As always, it is helpful to start with a definition.

What is public debt?

Public debt is the outstanding amount of money the United States government has borrowed to cover its spending. In general, the public debt grows when there is a budget deficit. The government, through the U.S. Treasury, borrows money to finance the

deficit by selling Treasury securities. The government then has to pay interest to the people and organizations it borrows from, just like when businesses and consumers get a loan from their bank. Often the government runs an annual deficit, but not

always; budget surpluses, as occurred from 1998 to 2001, may be used to pay back that debt, and reduce the total amount of outstanding public debt.

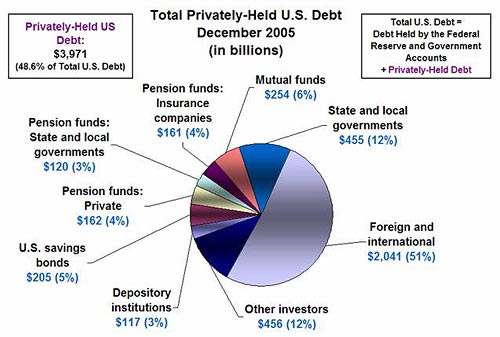

To gain a better understanding about which groups purchase U.S. government securities (that is, who the government is borrowing from), it is helpful to break down ownership of U.S. Treasury securities into two broad categories of debt: the amount held

by the Federal Reserve and Government accounts and the amount that is privately held. For a more detailed breakdown, see Chart 1.

As of December 2005:

|

Total Public Debt =

|

Holdings by the Fed

and Government accounts |

+ private holdings

|

|

$8,171 billion

|

$4,200 billion (51.4%)

|

$3,971 billion (48.6%)

|

Debt that is held by the Federal Reserve and Government accounts.

- As of December 29, 2005 (the last date reported in 2005), the Federal Reserve held roughly $744 billion in U.S. Treasury securities1, about 9% of total public debt. Interest paid on debt

owned by the Federal Reserve adds to government spending, though the Fed ultimately gives most of it back to the U.S. Treasury at the end of each fiscal year.2 - Government accounts are trust funds and some special funds and public enterprise revolving funds that accumulate cash in excess of current needs in order to meet future obligations. These cash surpluses are generally invested in Treasury

debt.3 For example, you may have heard in the media about the “Social Security Trust Fund”; this particular trust fund accounts for about 65 percent of total estimated investment by Government

accounts.4 Interest paid on debt owned by one government account to another government account does not have a net effect on government spending. 5

Debt that is privately held. Of particular interest today are the trends in debt that is privately held. Interest paid on this debt also adds to government spending. This category can be further subdivided into the following

holders of U.S. Treasury securities:

- Depository institutions

- U.S. savings bonds

- Pension funds – private

- Pension funds – state and local governments

- Insurance companies

- Mutual funds

- State and local governments

- Foreign and international institutions

- Other investors

Here’s a chart to show you what the breakdown of privately-held debt looks like.

Chart 1

The breakdown of privately held debt indicates that as of December 2005, more than half of total privately-held U.S. Treasury securities were owned by foreign and international entities (51%), followed by state and local governments (12%).

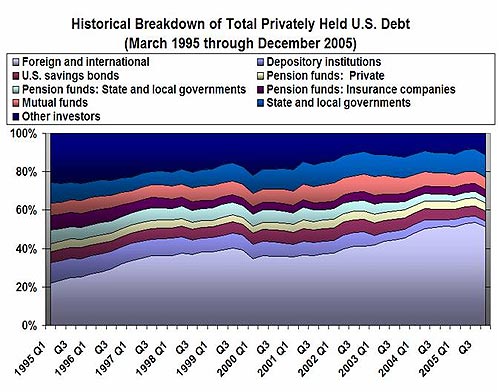

How has the breakdown of privately held debt changed over time?

As shown in Chart 2, since 1995 the share of debt owned by foreign investors has grown from one-fifth to roughly half of total private holdings.

