Thursday, Feb 23, 2023

11:00 a.m. PT

Virtual

Transcript

Sunny Zhang:

Again, welcome everyone streaming in right now. We’re going to get started very shortly.

Awesome. All right. Thank you everybody for joining us today. I am Sunny from Team Handshake, and I’m really, really excited to welcome you all here today for a very special conversation we have prepared with President Mary Daly here and Jules Terpak.

Just a couple quick notes before we get started here. We’ll have about 20 minutes of discussion and save about 10 minutes at the end for questions from all of you, the audience. So be sure to put any questions you have in the Q&A box, and we’re going to be doing our best to answer some of them before we end today.

So with that, I am thrilled to turn it over to today’s moderator, Jules.

Jules Terpak:

Thank you so much, Sunny, and thank you everyone for being here today. My name is Jules Terpak. I report on digital culture across social media platforms, which I consider to be anything that falls under human computer interaction, which is basically everything today. So I’ve been luck lucky enough to partner with Handshake, talking about breaking into tech, the future of education. And today I’m super excited because I’m going to be speaking with Mary Daly, president and CEO of the Federal Reserve Bank of San Francisco. But Mary, I don’t want to talk too much for you. How do you typically like to introduce yourself?

Mary Daly:

Well, I’m Mary Daly. I’m the president and CEO of the Federal Reserve Bank of San Francisco, as you said, but that’s not how I started in my career. I have a really interesting path of how to get here, and I’m just excited to be talking with all of you about your careers, your futures, what you’re thinking about.

Jules Terpak:

Yes, let’s get into it. But before we get into kind of the nitty-gritty of it all, we don’t want to make any assumptions about the guest here and kind of just want to go over the basics. So Mary, can you explain, what is the Federal Reserve?

Mary Daly:

Sure. The Federal Reserve is… You have to go back all the way to 1913 when the Federal Reserve was founded, and it was founded because we had a banking system. Think about all your payments, your banking, all this you do, that was basically state-based. So if you were living in New York, your currency, your banks would be different than if you were living in California. And that just didn’t work because we’re a linked up society.

And so the Federal Reserve was created to make all that the same, make sure that we have a safe and sound payment system, a safe and sound financial system, and then of course to think about managing the economy and really a healthy and sustainable economy. So the Federal Reserve System has 12 reserve banks and one Board of Governors in DC, and it’s been independent, in existence for about over a hundred years. It also employs over 20,000 people across the nation, so it’s a really nice group of people all dedicated towards the same thing, serve the American people, and that’s what we do each and every day.

Jules Terpak:

Okay, that’s super helpful. When you think about our economy, you’re thinking of Wall Street and you’re also thinking of the Federal Reserve, but how is a career at San Francisco’s Federal Reserve different than a traditional Wall Street bank career path?

Mary Daly:

So many of the skills that you think of getting when you would go to a Wall Street career are the same skills that we need here at the Federal Reserve Bank of San Francisco or any of my partner banks across the country. They’re really skills about technology. Technologists go to Wall Street, they come here. We need a lot of people who do technology, everything from app development to thinking about what do you do with CBDC? And we also need people who are interested in supervising financial institutions, thinking about checking their health, how will they respond under stress? What do we do when they get into stress? We have a large team of people who work in that. We also have economists who think about how to manage monetary policy. And then we have the full slate of people who support all of that work.

And one of the things that we have that people don’t know about is we have a large team of people who work in communications and bridge the space between economics and communications, technology and communications, payments and communications. And then what’s really interesting, and people are very surprised about this, we also process U.S. currency, meaning currency comes to our facilities, we count and clean it, make sure it’s fit for delivery and use, and then we ship it back out. So if you go to the floors of our Bank, you’ll see what looks like a giant manufacturing firm, and then you’ll see knowledge workers who are doing this other kind of work. It is an opportunity for everybody is how we like to think about it. You have a skill and an interest, we can probably employ you.

Jules Terpak:

Right. I love that because a big part of this event was, you don’t need to have a finance degree. There can be a place for you within the Federal Reserve. And what type of qualities within someone do you think would attract them to a career there?

Mary Daly:

Our work really is mission driven. So many, many people, I would say by and large people who choose the system, the Federal Reserve Bank of San Francisco in particular, are mission driven. They want to have something where they say, each and everything I do every day is in some way supporting the American people and countless global citizens. We have this mantra here. We used to have a poster before the pandemic that said, our work supports every American and countless global citizens. And that’s really what you have to believe to work here, and that’s how you get your value at work in addition to the compensation.

