Jens Christensen, research advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of July 14, 2022.

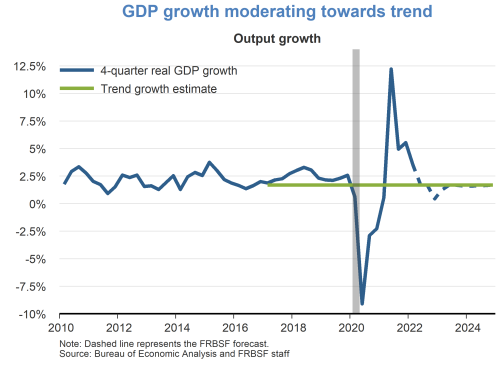

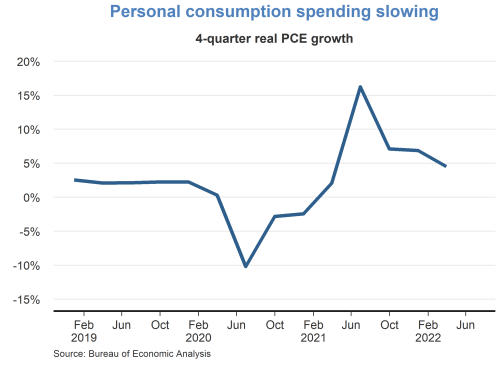

- GDP declined 1.6% at an annualized rate in the first quarter of 2022, according to the Bureau of Economic Analysis’s final estimate. This figure represents a marked slowdown from the 6.9% pace recorded in the fourth quarter of 2021. The first quarter decline was driven primarily by decreases in government spending and a sharp jump in imports, which together more than offset a healthy increase in consumer spending. The University of Michigan’s consumer sentiment index reached an all-time low in June, likely a reaction to the recent declines in equity prices and the rapid rise in mortgage interest rates. Industrial production slowed in May relative to April. Despite these readings, the labor market remains strong. For the second half of 2022, we expect real GDP to grow at an annualized rate that is close to the economy’s longer-run trend value of 1.7%.

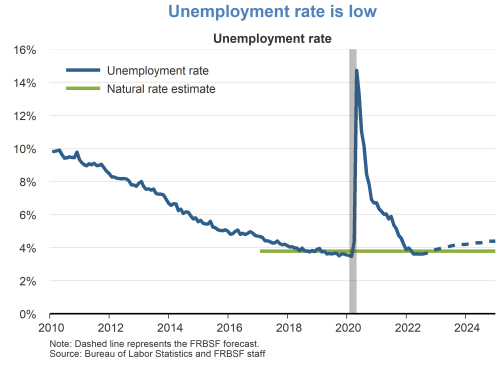

- Total nonfarm payroll employment grew by 372,000 jobs in June. Job growth was broad based, with notable gains in leisure, hospitality, professional and business services, and health care. The unemployment rate in June held steady at 3.6% while labor force participation ticked down a tenth of a percentage point to 62.2%. Still, total payroll employment remains about half a million jobs below the pre-pandemic level, with many former workers having since withdrawn from the labor force.

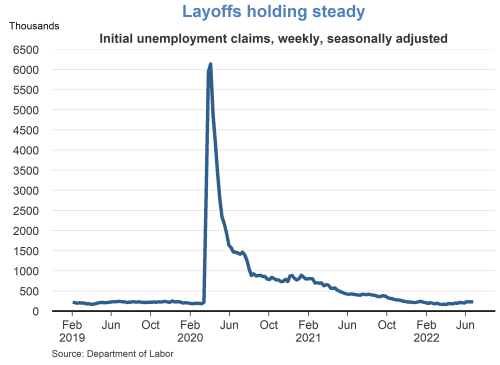

- Wage increases moderated in June, with average hourly earnings growing by 5.1% over the past 12 months versus 5.2% in May. Layoffs are hovering near pre-pandemic lows, supporting the view that the labor market remains strong.

