Good question! To provide the answer, we’ll need to travel overseas to check out the international money markets.

Eurodollars

Before discussing LIBOR, you should know about Eurodollars. A good place to start is the Federal Reserve Bank of Richmond online publication, Instruments of the Money Market. Chapter 5 (on Eurodollars) provides the definition for these deposits:

Eurodollars are bank deposit liabilities denominated in U.S. dollars but not subject to U.S. banking regulations. For the most part, banks offering Eurodollar deposits are located outside the United States.

Eurodollars originated in London during the Cold War but are now held at banks around the world, and today they constitute one of the largest short-term money markets in the world.

What is LIBOR?

LIBOR refers to the London Interbank Offered Rate, a money market interest rate that has become a standard in the interbank Eurodollar market. The term “interbank” refers to the fact that this is a market for banks and financial institutions, rather than individuals or nonfinancial businesses. However, consumers may be familiar with the term LIBOR because LIBOR interest rates are commonly used as an index to determine interest rates on adjustable rate mortgages and business loans in the United States. LIBOR is defined in Chapter 5 of Instruments of the Money Market:

LIBOR is the rate at which major international banks are willing to offer term Eurodollar deposits to each other. An active secondary market allows investors to sell Eurodollar CDs before the deposits mature.

Eurodollar Rates

Eurodollars provide large U.S. banks with an alternative to short-term borrowing in the domestic overnight federal funds market. Mishkin and Eakins explain in Financial Markets and Institutions, (2000) that because overnight LIBOR and overnight federal funds interest rates tend to be “near-perfect substitutes” the interest rates in these two markets tend to track each other very closely.

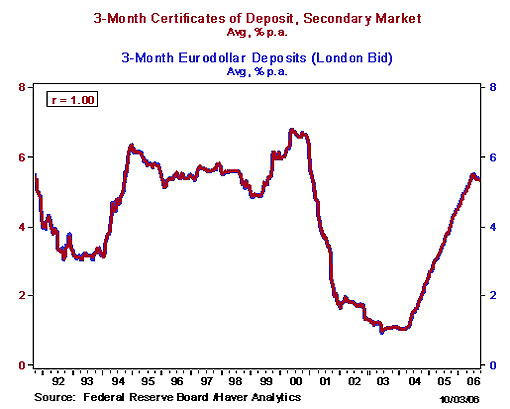

In fact, in today’s global financial markets, there is a strong correlation between short-term U.S. and Eurodollar interest rates of a similar maturity. You can see this in the following chart; it shows the very close relationship between a 3-month LIBOR interest rate (denominated in U.S. dollars) shown in blue and the 3-month U.S. secondary market certificate of deposit (CD) rate shown in red.

As you can see, the rates are nearly identical, rarely varying by more than several basis points over 15 years of weekly data. As noted in Instruments of the Money Market, in the competitive money markets, “Arbitrage keeps interest rates closely aligned between Eurodollar deposits and deposits with roughly comparable characteristics at banks located in the United States.”

To check out additional interest rate data, visit the Federal Reserve Board Statistical Releases listed below as references.

References

Economagic.com: Economic Time Series Page: LIBOR. Economagic.com (October 2006)

Instruments of the Money Market. (2006) Federal Reserve Bank of Richmond.

Mishkin, Frederic S. and Stanley G. Eakins. (2000) Financial Markets and Institutions. Addison-Wesley: Reading, Massachusetts.

Selected Interest Rates. Board of Governors of the Federal Reserve System, Federal Reserve Statistical Release H.15.

Survey of Terms of Business Lending. Board of Governors of the Federal Reserve System, Federal Reserve Statistical Release E.2.