This is a very timely question, as many analysts and policymakers today are closely watching commodity prices. How does one think about the link between this rise in commodity prices and headline inflation? Let me take a stab at outlining my thinking on the issue.

Oil and other commodity prices are volatile, responding to swings in supply and demand conditions.

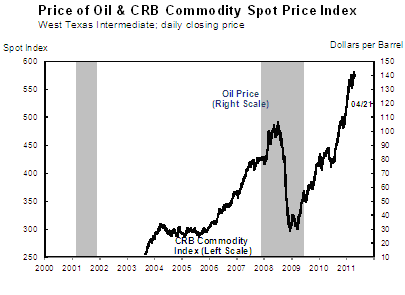

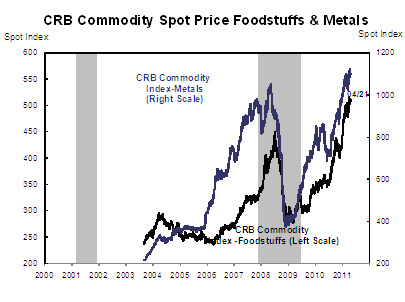

After commodity prices fell dramatically and inflation slowed during the worst U.S. and global recession since the 1930s, commodity prices are again registering noticeable gains. Oil prices rose from the trough of $41 a barrel in December 2008 to $90 a barrel in February 2011 – a 120% increase (Figure 1a). Although oil prices today remain below the unprecedented peak reached in the summer of 2008 (where the monthly average price reached as high as $134 a barrel in June of 20081), the unrest in the Middle East in early 2011 heightened concern about the global oil supply and made for an uncertain outlook for oil prices as well. During the same December 2008 to February 2011 period, the price of commodities (as measured by Commodity Research Bureau’s index) increased by 83% (Figure 1a). In particular, food prices rose by 74% (see Figure 1b) and metals — by 153% (Figure 1b). The rise in commodity prices can be attributed to the strong global demand (most notably from strong growth in emerging economies, in particular China and India) and recent constraints on supply (for instance, the worst drought in at least 50 years in Russia in the summer of 2010) (see, for instance, Bernanke 2011).

Figure 1a

Figure 1b

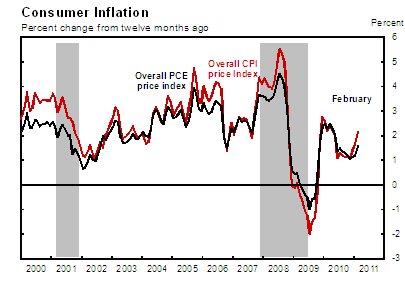

The swings in oil and commodity prices have contributed to volatility in overall consumer price inflation.

Indeed, with the recent run-up in commodity prices, measures of headline inflation have increased. For instance, based on the data for February 2011 the consumer price index (CPI) inflation rate over the previous 12 month period moved up to over 2 percent and Personal Consumption Expenditure (PCE) prices index moved up to 1.6 percent (see Figure 2).

Figure 2

However, the rise in headline inflation has been much smaller than the rise in commodity prices.

From comparing figures 1 and 2, it is clear that while the increase in commodity prices pushed up headline inflation, the increase in headline inflation has been of a much smaller magnitude than the increase in commodity prices. One reason for that is that oil and commodities in general account for only a fraction of the value of total consumer goods and services produced in the economy. Overall, the share of value of consumption accounted for by commodities is about around 4 percent according to one 2008 study (Hobijn 2008).2

It is clear, then, that we need to consider factors beyond past commodity prices when assessing inflation and the outlook for inflation.

In the US economy today, there are several factors that are likely working to dampen consumer price inflation

The Amount of Slack in the US Economy is Large.

One such factor that I have talked about in the past is the degree of slack in the economy. While the supplies of commodities currently are tight compared to demand, that is not the case for other inputs used to produce goods and services. Let me run through several examples of slack.

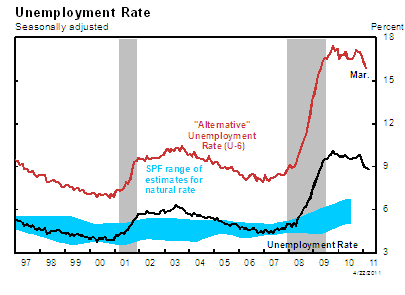

Let’s begin with the enormous amount of slack in the U.S. labor market, which I have recently written about (see my January 2010 and August 2010 responses). Although the unemployment rate began to decline in late 2010 and stood at 8.8 percent in March 2011, it is still considerably higher than most estimates of the natural rate of unemployment (Figure 3). As I wrote in January 2010, the commonly cited unemployment rate estimate includes only those workers who satisfy a rather strict definition of unemployed.3 Broader measures are available and paint an even grimmer picture – according to Figure 4, in March 2011 15.7 percent of the U.S. labor force was either unemployed or underemployed (work less than they would prefer).

Figure 3

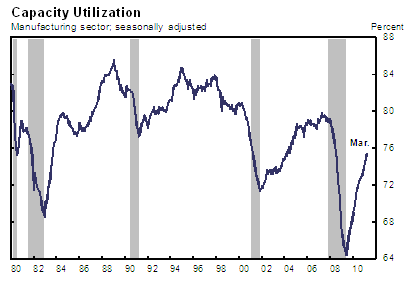

Another example of slack is industrial capacity utilization. Total industrial capacity utilization, although recovering, still reached only 77.4 percent in March 2011, below its average of around 81 percent over the past 45 years (see Figure 4), which suggests that, in addition to labor, there is a considerable amount of underutilized capital (plant and equipment) in the U.S. economy.

