In the context of recent housing busts in the United States and other countries, many observers have highlighted the role of credit and speculation in fueling unsustainable booms that lead to crises. Motivated by these observations, we develop a model of credit-fuelled bubbles in which lenders accept risky assets as collateral. Booming prices allow lenders to extend more credit, in turn allowing investors to bid prices even higher. Eager to profit from the boom for as long as possible, asymmetrically informed investors fuel and ride bubbles, buying overvalued assets in hopes of reselling at a profit to a greater fool. Lucky investors sell the bubbly asset at peak prices to unlucky ones, who buy in hopes that the bubble will grow at least a bit longer. In the end, unlucky investors suffer losses, default on their loans, and lose their collateral to lenders. In our model, tighter monetary and credit policies can reduce or even eliminate bubbles. These findings are in line with conventional wisdom on macro prudential regulation, and stand in contrast with those obtained by Galí (2014) in an overlapping generations context.

About the Authors

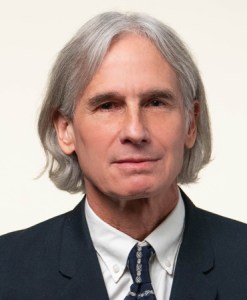

Kevin Lansing is a senior research advisor in the Economic Research Department of the Federal Reserve Bank of San Francisco. Learn more about Kevin Lansing