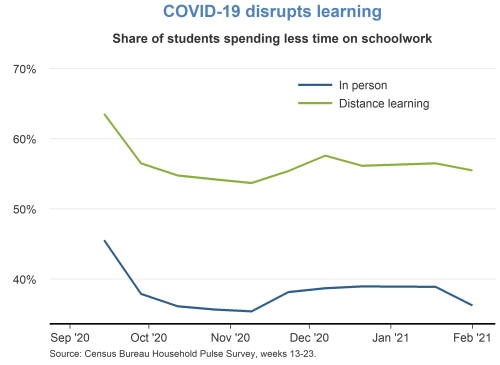

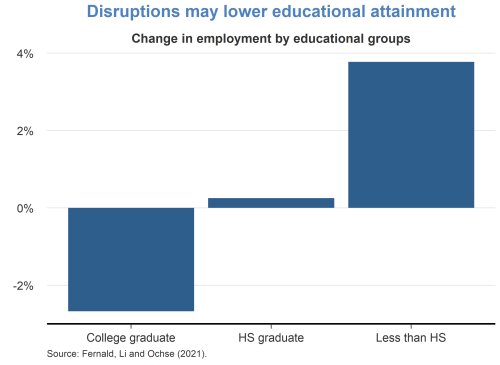

- While the near-term outlook for the economy has improved relative to earlier in the year, the pandemic may still adversely affect the economy in the long run. The effect of social distancing measures on schooling and educational attainment is a particularly important channel through which these effects may occur. The Weekly Household Pulse Survey conducted by the Census Bureau shows that about 35% of students learning in person and 55% of students engaged in distance learning report spending less time on schoolwork than before the pandemic.

- Preliminary studies suggest that such disruptions, if unremedied, may lead to lower lifetime educational attainment of children today. Children spending less time on schoolwork may find it difficult to catch up on the knowledge needed for college admission. In addition, their parents may suffer income losses during the pandemic that prevent them from saving for college tuition or devoting resources for tutoring to supplement learning.

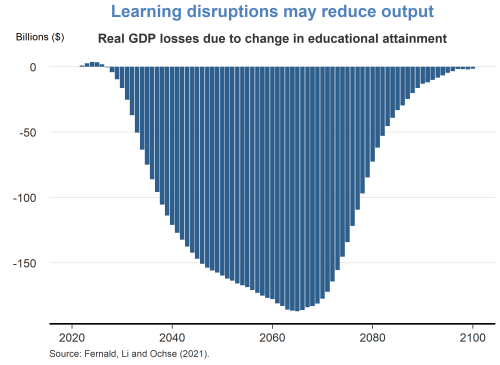

- As children today are the workforce of tomorrow and educational attainment is correlated with employment prospects and labor productivity, lower educational attainment may reduce the future potential output of the economy. One estimate (Fernald, Li, and Ochse, 2021) is that the loss could be as large as ¼ percentage point of GDP on average or $90 to $100 billion (inflation adjusted) per year over the next 70 to 80 years.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.