Mark Spiegel, senior policy advisor at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of June 2, 2022.

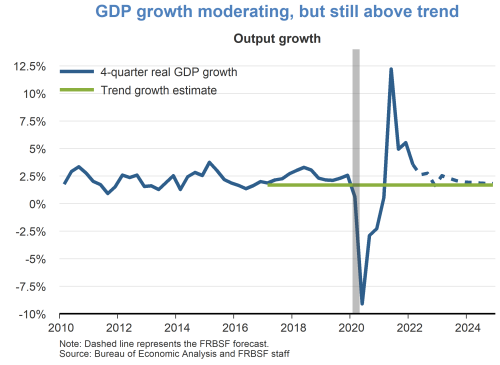

- GDP declined 1.5% at an annualized rate in the first quarter of 2022, according to the Bureau of Economic Analysis (BEA) second estimate, indicating a marked slowdown from the 6.9% pace in the last quarter of 2021. The first quarter 2022 decline was driven by decreases in private inventory investment and government spending as well as a sharp increase in imports, which offset strong consumer spending. Resurgences in COVID-19 cases in some areas of the United States and continued global supply chain disruptions appear to have weighed down first quarter growth as well.

- However, there are signs of continued economic strength. Domestic consumption is robust, as evidenced in April by both rising imports, particularly in consumer goods, and growth in retail sales. Industrial production also increased in April. Overall, our expectation is that the decline in first quarter growth is temporary and that the economy will experience moderate growth near its 1.7% trend later in 2022.

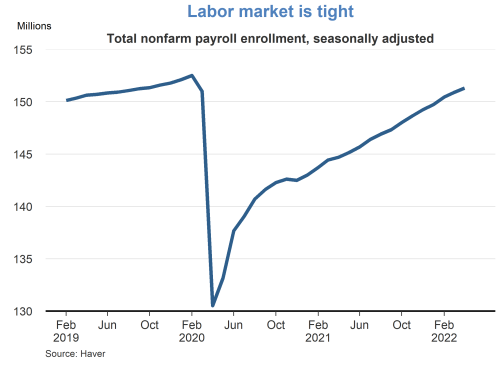

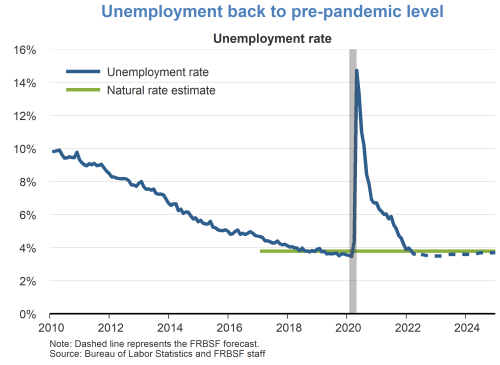

- The labor market remains tight. Total nonfarm payroll employment grew by 428,000 jobs in April. Job growth was broad based, with notable gains in sectors previously exposed to pandemic-related slowdowns, including leisure and hospitality, while job growth was also strong in manufacturing, transportation, and warehousing. The unemployment rate remained at 3.6%, as labor force participation rate fell to 62.2%. Total employment remains over a million jobs short of pre-pandemic levels, with many former workers having withdrawn from the labor force.

- Consistent with a tight labor market, wage growth has been elevated, with average hourly earnings growing by 5.5% in the 12 months through April. Wage gains were particularly strong in the leisure and hospitality sectors, associated with normalization from COVID-related declines in activity.

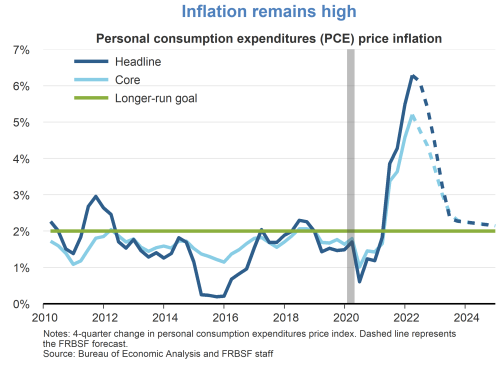

- Inflation remains high, with pressures from global supply chain disruptions and elevated energy prices associated with the Russian invasion of Ukraine. On a year-ago basis, headline personal consumption expenditures (PCE) inflation edged down to 6.3% in April, while core PCE inflation edged down to 4.9%. Energy prices have played a large role in headline inflation. The Bureau of Labor Statistics energy index is up more than 30% in the past 12 months, though it slowed slightly in April.