Figure 4

Long-Run Average

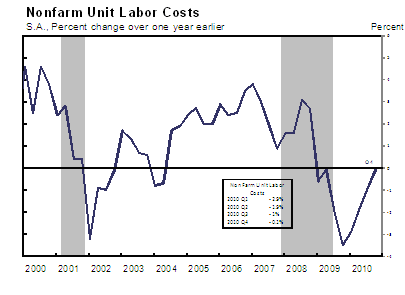

Slack has the effect of dampening inflation. High rates of unemployment tend to limit the rise in wages. This along with the growth in productivity has worked to reduce labor costs. This is important, as labor compensation is the largest cost category for businesses (see Williams 2011). Labor costs have actually been declining on a year-over-year basis (see Figure 5). In addition, with excess production capacity, competitive pressures may limit the scope for some producers to pass on higher costs of commodities to the prices of final goods and services.

Figure 5

Looking ahead, the real issue is whether the increase in overall inflation will persist.

To get back to your question, the real issue is whether the bump up in overall inflation will persist or turn out to be transitory. The evidence seems to suggest that it is more likely to be temporary.

At least some of the rise in commodity prices likely reflects temporary supply conditions.

The outlook for commodity prices remains uncertain. There is a risk, for example, that supply factors could lead to a further rise in oil prices. Also strong world demand can be expected to continue to affect commodity prices. However, as I suggested earlier, at least some of the rise in commodity prices likely reflects temporary supply conditions. This implies that, as we have seen in past cycles, some commodity prices could retrace earlier increases. In any case, even if commodity prices were to remain at currently high levels, the impact from the most recent rise in commodity prices would dissipate, as it is not the level but the change in commodity prices that pushes up inflation.

The degree of slack and the eventual removal of monetary accommodation can be expected to moderate inflation.

In the intermediate term, the high degree of slack can be expected to continue to moderate inflation. In the longer term, as the economic expansion matures and the degree of slack diminishes, the Federal Reserve will need to begin tightening monetary conditions to prevent the development of inflationary pressures (to read more on the Federal Reserve’s commitment to price stability and on the strategy to remove accommodation, please visit our Crisis and Response site). The tighter stance of monetary policy should then be expected to moderate inflation at that point.

Inflation Expectations Remain Well Anchored.

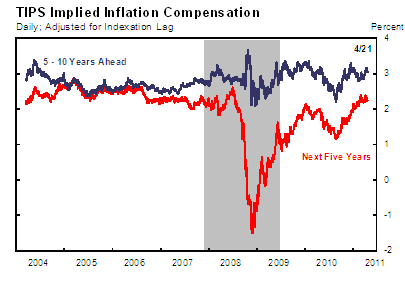

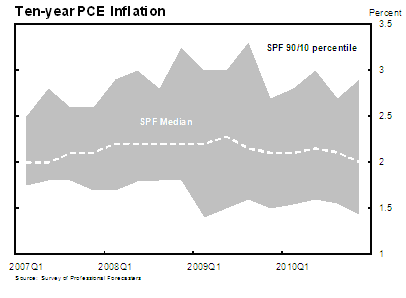

Long-term inflation expectations in the United States have been stable since 1984 and they remain stable today. For instance, Figure 6 shows inflation expectations obtained from the yields on Treasury Inflation-Protected Security (TIPS).4 Inflation expectations over the next five years rose in the second half of 2010 and early 2011 and are now back at a level that is within the range that existed prior to the financial crisis. They are also consistent with the Fed’s goal of price stability. Survey measures of inflation expectations, like the Survey of Professional Forecasters, published by the Philadelphia Fed (shown as Figure 7), paint a similar picture.

Figure 6

Figure 7

I want to draw your attention to inflation expectations because they can play an important role in determining actual inflation. To be more specific, higher inflation expectations can lead to higher actual inflation. For instance, higher expected inflation can lead to demand for higher wages, which, in turn, can be expected to push up the price level. In contrast, anchored inflation expectations help mitigate inflationary pressures from other forces.

Conclusion

Although commodity prices rose noticeably in the late 2008 to early 2011 period, several factors mitigate their impact on headline inflation:

- the weight of commodities in the aggregate price indices is relatively small;

- there is a large amount of slack in the U.S. economy and it is expected to persist for some time;

- U.S. inflation expectations are well anchored, and

- the recent rise in commodity prices is likely driven in part by temporary factors.

However, monetary policymakers and market participants continue to carefully watch the developments in the commodity markets, along with a variety of measures of actual and expected inflation. Should the rise in commodity prices prove to be sustained, it would threaten price stability, especially in the event inflation expectations were to become unanchored.

Date of publication: First Quarter 2011

Endnotes

1. Note that these are monthly average figures. Daily prices reached higher levels during the summer of 2008 (record peak of $145 per barrel was reached in June 2008).

2. http://www.newyorkfed.org/research/current_issues/ci14-8.pdf

3. BLS defines them as “Persons aged 16 years and older who had no employment during the reference week, were available for work, except for temporary illness, and had made specific efforts to find employment sometime during the 4-week period ending with the reference week. Persons who were waiting to be recalled to a job from which they had been laid off need not have been looking for work to be classified as unemployed.”

4. For information and data on GDP, see National Income and Product Accounts from the Bureau of Economic Analysis.