Mauricio Ulate, senior economist at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of April 21, 2022.

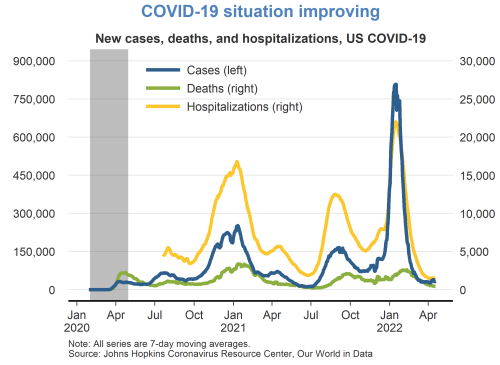

- COVID-19 cases, hospitalizations, and deaths in the United States have declined rapidly since the Omicron wave peaked in January. However, the new Omicron subvariants BA.2 and XE remain a potential worry. COVID-19 breakouts have led to renewed lockdowns in parts of China, delaying the normalization of global supply chains.

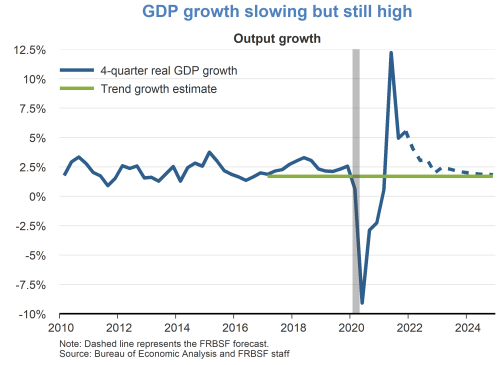

- The U.S. economy recovered rapidly since the bottom of the pandemic recession, growing over 5.6% during the 2021 calendar year. We expect growth to slow to around 2% during 2022 due to a combination of continued global supply chain disruptions, waning fiscal support, monetary tightening, and the war in Ukraine

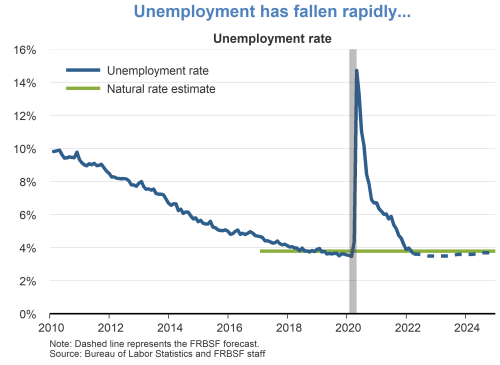

- Along with the output recovery, the unemployment rate declined sharply from its pandemic peak of 14.7% in April 2020 to just 3.6% in March of this year. This level is below our estimate for the natural rate of unemployment of 3.8%, putting additional pressure on inflation. We project that continued economic momentum will push unemployment down slightly more, before returning to its natural rate as the economy slows.

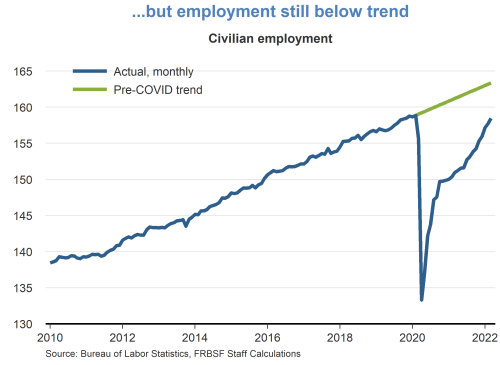

- Even though the unemployment rate is very low, the picture for the level of employment is less encouraging. The number of civilians employed in March 2022 remains below the number in February 2020, before the onset of the pandemic. Moreover, the current level of employment is roughly 4.5 million jobs short of projections based on pre-pandemic dynamics. Factors behind the employment shortfall include concerns by households about the potential health implications of returning to work, increased family care responsibilities, early retirement decisions, and diminished immigration.

