A large share of small businesses in the District continue to feel the negative effects of COVID-19. In the first quarter, small- and medium-sized firms shed more than 15% of their employees year over year, only some of which recovered through June according to stats from ADP, a payroll processing firm. By the third quarter, the Census Bureau’s weekly Small Business Pulse Survey reported that three-quarters of small businesses nationally had felt negative impacts from the pandemic.

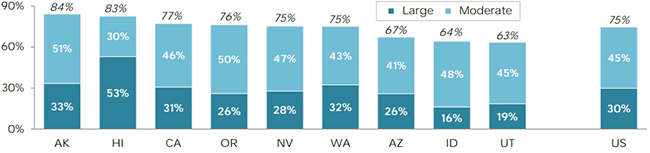

The hardest-hit states in the District continue to be those with a high reliance on energy and tourism (such as Alaska and Hawai’i) and those with more extensive COVID-19 restrictions and mandates (such as California and Washington). Unsurprisingly, the following sectors have reported the highest percentage of negative effects due to COVID-19: educational services, accommodation/ food service, health care, arts/entertainment, and other services such as spas, salons, and repair shops.

Share of Small Businesses Reporting Moderate-to-Large Negative Impact form COVID-19

Source: Census Bureau Small Business Pulse Survey via Haver Analytics (11/16-22/2020).

Although Small Business Administration (SBA) emergency programs had a slow start in the District, coverage improved over time. Through the third week of November, roughly two-thirds of the District’s small businesses surveyed by the Census Bureau received Paycheck Protection Program (PPP) funds, and a notable minority also reported using Economic Injury Disaster Loan (EIDL) proceeds. PPP was designed to provide a direct incentive for small businesses to keep their workers on payroll, versus EIDL, which offers economic relief in the form of loans to aid small businesses that experience a temporary loss of revenue.

For more details and implications for banking, visit the full First Glance 12L 3Q20 report.

Image credit: Volodymyr Rozumii via iStock.

You may also like:

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.