John Mondragon, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of January 14, 2022.

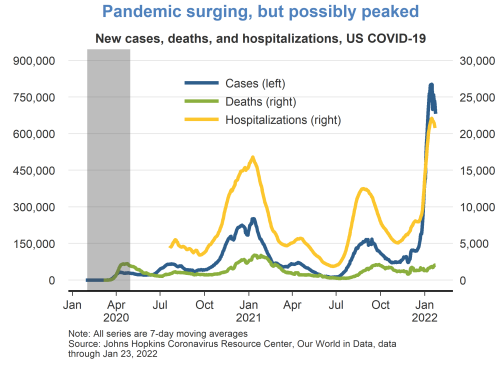

- The economy grew robustly in the first half of 2021, before slowing as the Delta variant of COVID-19 surged during the summer. With the current spread of infections from the Omicron variant, this latest wave of COVID-19 poses an additional challenge to the recovery. COVID-19 case rates and hospitalizations are both high, though the number of deaths has not followed the same pace as that for infections. Consistent with evidence that the vaccines can provide considerable protection, Omicron may be less dangerous than prior variants.

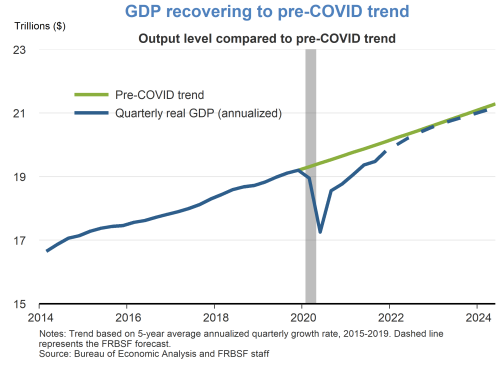

- Real GDP growth at an annual rate slowed to 2.3% in the third quarter of 2021 but is expected to rebound very strongly in the fourth quarter. We also expect annual GDP growth to gradually return to our long-run estimate of about 1.8%, although this depends on the evolution of the pandemic and the responses of households, businesses, and governments.

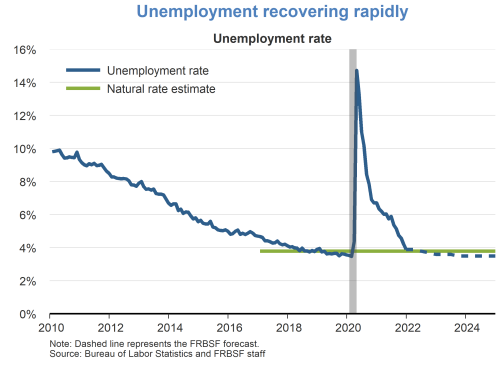

- The unemployment rate has declined steadily, falling to 3.9% in December, signaling that the economy continues to recover. However, employment and labor force participation are both well below their pre-pandemic levels, suggesting there is still some distance for the economy to reach maximum employment.

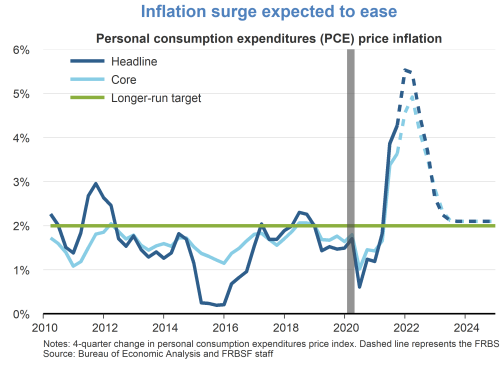

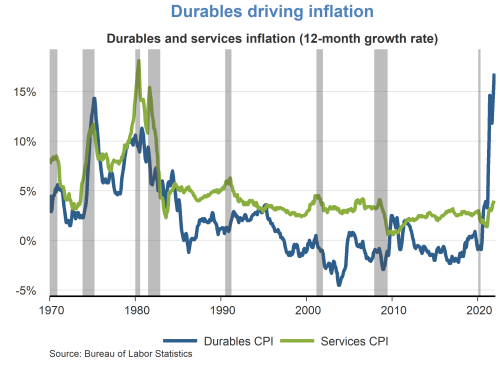

- After easing from a surge in the spring, inflation accelerated again in the fall with core personal consumption expenditure prices growing by 4.7% over the past year through November. This likely reflects the combination of unusually and persistently high demand for durable goods along with supply chain disruptions in their production and distribution.

