Zheng Liu, vice president at the Federal Reserve Bank of San Francisco, stated his views on the current economy and the outlook as of October 20, 2022.

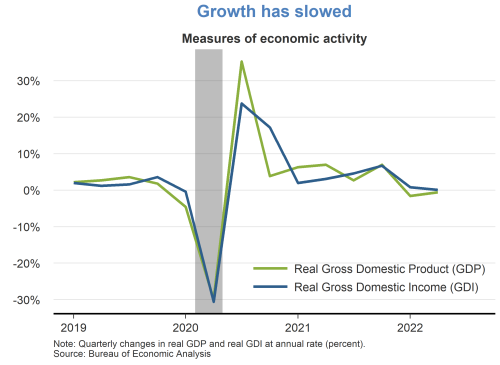

- Economic growth has slowed this year. Real gross domestic product (GDP) fell at an annual rate of 0.6% in the second quarter, according to the final estimate by the Bureau of Economic Analysis. Real gross domestic income (GDI), which measures economic activity from the income side and in principle should be identical to GDP, grew at an annual rate of 0.1% in the second quarter, which is much closer to reported GDP growth than the initial estimate of 1.4%.

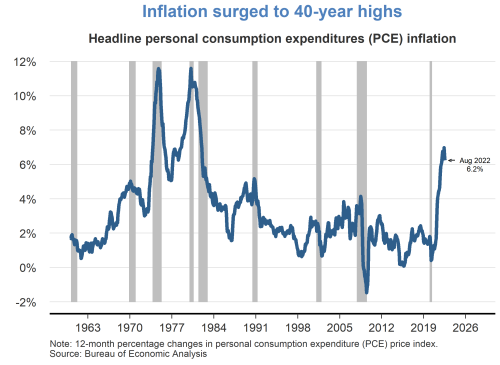

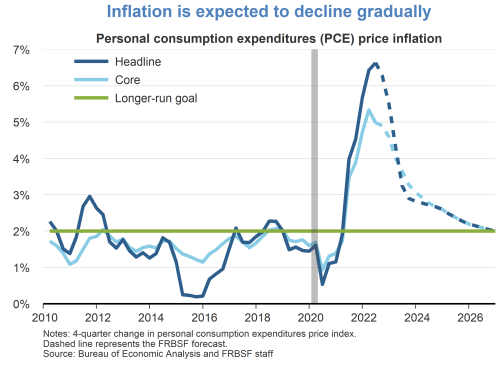

- Despite the slowdown in economic activity, inflation remains high by historical standards and much higher than the Federal Reserve’s 2% longer-run goal. Helped somewhat by recent declines in energy prices and the easing of durable goods inflation, the 12-month change in the personal consumption expenditures (PCE) price index declined to 6.2% in August from the recent peak of 7.0% in June. By contrast, core inflation, which excludes food and energy prices, has remained high and rose a few tenths in August to 4.9%.

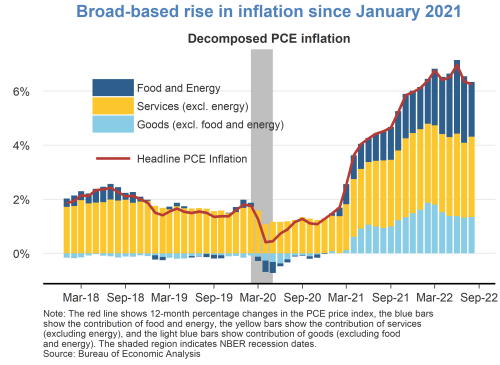

- The surge in inflation from early 2021 through the first half of 2022 was broad based. Price increases accelerated for all major components of the PCE price index. Inflation contributions from goods, food, and energy have moderated somewhat since March. During the same period, inflation for services (excluding energy services) has remained elevated. Non-energy services is the largest component of consumer spending, accounting for about 65% of the total PCE price index.

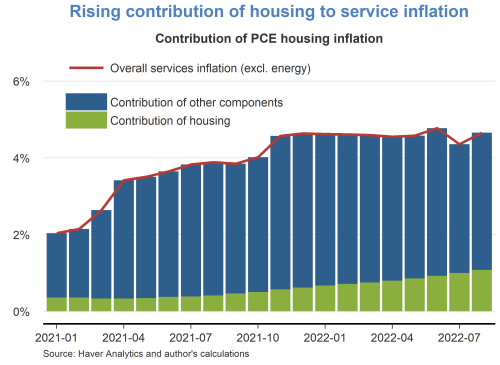

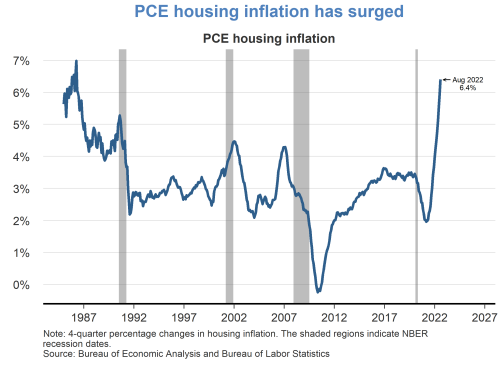

- The recent rise in non-energy PCE services inflation has been partly driven by the surge in housing costs. The housing component of the PCE price index includes rents of tenant-occupied housing and imputed rents of owner-occupied housing. Spending on housing accounts for about 15% of the total PCE price index and about 24% of the non-energy PCE services price index.

