The U.S. Bureau of Labor Statistics or BLS compiles data on the employment status of the population. These data come from the Current Population Survey (CPS), conducted for the BLS by the U.S. Census Bureau. The CPS is a monthly survey of about 50,000 households and it has been conducted for over 50 years (to learn more about the CPS, visit the U.S. Census Bureau’s web page). In my June 2004 answer, I discussed the employment data that come from the survey (“civilian employment” series). Today I will focus on unemployment.

Definitions: Unemployment and the unemployment rate

To be classified as unemployed in the CPS people must satisfy two primary criteria: (i) they must have no job and (ii) they must be actively seeking employment. Those who do not have jobs and are not actively searching are considered to be out of the labor force.

To be precise, the BLS defines unemployed persons as those who “had no employment during the reference week, were available for work, except for temporary illness, and had made specific efforts to find employment sometime during the four-week period ending with the reference week.” There is one exception to this rule: “persons who were waiting to be recalled to a job from which they had been laid off need not have been looking for work to be classified as unemployed.”1

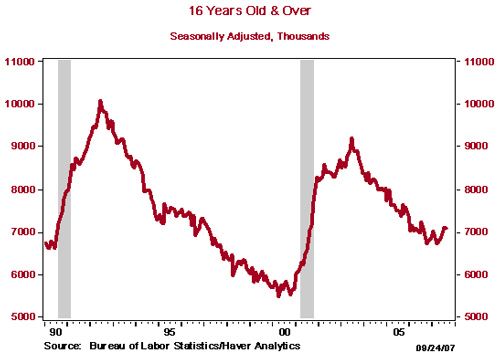

Chart 1 below shows civilian unemployment for the 1990s and 2000s. As one would expect, the number of unemployed increases during and after the recessions (designated with gray bars).

Chart 1: U.S. Civilian Unemployed

Note that the group classified as out of the labor force is not limited to people who don’t desire employment. Indeed, it includes people who do not have jobs and are interested in finding work (as signaled by the fact that they have looked for work sometime in the past year), but gave up looking because they do not believe that there are jobs available. Such people are classified in the survey as discouraged workers. While it is true that discouraged workers are in a situation similar to the unemployed, this group typically is quite small in relative terms and exhibits a cyclical pattern similar to the unemployed. As such, including discouraged workers in an expanded measure of unemployment does not significantly alter the evaluation of changes in labor market conditions over time (Kodrzycki 2000).

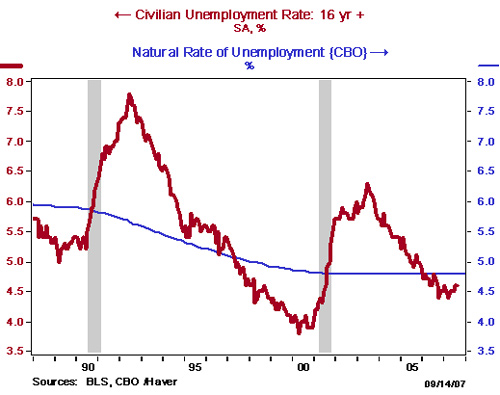

To assess labor market conditions, economists use the unemployment rate, defined as the number of unemployed persons as a percent of the total labor force,2 rather than the number of unemployed. It is useful to compare the actual unemployment rate to the estimate of the “natural” rate of unemployment or the unemployment rate that occurs when short-run cyclical factors have fully played out—that is, wage rates in the economy have adjusted such that overall labor demand and supply are in balance (for details about the natural rate of unemployment, see a Federal Reserve Bank of San Francisco Economic Letter from September 1998 on the subject). Chart 2 plots the actual unemployment rate (the thick red line) and the estimated natural rate (the thin blue line) from the U.S. Congressional Budget Office or CBO. The deviation of unemployment from its natural rate is referred to as cyclical unemployment, or unemployment that results from short-run variation in labor demand. You’ll notice that the actual unemployment rate exhibits considerably more volatility than the natural rate, because the natural rate by definition omits volatility caused by short-term fluctuations in the labor market.

Chart 2: U.S. unemployment rate: The actual rate vs. the natural rate

When the actual unemployment rate dips below the estimated natural rate, labor markets typically are described as “tight.” When the opposite occurs, you might start hearing about a “softer” labor market, or a labor market that has “slack.” Of course, the comparison of the actual and natural rates of unemployment is complicated by the fact that the latter is only an estimate of a theoretical concept, not a number that one can explicitly measure, and considerable uncertainty surrounds that estimate.