So people come to work here for that reason, and what they find when they get here that keeps them… It’s one thing to come and start working here. It’s another thing to stay. When I ask employees, which I do all the time, I’m always asking team members, why do you stay? Why’d you come? What would make you leave? They always say the same things, mission, the culture. They really come for the culture. Our culture is people first, evidence-based. We know we’re in service, but we have to bring evidence. And we have a best idea wins culture. It’s not about what age you are, how much experience you have. It’s not about where you came from, what degree you even have. It’s about how do you come to work and work in a team and collaborate. And if you have a good idea, you’re going to get a voice and you’re going to get voice here and be inclusive.

So it’s inclusive and people first. And then finally I’d say the thing that really attracts people here is we have a lot of opportunities for growth. We have the idea that sometimes navigating through your career isn’t just going up a linear chain or climbing a ladder that’s straight. It’s going and doing different things to build a portfolio of skills that then allows you to pursue different interests, try things out, ultimately always building your career that you’ve planned as opposed to you’re on a track and you can’t get off of it. So we have a system there and a commitment to that, and that I think has been one of the things that’s kept people here. We have a lot of people moving back and forth across lines of business.

Jules Terpak:

The path that you had to now being president and CEO of the Federal Reserve Bank has been so interesting. Can you tell us a little bit about your college experience initially? Because a lot of the people here today are probably within college, would love to hear about that experience for you.

Mary Daly:

So I came to college almost accidentally, but really with a lot of help. But what do I mean by accidentally? Well, I dropped out of high school when I was 15 to help support my family. And I didn’t come from an upbringing where college was ever discussed. I didn’t know anybody who had gone to college. I didn’t even realize at that point that my teachers in primary school probably had gone to college. I mean, they must have gone, but I didn’t know that. So I’d never really heard of college. I knew people went to be court reporters and that you got a community college certificate, but I didn’t know many people beyond that.

So I drop out and I think that I’m going to be a bus driver or something else. I’m scraping together different jobs, got lots of part-time jobs to make ends meet. And I was lucky. I met a woman, Betsy, still lover her and know her today. Betsy was in her thirties and she just took me under her wing, and she said, “You’re going to need to get a GED or you’re not going to be able to be a bus driver.” And so I got a GED. And then I got the GED and I scored well enough, she said, “You know, should take a semester of college.” “I can’t afford college, and I’m not sure they’d let me in.”

So she helped me with the application materials and she paid my first semester of college. And I really did pretty well. I got some Bs and some As, and she said, “You should go to a four-year school.” And that seemed very foreign to me, and I was kind of terrified about it frankly, because nobody in my entire extended family, not just my immediate family, I’d never known anybody who had gone to college. And so I was going to be the first person to go. But I went and it was… I have this thing that I think of, I don’t say it very often, but I think of it as, I was just doing this. My world was very small, it was like this big. And then I went to college and my world just went… It just opened up, and things I never imagined. I was taking philosophy classes and psychology classes and economics and social sciences. I was like, “Wow, this is amazing.” So then I settled on philosophy and economics, and learned early on that it’s very hard to make a living in philosophy. But I blended those. I never regret any of the classes I took in psychology and philosophy because they’ve helped me recognize something most critical about economics. Economics is about people. If you don’t understand people and how they think about things and what their existential risks are and how they feel about their world immediately, you’re really not going to be able to do a good job as a policymaker or a policy person.

So then I went on, I got a four-year degree, I got a master’s degree, I got a PhD. I actually majored in social sciences, like labor economics and fiscal policy. And then I ended up taking a job at the Federal Reserve Bank of San Francisco, which is macroeconomics and monetary policy. So it’s paid dividends though. It’s paid dividends to be in different fields and bring those different lenses to a field that was dominated by, at that point, people who all thought one way. So I think that diversity has helped me, and it’s something that I really value and we’ve embedded into the principles here in San Francisco Fed because it’s been such an important thing for me in my journey.

Jules Terpak:

Yeah. I love that you brought that point up because when people think of economics, they think of the numbers, all the data, but bringing in the people aspect of it not only makes it more compelling, I feel like, to the average person because that is the biggest component of economics. So I love that you brought that up. Also, just your story in general is so fascinating and being a product of your environment. Today, luckily, we have the internet, which people are able to be exposed to a wide range of cultures and realities, which makes that a better situation, I would say, for college students and kids today. But are there any resources you’d recommend for today’s first-generation college students, whether these were resources that you were exposed to in college or just up until this point that you think would be useful for them?