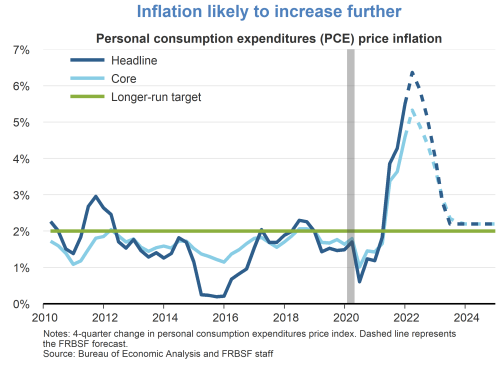

- Recent inflation readings show substantial increases in the headline personal consumption expenditures (PCE) price index with the 12-month growth rate reaching 6.4% in February. The core PCE inflation rate that excludes volatile energy and food prices grew by 5.4%. March figures for the consumer price index (CPI) are even higher, with 12-month inflation at 8.5% for headline and 6.5% for core. This high inflation is attributable to the strong demand for goods spurred by fiscal pandemic support combined with continued wage gains, global supply chain disruptions, and the slow labor supply recovery because of ongoing COVID-19 concerns. The war in Ukraine has added to inflationary pressures on energy, food, and commodity prices. We expect inflation to moderate during the second half of 2022 as these factors resolve themselves and monetary policy tightening impacts the economy.

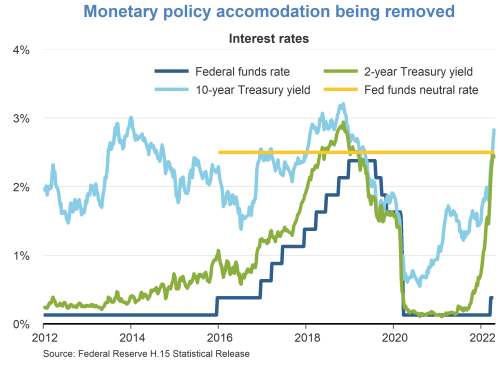

- Monetary policy was accommodative during the first stages of the pandemic. As the economy began to recover in the second half of 2020, long-term U.S. Treasury yields started rising. Shorter-term rates, such as the two-year yield, only started picking up more recently, as expectations of policy rate hikes percolated throughout financial markets. In its latest meeting, the Federal Open Market Committee (FOMC) increased the federal funds rate by 25 basis points, and FOMC participants indicated that they expect six more hikes during the rest of the year, with the option to do even more if inflation continues to increase.

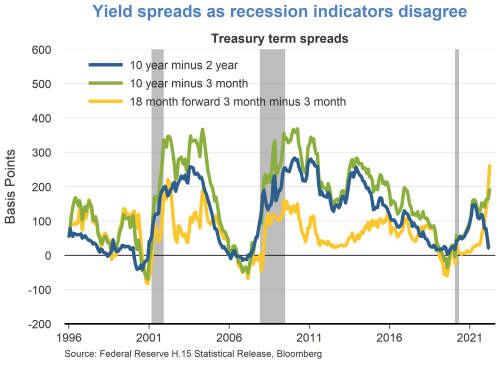

- Tighter monetary policy, high inflation, and the war in Ukraine have raised concerns about the possibility that the Federal Reserve will be unable to achieve a “soft landing” and that the economy will enter a recession. Spreads between Treasury yields at different maturities are often used as informal indicators for the probability of a recession. Typically, the slope of the yield curve is positive, with long-term interest rates exceeding short-term rates to compensate for the greater risk associated with investment decisions over longer horizons. When the difference between long-term yields and short-term yields is negative—that is, long-term yields are lower, and the yield curve is thereby inverted—this indicates that investors expect, possibly as a result of weaker economic confidence, interest rates to decline in the future, a signal that a recession may be approaching.

- The spread between the 10-year yield and the 2-year yield, the spread between the 10-year yield and the 3-month yield, and the spread between the 18-month forward 3-month yield and the 3-month yield have all been referenced recently. These indicators all turned negative, or nearly so, before each of the last three recessions. However, they now disagree, with the spread between the 10-year yield and the 2-year yield close to negative territory, signaling a possible recession, while the other two indicators are positive and in fact increasing.

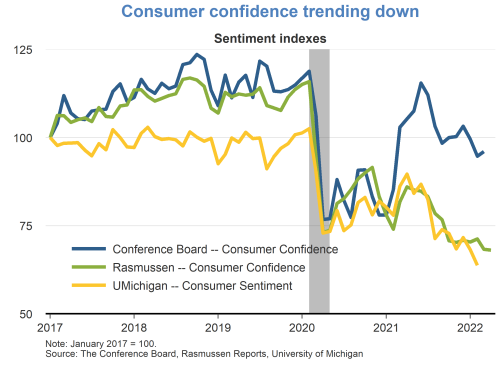

- Consumer confidence is another indicator for the medium-term prospects of the economy. Consumer sentiment measures from The Conference Board, Rasmussen, and the University of Michigan all fell sharply during the pandemic. The Conference Board’s sentiment index has since mostly recovered, but the other two remain low. In the past six to eight months, all three indicators have declined, warning of potential headwinds for economic growth, though not necessarily signaling a recession.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.