Andrew Foerster, senior research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of September 9, 2021.

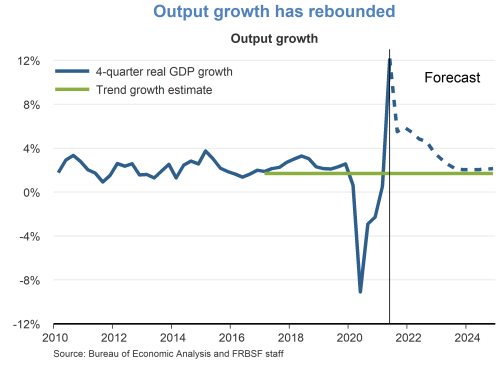

- The economy is rebounding with strong growth, as it continues to recover from the recessionary effects of the pandemic. However, high transmission of the Delta variant and low vaccination rates in some areas of the country pose a downside risk to economic growth.

- GDP in the second quarter of 2021 exceeded 12% on a year-over-year basis, the highest reading since 1950. The base effects from the very low levels of GDP during the depths of the pandemic in early 2020 play a role in this high reading, but growth on a quarterly basis in the first half of 2021 has been robust.

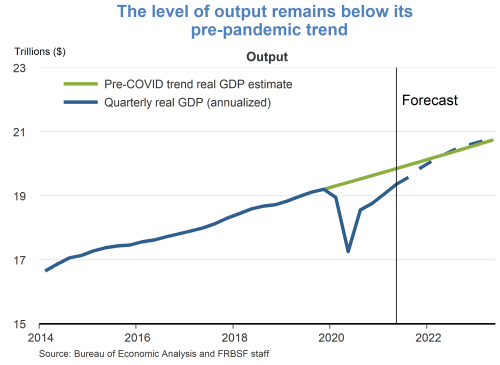

- The level of GDP now exceeds its pre-pandemic high reached at the end of 2019. While this suggests the economy has made up for the drop in output during the pandemic, GDP still sits below the trend implied by average growth in the pre-pandemic years. Continued above-trend growth is expected to narrow this gap in coming quarters.

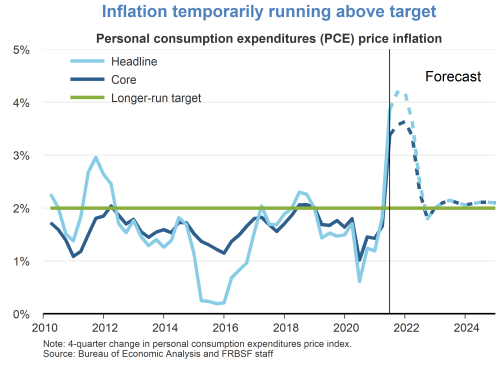

- Supply chain disruptions and bottlenecks have exacerbated the price pressures generated by strong demand. Personal consumption expenditures (PCE) inflation was 4.2% in the 12 months through July. Core PCE inflation over the same horizon was 3.6%. Inflation’s rise above the Federal Open Market Committee’s 2% target is expected to be transitory, with price increases moderating as the economy continues to adjust to the resumption of activity.

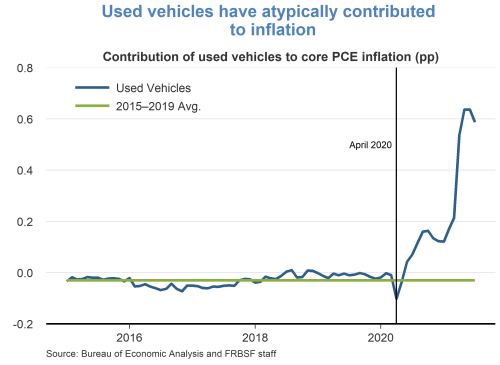

- Used vehicles is a relatively small sector. Nonetheless, it has added atypically large contributions to overall inflation readings over the last several months. From 2015 to 2019, this sector averaged a negative contribution to PCE inflation because of generally falling used car prices. However, supply chain disruptions in computer chip manufacturing that began early in the pandemic have limited new vehicle manufacturing. As a result, consumers shifted demand toward used vehicles, leading to monthly double digit price increases. The last several months have thus seen used vehicles contribute around 0.6 percentage points to overall inflation, though the most recent data suggest this dynamic is starting to abate. While prices for used vehicles could remain high, if price increases cease, this sector will stop contributing to inflation. If price increases reverse, a negative contribution is possible, putting downward pressure on inflation.

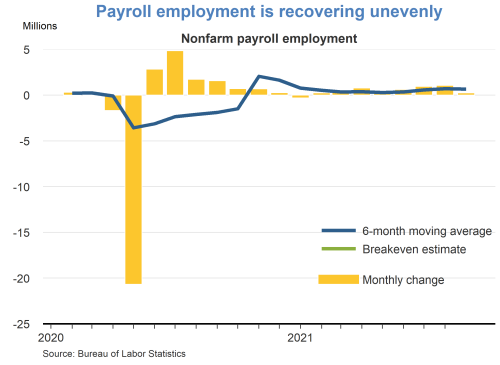

- The labor market continues to improve, but at an uneven pace. Concerns about the Delta variant slowed hiring in August relative to June and July, as payrolls expanded by a modest 235,000 jobs. Both the leisure and hospitality and retail trade industries saw tepid job growth, suggesting the increase in cases of the virus is a major factor for the slowdown.