- The 12-month change in the non-energy PCE services price index accelerated from 3.4% in April 2021 to 4.7% in August 2022. Over the same period, the 12-month change in the PCE housing price index surged from about 2% to 6.4%.

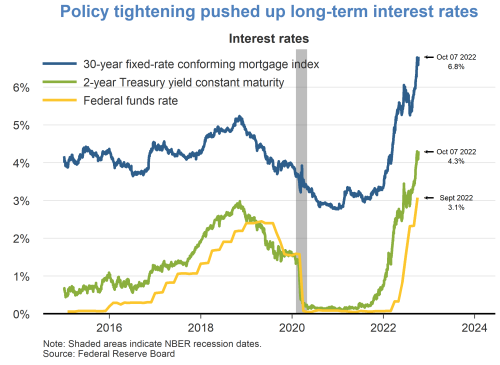

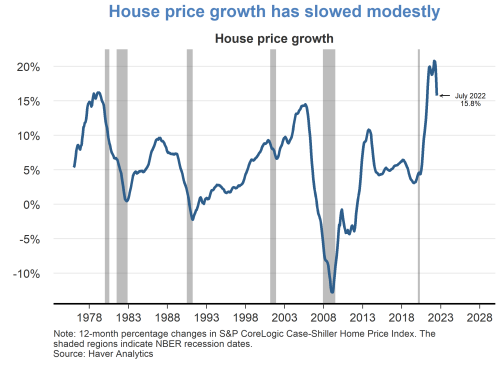

- Following the increase in the federal funds rate in March and ongoing policy guidance for further rate increases, the 30-year mortgage interest rate has surged. The increase in mortgage rates likely has contributed to moderating house price growth. The 12-month change in the S&P CoreLogic Case-Shiller U.S. National Home Price Index has eased from the recent peak of 20.8% in March to 15.8% in July.

- However, PCE housing inflation continues to rise, reflecting continued strength in demand for rental housing. The increases in house prices and the surge in mortgage rates have discouraged some potential homebuyers and likely kept many in the rental market, contributing to elevated rent inflation.

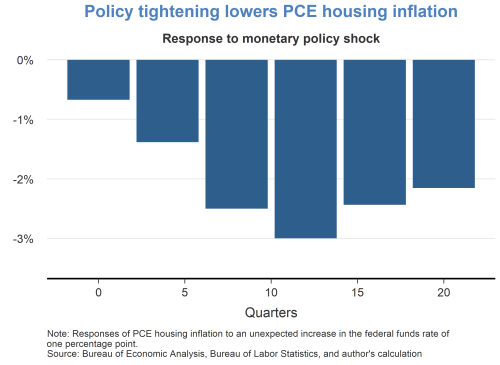

- Evidence from episodes of past monetary policy tightening shows that tighter policy can slow PCE housing inflation over time. For example, an unexpected increase in the federal funds rate of one percentage point can reduce PCE housing inflation by up to 3 percentage points, with the peak effects coming after about two and a half years.

- The slow transmission of monetary policy changes to PCE housing inflation reflects the slow adjustments of rents, which are calculated based on averages of rents on existing leases and those for newly signed leases. Once a rental contract is signed, rents typically do not adjust for several quarters or even years.

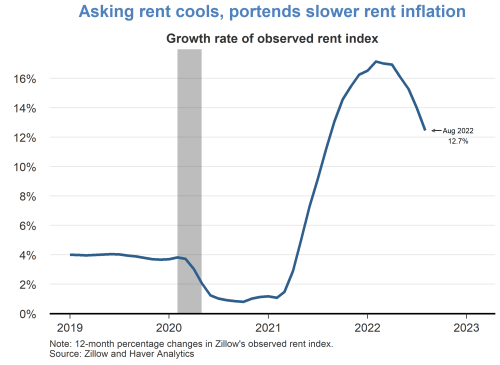

- One signal that monetary policy tightening might be starting to tame housing inflation emerges from the recent slowdown in the growth rate of asking rents on listed rental properties. For example, the 12-month change in Zillow’s observed rent index has slowed from a peak of 17.2% in February 2022 to 12.5% in August 2022. This development portends slower future housing inflation as changes in rents on newly signed lease contracts gradually enter the calculations for overall average rents and overall PCE housing inflation.

- Since it will take time for housing inflation to respond to monetary policy tightening, we expect housing inflation to continue to push up non-energy PCE services inflation in the next few quarters. We project that headline PCE inflation will decline gradually toward the Fed’s 2% longer-term goal by the end of 2025.

The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews appears eight times a year, generally around the middle of the month. Please send editorial comments to Research Library.