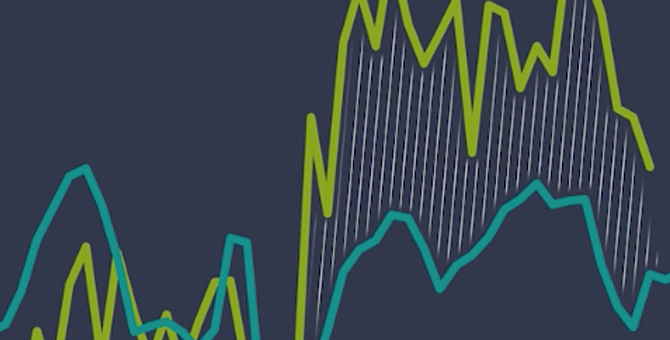

Housing prices surged as housing inventories dropped to historically low levels in the first two years following the onset of the pandemic. Watch our Economic Letter video with John Mondragon, research advisor, to learn more about the shifts in housing demand during and since the pandemic.

To read more, see our January 6, 2025, Economic Letter, “Pandemic-Era Demand Squeezed Housing Inventories.”

The Federal Reserve Bank of San Francisco (SF Fed) works to advance the nation’s monetary, financial, and payment systems to build a stronger economy for all Americans. As part of the U.S. central bank, the SF Fed serves the Twelfth Federal Reserve District, which covers the nine western states—Alaska, Arizona, California, Hawai’i, Idaho, Nevada, Oregon, Utah, and Washington—plus American Samoa, Guam, and the Commonwealth of the Northern Mariana Islands. By pursuing our two key goals of maximum employment and price stability—known as the Fed’s dual mandate—we work toward supporting an economy that works for everyone.