In the world of Apple Pay, Bitcoin, and Square, many believe that the days of cash are numbered.1 More payments are being made with a click, a tap, or a swipe, and it feels like we’re carrying fewer notes and coins than ever before.

But what do the data say? Are claims about the end of cash to be believed, or, like Mark Twain’s famous quip, are reports of its death greatly exaggerated?

The answer’s in the data

To answer this question, we looked at cash use in 42 economies across the globe, which together account for 75 percent of world GDP. We used currency in circulation (CIC) in these countries as a proxy for cash use. CIC measures the total amount of cash held by the public, including businesses, banks, and consumers.2 When people want to hold more cash, the central bank adds cash into the banking system, resulting in an increase in CIC.

Why people hold cash

There are many different reasons why the public may demand and hold cash. The most obvious purpose is as a medium of exchange—that is, to pay for goods and services. Cash is widely accepted, easy to use, and doesn’t require a bank account or mobile phone. In addition, people hold cash as a store of value. It can be convenient and reassuring to have immediate access to money, especially in case of an emergency or in situations of political or economic turmoil.

Given these motives for holding cash, two economic factors play a major role in determining how much cash people hold: income and interest rates. When incomes rise, people have more money to spend and need more cash to carry out transactions, causing CIC to go up. At the same time, holding cash means that you are giving up the interest you could have earned if you kept your money in a savings account or other investment. This foregone interest is called the opportunity cost of holding cash. If interest rates go up, people tend to cut back on how much cash they hold and CIC will go down. In addition, other factors affect the demand for cash, including natural disasters, political instability, and new currency designs and features.

Global cash trends

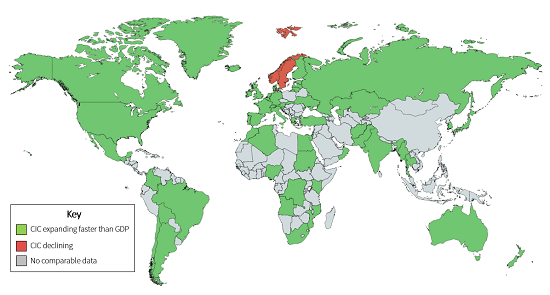

Keeping in mind the factors that influence the demand for cash, what has been happening with CIC around the world? The map shows how fast CIC grew compared to GDP from 2006 to 2016 in 42 countries. We compare CIC growth to that of GDP based on the conjecture that CIC should grow at about the same pace as GDP, assuming other factors affecting demand for cash are not at play.

The countries colored green saw CIC growth match or outpace the growth of GDP. The two countries colored red—Norway and Sweden—experienced outright declines in CIC over the past decade. The countries colored gray are those for which we do not have comparable data.

Figure 1

CIC growth compared to GDP from 2006 to 2016

It may come as a surprise that, despite the explosion of technology in the payments sector, over the past ten years, CIC grew faster than GDP in most countries. Some countries like Mexico and South Korea saw CIC outpace GDP by more than 100 percentage points. The predominance of countries colored green suggests that other factors besides income growth are fueling the growth in CIC. Presumably, very low interest rates in many countries over the past decade has been one factor boosting the demand for cash, as well as uncertainty following the global financial crisis.

Policies to get rid of cash

In stark contrast to the rest of the world, two countries have seen CIC decline outright: Norway and Sweden. These countries have been able to move away from cash through government initiatives, financial institution coordination, and widespread electronic payments infrastructures.

Norway’s central bank acknowledges that cash’s role “continues to diminish” as consumers move towards electronic payments, and it contemplates what the future form of money should be. The country’s largest bank, DNB, has eliminated cash in its branches, explaining that only 6 percent of Norwegians use cash on a daily basis. The bank has also proposed that Norway eliminate the 1,000 kroner note.

While Norway has been moving away from cash, Sweden has garnered attention as the poster child of cashless countries. Since the 1960s, Swedish banks have encouraged digital bank transfers, charged for checks, and invested heavily in card payment systems. The banking system collaborated to create an automated clearing house, Bankgirot, and to launch a popular mobile payments app, Swish. Sweden also has a cultural stigma against cash, with some Swedes associating the payment method with crime. The 2009 Money Laundering and Terrorist Financing Prevention Act required police reports be filed for large cash transactions, and high-profile cash robberies have contributed to public wariness of cash.

A few other countries have also taken measures to move away from cash, though their CIC continued to grow. In 2012, Nigeria launched a “Cash-less Nigeria Project” to reduce CIC by charging fees for large cash transactions. Meanwhile, Kenya’s mobile money app, M-PESA, is used by 60 percent of adults and rivals Sweden’s Swish app in popularity.

A look at the data shows that Mark Twain’s wise words ring true: reports of the death of cash have been greatly exaggerated. A few countries have managed to move away from notes and coins, in favor of digital payments. But despite the plethora of digital options, in most countries, demand for notes and coins is strong and shows no signs of slowing down.

Download currency in circulation data (xlsx, 26 kb)

John Williams is the president and CEO of the Federal Reserve Bank of San Francisco.

Claire Wang is a data and policy analyst in the Federal Reserve’s Cash Product Office.

End Notes

1. Wired. (May 2015). “It’s official: cash is dying.”; The New Yorker. (October 2016). “Imagining a Cashless World.”

2. Some of the countries’ CIC data refers to their “monetary base,” which includes notes and coins in circulation as well as commercial bank deposits held at the central bank. More information on the components of monetary base can be found here: IMF. (2008). “Monetary and Financial Statistics Compilation Guide.”

The views expressed here do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.