This paper derives a general class of intrinsic rational bubble solutions in a Lucas-type asset pricing model. I show that the rational bubble component of the price-dividend ratio can evolve as a geometric random walk without drift, such that the mean of the bubble growth rate is zero. Driftless bubbles are part of a continuum of equilibrium solutions that satisfy a period-by-period no-arbitrage condition. I also derive a near-rational solution in which the agents forecast rule is under-parameterized. The near-rational solution generates intermittent bubbles and other behavior that is quantitatively similar to that observed in long-run U.S. stock market data.

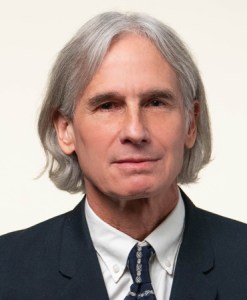

About the Author

Kevin Lansing is a senior research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco. Learn more about Kevin Lansing