Chart 2

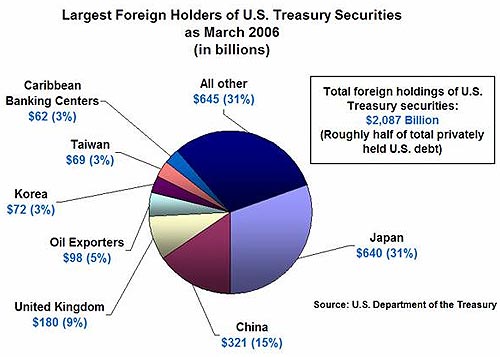

Which foreign entities are major holders of U.S. debt?

The U.S. dollar is an international reserve currency. Most of the world’s official reserves are held in U.S. dollars. 6 Also, because of its relative safety, foreign investors (both government and

private) may choose to hold assets denominated in dollars, such as U.S. Treasury securities, to diversify their portfolios. Central banks or other monetary authorities (often called “official” foreign entities) may hold foreign exchange

reserves—such as dollars—in order to influence the value of their domestic currency in the foreign exchange market. 7

The Office of Management and Budget states that, at the end of 2005, “[f]oreign central banks owned 63 percent of the Federal debt held by foreign residents; private investors owned nearly all the rest”. 8 The official foreign holdings of specific countries is a “well-guarded secret,” 9 but overall foreign holdings (that is, official foreign holdings plus holdings from private foreign investors)

are tracked by the Treasury, and are displayed in Chart 3.

Chart 3

Footnotes

1.

Federal Reserve Statistical Release H.4.1: Factors Affecting Reserve Balances.

2.

The Fed’s primary source of income is interest earned on the U.S. Treasury securities it holds; after covering expenses, the Fed distributes any profit back to the U.S. Treasury. For more information on the Fed’s structure, see the

September 2003 Dr. Econ. Also, click here to see Reserve

Bank income and expense data and transfers to the Treasury for 2005.

3.

Analytical Perspectives. Budget of the United States Government, Fiscal Year 2007. p. 229 provides a breakdown of debt held by Government accounts.

4.

Analytical Perspectives, p. 228.

5.

Analytical Perspectives, p. 224. Analytical Perspectives states that, “issuing debt to Government accounts does not have any of the economic effects of borrowing from the public. It is an internal transaction

of the Government, made between two accounts that are both within the Government itself. It is not a current transaction of the Government with the public; it is not financed by private saving and does not compete with the private sector for available

funds in the credit market; it does not provide the account with resources other than a legal claim on the U.S. Treasury, which itself obtains real resources by taxation and borrowing; and its current interest does not have to be financed by taxes or

other means.” Therefore, the Office of Management and Budget states that gross debt excluding that held by Government accounts “is a better concept than gross Federal debt for analyzing the effect of the budget on the economy.”

7.

Under this scenario, a central bank will single out one currency (called the reserve currency) in which to hold their international reserves. It can then influence its currency’s exchange rate against the reserve currency by trading domestic

money for reserve assets. For a more detailed discussion of various exchange rate regimes, see Krugman and Obstfeld 2006.

8.

Analytical Perspectives, p. 233.

Data Sources

Federal Reserve holdings of U.S. Treasury securities: Federal Reserve Board. 2006. Statistical supplement to the Federal Reserve Bulletin (January

2006). Table 1.18.

Foreign holdings of U.S. Treasury securities: Treasury International Capital System, U.S. Department of Treasury’s Office of International Affairs. Part I.A.3.

References

Office of Management and Budget. 2006. Analytical Perspectives, Budget of the United States Government, Fiscal Year 2007.

Krugman, Paul R. and Maurice Obstfeld. 2006. International Economics: Theory and Policy. Pearson Addison Wesley.

Valderrama, Diego. 2005. “What If Foreign Governments Diversified Their Reserves?” FRBSF Economic Letter 2005-17 (July 29)