Do risky investments earn better returns than safe ones? The answer to this question is not only meaningful for hedge fund managers seeking high profit margins. Economists also obsess about asset returns, although for different reasons. The returns of one asset class relative to another—and the overall rate of return on all assets relative to an economy’s rate of growth—are windows into an economy’s inner workings. Examining them helps economists better understand financial stability, monetary policy, income inequality, and more.

Collecting data on the evolution of asset returns is therefore critical. After many years of dusting off long-forgotten almanacs and statistical yearbooks, Jordà, Knoll, Kuvshinov, Schularick, and Taylor (2017) provide an in-depth look at the rates of return of housing, equities, and short- and long-term government debt for 16 advanced economies since 1870. These four asset classes usually represent more than 50% of a country’s wealth portfolio.

What the data reveal is quite unexpected.

Consider housing, one of the most widely held assets by households. Returns consist of two components. One is the appreciation in the price of a house over time. The other is determined by the rent, whether paid by renters or credited to owners, net of depreciation and other costs.

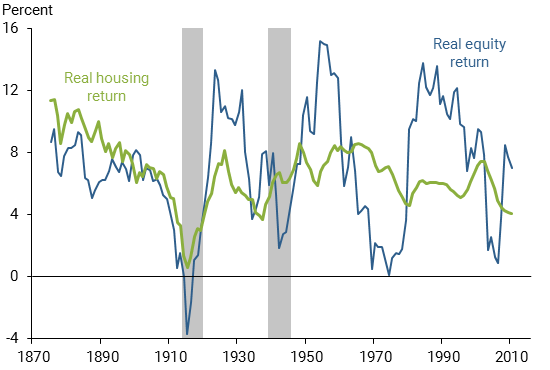

In investment terms, you can think of housing returns as similar to the dividends a stock would earn or the coupon payments of a government bond. In aggregate, across countries and over time, housing returns are close to what investors earn for publicly traded stocks, about 7% per year in real, or inflation-adjusted, terms. More surprising is that, despite having just recovered from the Great Recession, housing returns are half as volatile as equity returns. Figure 1 illustrates this, comparing returns for housing and equities averaged over 10-year windows.

Figure 1

Real returns on housing and equity investments

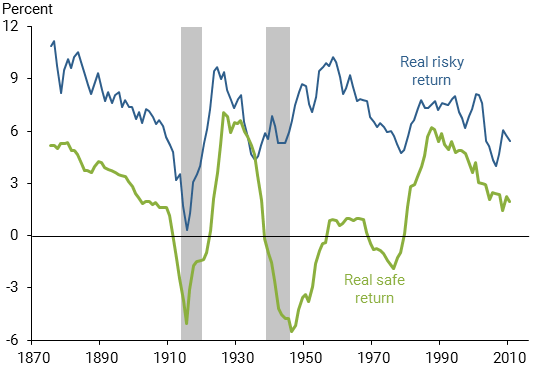

Housing and equities are often classed as “risky” assets, whereas government debt is classed as a “safe” asset because governments seldom default on their obligations. In the short run, risky assets are more volatile than safe assets. But over the longer run, that is not the case. As Figure 2 shows, the cross-country average of safe asset returns fluctuate wildly, especially during wartime but at other times as well. This runs counter to the basic notion that risky assets should have higher returns to compensate investors for risk.

Figure 2

Rates of return on risky vs. safe assets

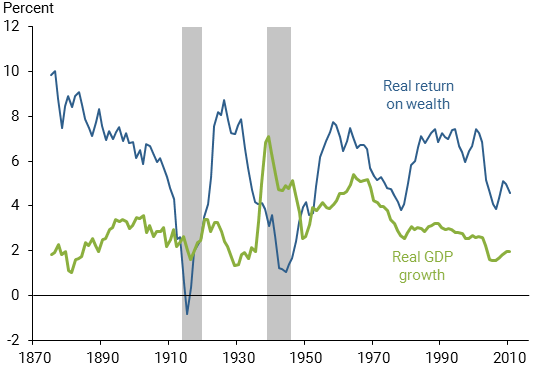

So how do total returns for the combination of safe and risky assets compare with the rate of growth of economies? Piketty (2014) argues that, when the real return on investments exceeds the rate of growth of the economy, wealth grows more quickly than income, broadening inequality. The debate on Piketty’s (2014) thesis and policy recommendations to reduce inequality rages on. But as a first pass, Figure 3 provides a good visual of what has happened across countries in the past 150 years. Returns have consistently exceeded economic growth, sometimes by large amounts. Yet more challenges for economists to puzzle over.

Figure 3

Returns on wealth and growth across 16 advanced economies

Òscar Jordà is a vice president at the Federal Reserve Bank of San Francisco.

Dmitry Kuvshinov is a graduate student at the University of Bonn.

Katharina Knoll is an economist at the Deutsche Bundesbank.

Moritz Schularick is a professor at the University of Bonn.

Alan M. Taylor is a professor at the University of California, Davis.

References

Jordà, Òscar, Dmitry Kuvshinov, Katharina Knoll, Moritz Schularick, and Alan M. Taylor. 2017. “The Rate of Return on Everything, 1870-2015.” FRB San Francisco Working Paper 2017-25.

Piketty, Thomas. 2014. Capital in the Twenty-First Century. Cambridge, MA: Harvard University Press.

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.