- Going forward, we expect that inflation should moderate with the easing of ongoing supply chain disruptions, continued recovery from the pandemic, and monetary policy tightening. However, considerable risks to the upside remain, including pressures from global supply chain disruptions as well as elevated wage growth enduring longer than anticipated.

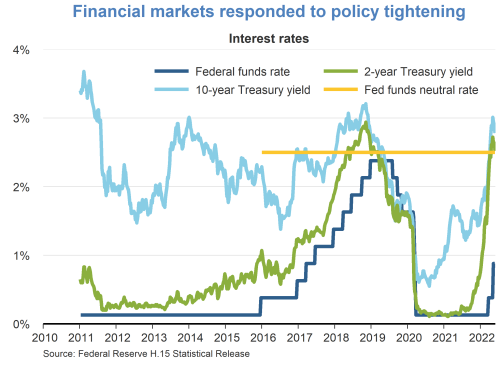

- The Federal Open Market Committee (FOMC) announced continued removal of monetary accommodation at its May meeting, raising the federal funds rate target range by 50 basis points to 0.75-1.0%, and noting that it anticipated that ongoing increases in the target range would be appropriate.

- The FOMC also announced that the balance sheet reduction would commence on June 1. The reductions will be phased in, beginning monthly for the first three months at $30 billion in Treasury securities and $17.5 billion in mortgage-backed securities, and then increased afterwards to $60 billion for Treasury securities and $35 billion for mortgage-backed securities. The Committee reiterated that it intended to maintain securities sufficient to implement monetary policy efficiently under its “ample reserves” regime. A number of Committee members, including Chair Powell, reiterated that the federal funds rate remains the primary policy tool for adjustments to the stance of monetary policy.

- Financial markets have responded to both ongoing policy tightening and forward guidance concerning future tightening. Since the start of the year, medium- and longer-term yields have moved up considerably, with 2-year Treasury yields rising 187 basis points, and 10-year Treasury yields rising 125 basis points. Equity markets have also sold off since the start of the year, with steep declines in broad indexes.

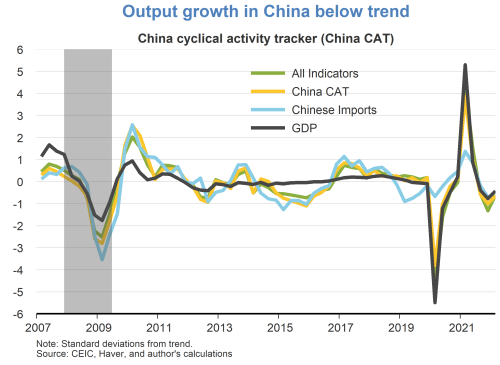

- COVID-related shutdowns have continued to be an important component of the global supply chain disruptions dampening U.S. and foreign output growth and feeding inflationary conditions. A major lockdown of activity in March in Shanghai and other big cities in China to curb rapidly escalating surges in infections weighed on China’s economy during the first quarter of the year. This decline in China activity can be seen in the SF Fed’s China Cyclical Activity Tracker (China CAT), which indicates that China’s growth in economic activity for the four quarters ending in the first quarter of 2022 is modestly below trend, consistent with reported GDP growth.

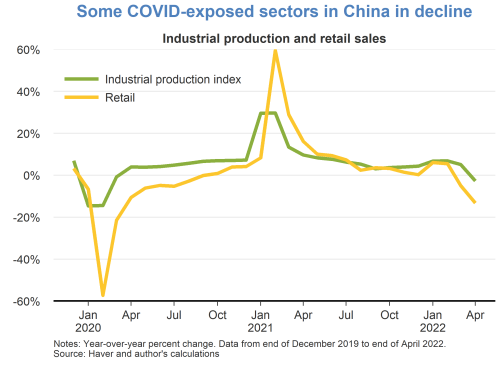

- More recent data suggest that the COVID-related shutdowns in China have played a prominent role in the poor performance of several COVID-sensitive activity indicators. In April, retail sales fell 11.1% and industrial production was down 2.9%, compared from a year ago.

- These declines in China’s economic activity have begun to affect Chinese export levels, which dropped 4.0% in the first quarter on a seasonally adjusted basis. If the declines in Chinese exports persist, global supply chain disruptions could be further prolonged, adding to inflationary pressures. However, the recent partial reopening of Shanghai’s transportation network may signal a more widespread easing of restrictions in Shanghai in the near future.

TopicsInflation

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.