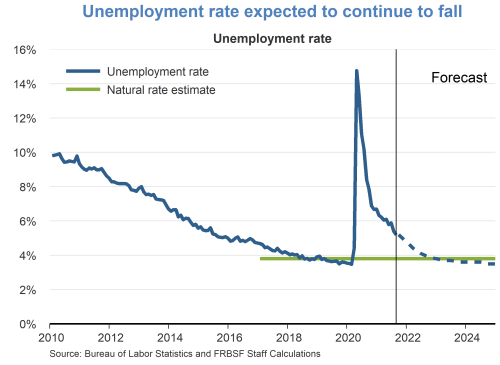

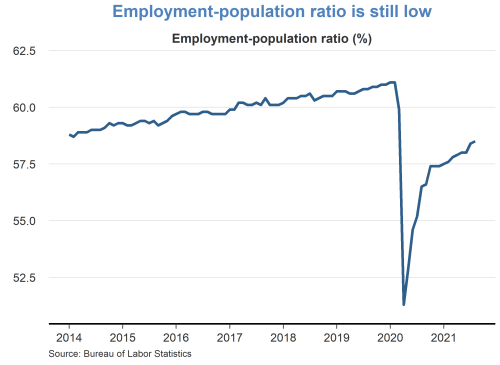

- Despite the slowing growth in hiring, the unemployment rate in August fell to 5.2%. This measure however sends an incomplete signal about the extent of the labor market recovery. A number of key groups—including parents who have temporarily left the labor market due to childcare concerns—are not officially counted as unemployed. The employment-population ratio still sits 2.6 percentage points below its pre-pandemic high.

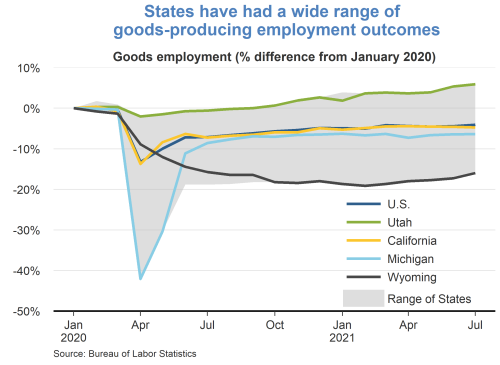

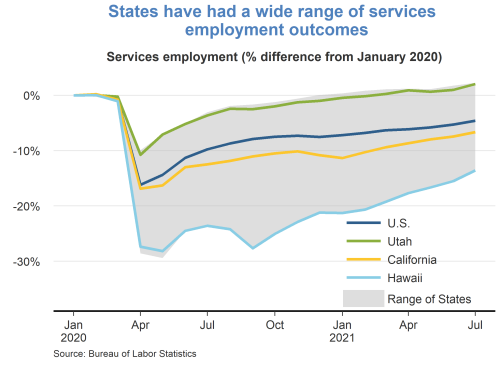

- Total U.S. employment is still about 5.7 million jobs below its pre-pandemic peak. This aggregate figure masks different employment dynamics across goods-producing and services sectors as well as across states.

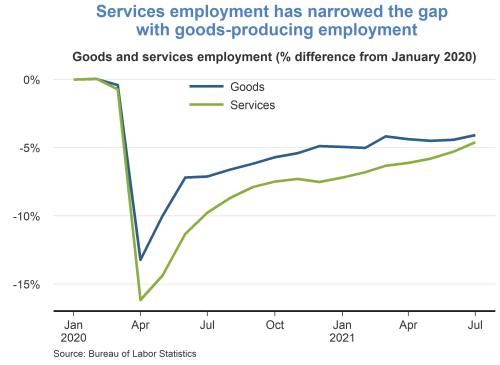

- The substantial decline in employment seen in April 2020 hit the services industries relatively harder than the goods-producing industries, as demand for many in-person services declined because of mandated social-distancing restrictions associated with virus concerns. Goods-producing employment fell by a little over 13% relative to January 2020, while services employment fell by 3 percentage points more. Since that initial decline, services employment has recovered at a relatively faster rate as social-distancing limits have been relaxed, and the gap between goods-producing and services employment has narrowed.

- Employment patterns have varied substantially across the United States during the pandemic. Differences in the composition of sectors play a major role in how some state economies have fared. Goods-producing employment in Michigan initially fell by over 40% due to particularly large cutbacks in manufacturing jobs, but subsequently recovered toward the national average. Goods-producing employment in Wyoming remains particularly depressed because its mining and construction sectors were already contracting but have worsened since the onset of the pandemic. On the services employment side, Hawaii has an exceptionally high reliance on its leisure and hospitality sector. With lower tourism, that sector has dragged on employment, leading Hawaii to be the slowest state to recover services employment. Utah has been a relatively strong performer in both goods-producing and services employment, led by strength in construction and professional and business services.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.