- While the rate of inflation for services has increased recently, it is still well within recent historical experience. By contrast, the inflationary pressure coming from durables is a sharp reversal of the general deflation in durable prices over the past 20 years.

- We expect inflation to gradually return to the Federal Open Market Committee’s target rate of 2%. Current inflation across durables and services is quite different from the 1970-80s inflationary episodes, when inflation rates were tightly linked across sectors. The recent divergence in inflation between durables and services suggests that reducing overall inflationary pressure will depend in part on resolving the supply chain issues and on households shifting expenditures back to services, in addition to pullbacks of monetary and fiscal stimulus.

- Recent increases in inflation and expectations by market participants about the future path of monetary policy have contributed to increasing nominal interest rates. Monetary policy is currently accommodative with policy rates held low, but asset purchases are tapering and expected to conclude by this March, followed by rising policy rates.

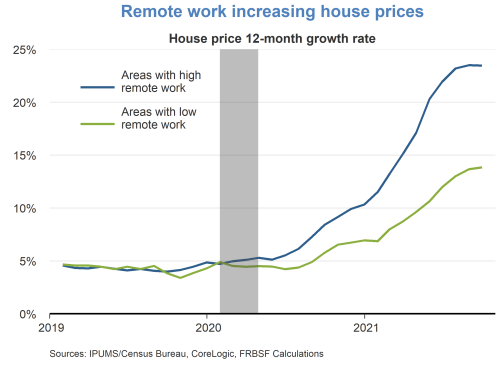

- Rapid growth in house prices and rents are contributing to inflationary pressure and concerns that the housing market may be overheating. Large declines in rents for commercial properties suggest that the pandemic, in addition to other factors, may have caused a reallocation of demand from commercial to residential real estate.

- A deep dive into this question using city-level data permits us to analyze which cities are more likely to attract remote workers. This data also allows us to see how the pandemic’s impact on work relates to house price growth over the past two years.

- Data show that cities with more people working from home during the pandemic also experienced significantly higher house price growth than cities with relatively fewer people working remotely. Some of this effect is due to higher migration during the pandemic, but most of it is likely due to the higher demand for housing as workers spend more time in their homes.

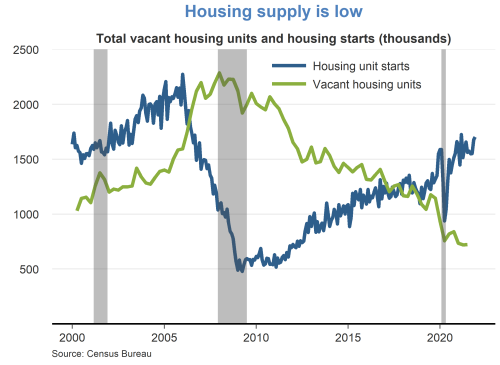

- This surge in demand for housing is occurring after a long period of declining housing supply, as shown by falling vacancies and a very sluggish recovery in housing construction after the 2007-2009 recession. Together, these factors imply that there is relatively little supply to meet the current increase in housing demand, contributing to the rapid increase in prices for houses and rental properties. Housing supply should expand going forward, although supply chain constraints on construction materials are a challenge.

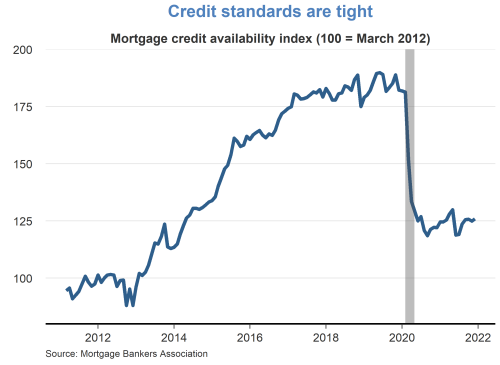

- High house prices may raise concerns about the risk of defaults in the mortgage market from lax credit standards. However, the data show that credit availability in the mortgage market tightened up significantly at the onset of the pandemic and has remained tight. This suggests that credit quality in the mortgage market is relatively high, and that default risk is quite low.

- It will be important to continue to closely monitor the state of the housing market, especially as the course of the pandemic and its impact on remote work evolves. In particular, where and how people work is already having a significant impact on house prices, rents, and inflation, suggesting that future COVID-19 conditions may still have large effects on the economy.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.