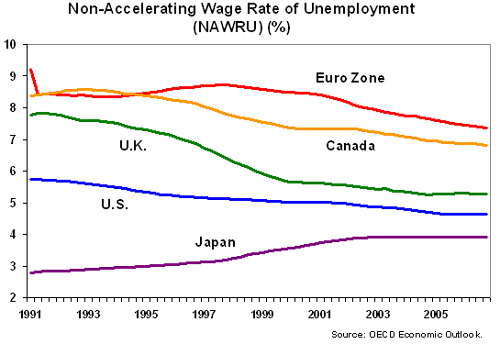

Chart 3 shows estimates of natural rates of unemployment for various countries prepared by the Organization for Economic Cooperation and Development, or OECD.3 The two estimates for the U.S. natural rate of unemployment presented in Charts 2 and 3 are quite comparable; both are currently close to 5%. Chart 3 compares estimates of the natural rate of unemployment for the U.S. with those for the Euro Zone countries, Canada, the U.K., and Japan. The higher natural rates estimated for the European countries and Canada compared with the U.S. are commonly attributed to less-flexible labor markets and more-generous social welfare policies in those countries.

Chart 3: Natural Rates of Unemployment in the U.S. and Other Select Areas

Types of unemployment

One might question why economies experience unemployment at all and why, even in the most developed and prosperous economies, unemployment always exists. Part of the answer is that it takes time for workers to find new jobs. Thus, even if a job that matches a person’s skills and preferences exists, it may take some time for the person to discover that job. The type of unemployment that exists because a job search takes time is sometimes referred to as frictional unemployment. In contrast, structural unemployment refers to a persistent mismatch between labor supply and demand, arising, for example, from a shortfall of skilled workers relative to available jobs or unbalanced growth in labor demand across regions or industries.

As you probably suspect, policymakers typically consider frictional unemployment to be less problematic than structural unemployment, since it reflects the time it takes for workers to find the jobs that suit them best and at which they presumably will be the most productive. Unemployment spells, defined as an uninterrupted period of months in which an individual was unemployed, associated with frictional unemployment tend to be shor

t, whereas those associated with structural unemployment can be quite long.

When can high employment be problematic?

Finally, you asked what can be bad about high employment. Most people are aware that high unemployment is not desirable. As Federal Reserve Governor Mishkin said in a 2007 speech, high unemployment “is associated with human misery, including lower living standards and increases in poverty as well as social pathologies such as loss of self-esteem, a higher incidence of divorce, increased rates of violent crime, and even suicide.” In addition to these social costs, unemployment clearly causes economic problems for the unemployed. On a macroeconomic level, high unemployment implies that the economy isn’t utilizing its resources and, therefore, is performing below its potential. High unemployment also costs the government money in terms of increased expenditures on social insurance programs and reduced tax receipts.

Given the above, shouldn’t policymakers try to push the unemployment rate as low as possible? Not quite: pushing unemployment far below its natural rate would also lead to negative consequences, primary among them inflationary pressures. The reason is that the maximum level of employment in the economy that is sustainable (some refer to it as the long-run employment level) depends not on monetary policy, but on the fundamental structure of the economy: demographics, characteristics of the labor force, technology, natural resources, etc. If employment is pushed above this maximum sustainable level, wages will eventually rise as people realize jobs are abundant and thus they have some bargaining power. As wages rise, production costs increase, which could then be passed along to consumers and hence the rate of price inflation rises. Price inflation has considerable costs, too (see my March 2006 posting that discusses the costs of inflation).

As a side note, while monetary policymakers cannot keep unemployment below the natural rate indefinitely without negative consequences, other policymakers can influence the structure of the economy by pursuing policies that enhance education and productivity, thereby increasing the maximum sustainable level of employment itself, though this is notoriously difficult to do.

Endnotes

1. Bureau of Labor Statistics. 2006. “Labor Force Concepts.”

2. The total labor force is the sum of all persons employed and unemployed.

3. Estimates presented are for the NAWRU – non-accelerating wage rate of unemployment. This is a rate of unemployment that is consistent with stable wage inflation (see OECD 2006).

References

Kodrzycki, Yolanda. 2000. “Discouraged and Other Marginally Attached Workers: Evidence on Their Role in the Labor Market.” New England Economic Review.

OECD. 2006. Sources and Methods of the OECD Economic Outlook.