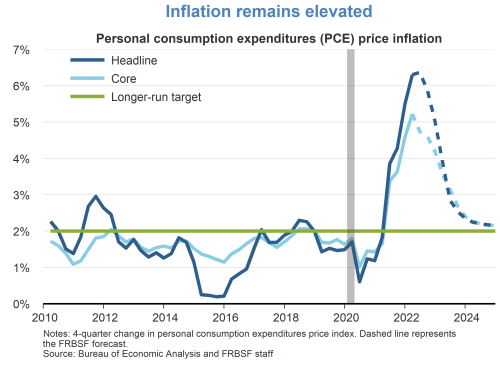

- Inflation is elevated, driven mainly by supply and demand imbalances related to the coronavirus (COVID-19) pandemic and associated policy responses, and then having been exacerbated more recently by events stemming from Russia’s invasion of Ukraine. The 12-month change in the personal consumption expenditures (PCE) price index held steady at 6.3% in May. The 12-month change in the core PCE price index dropped slightly to 4.7% in May versus 4.9% in April.

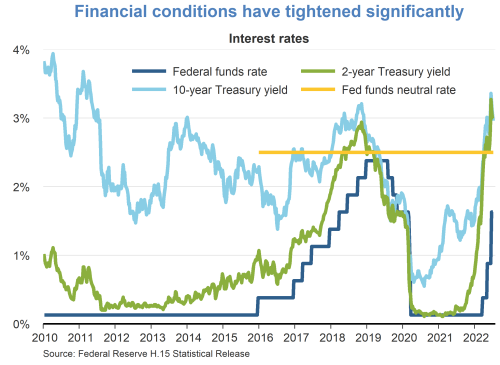

- We expect inflation to moderate over the medium term as ongoing supply chain disruptions are gradually resolved and monetary policy accommodation is removed. However, the risks to the inflation outlook appear to be tilted to the upside, as further supply chain disruptions may arise from the war in Ukraine and the associated economic sanctions. The Federal Open Market Committee (FOMC) raised the target range for the federal funds rate to 1½ and 1¾% at its June meeting and stated that it anticipates further increases in the target range. In addition, the FOMC stated that it will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities.

- Financial market conditions have tightened considerably this year. Medium- and longer-term Treasury yields have moved up sharply, with the 2-year yield rising by 239 basis points and the 10-year yield rising by 157 basis points. As of the end of June, the Standard & Poor’s 500 stock index had declined by about 26% from its December 31, 2021, closing value. This was the steepest decline to happen during the first six months of a year since 1970.

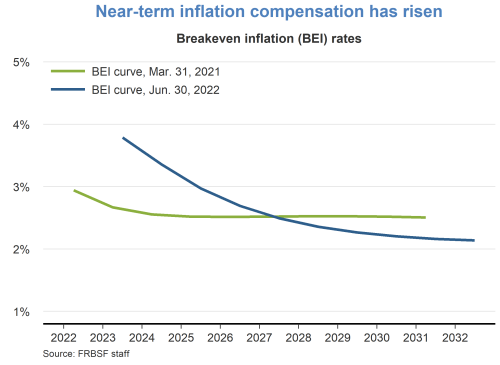

- Market-based measures of inflation compensation known as breakeven inflation (BEI) rates are derived from the difference between nominal and real yields of comparable maturities. BEI rates have risen sharply in recent months for contracts maturing in the coming years. Our analysis shows that, by using an asset pricing model of the entire BEI curve, it is possible to extract estimates of investors’ 10-year-ahead inflation expectations through adjustments for the premium that investors demand for assuming inflation risk and for changes in other risk and liquidity premiums.

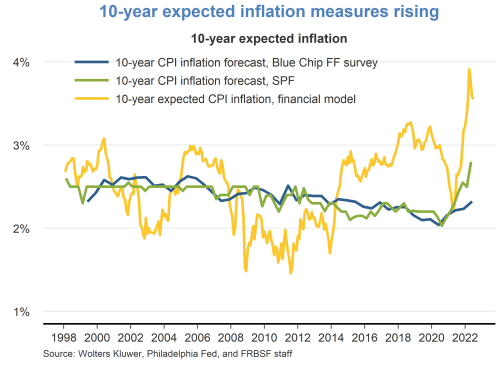

- According to the model, investors’ 10-year-ahead inflation expectations have risen by much more than the consensus survey forecasts of 10-year-ahead CPI inflation from the Blue Chip Financial Forecasts and the Survey of Professional Forecasters. In the past, the model’s 10-year expected inflation forecast has reverted back to the level of the survey forecasts relatively quickly. It will be important to monitor whether this pattern will repeat in the current situation.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.