Mary Daly:

So it’s interesting. One resource that people underuse is conversing with other people, people who come from… I mean, I don’t mean people your age, I mean people who are older who do different things. It’s hard because you think, “Oh my gosh, I don’t even know that person. How will I meet that person?” It just takes a lot of bravery and courage. But I would say that is one of the most underutilized resources there is. The current Treasury Secretary, Janet Yellen, is a great mentor of mine and a great friend. And here’s what she told me because I was expressing. This is way back when I first met her. I said, “Ah, I don’t know. I don’t want to bother you.” And she said, “Mary, just know something fundamentally about people. No one doesn’t like to talk about themselves,” which was taking out the negatives means everyone wants to talk about themselves.

So one resource I would really encourage all of you listening to use is just your courage to go up and say to someone, “Do you mind if I have 15 minutes? I’d just like to hear more about how you did X or Y,” or, “I really admire this,” or, “I saw you in a meeting and I really thought that was great. How did you get here?” Or if you’re thinking about even doing informational interviews, there’s no reason you should wait till the job opening occurs at a place you think you might want to work. Just call them up and try to get an informational interview. These are the things that really are resources that help you navigate when maybe you can’t look to immediate family or immediate groups to know how to do things. It’s something that I do all the time myself still. I do actually continue to reach out to people if I’m trying to make a tough decision or I want to think about, “Hey, how would someone else approach this?” I absolutely use that resource constantly, and it’s one that, again, I would really encourage you to use.

Jules Terpak:

I love that advice, especially for my generation. We’re always head down our phones, whether we’re on the train, the elevator. I think sparking those conversations is more uncomfortable than ever, but getting out of your comfort zone, that’s where you’re going to lead to growth. So going to take your advice too, getting into your career journey, what was your first job or internship? Just talk about how that eventually led you into your current role and just the San Francisco Fed in general.

Mary Daly:

So do you want me to roll all the way back to my job that I did as a teenager or just start after college?

Jules Terpak:

Let’s do college. Yeah.

Mary Daly:

Okay. So after college, I went right into graduate program because I was capable and I was doing economics well. And then I got into this graduate program and realized I was on a train that I had never questioned about whether I wanted to be on. So I was in a PhD program, I stopped, I got a master’s degree. And then I went and took jobs in the most unlikely of things. I went and worked in the theater. I was not an actress. I did prop design and prop dressing. So I would put the props up for people. I did the moving stuff around in the backstage, handing people their costumes and their props. I also did all the accounting for those different things. And I was in Chicago, so I put together all these little jobs at different theater companies and even a dance company doing this. And I did that for about a year because I actually loved the arts.

And then I got to the point where I was like, this probably isn’t my destiny to do this because I like going to the arts, but I don’t want to actually do that all the time. And I really miss economics and public policy. So that’s when I went back to get my PhD and I went to… But it helped me a lot because I was in a sort of straight econ program, not in a public policy school. But when I went the second time and got my PhD, I went to the Maxwell School of Public Policy and got my PhD in economics at Syracuse, which had a public policy interdisciplinary approach to get my degree and go on. And then I came out and I went to a postdoc because I wasn’t sure I want what I wanted to do. I wanted to make sure that I was really testing all the options.

So I went and worked in a poverty center at Northwestern and did a variety of things. And only then I went out on the job market and I had a range of jobs that I could choose from, and I chose, again, the San Francisco Fed, which was my job I’ve been at since that time. And it’s interesting because it was the one on my list of jobs that my advisors thought was the least likely for me to take, because it wasn’t in labor and economics, it was in macro monetary policy. It wasn’t in fiscal, it was in monetary. And it was just so different. But what attracted me to it is I got to use all the skills. I got to be out with the people in public engagement. I got to do economics for publication, researcher, like an academic. And then I got to do research that directly influenced policy for the American people.

I guess the point I want to make on all those things is, I’ve taken some unlikely jobs and it’s been totally worth it. I didn’t do them because I was forced to. I did them because I wanted to. And people looked at scans like, “Why would you think that would go with this?” And some people told me that I would never make it. I’d never make anything of myself because I did theater and then I did this other thing and I went to the Fed. But what I have learned is, you can make what you want out of your career by just following things that seem right to you and you have a logic of how they’re going to work together.

Jules Terpak:

For sure. It doesn’t sound like your career path was linear. And I think in college, no one really warns you about that, but that is the case for most people. Your career path is by no means linear, but you get all these puzzle pieces along the way that eventually fit together nicely. And that’s exactly how it sounds for you.

Mary Daly:

Sure.

Jules Terpak:

Yeah. Yeah, for sure. I want to get into a bit of authenticity at work. Ideally, people find a career that best aligns with their nature, and you’ve talked about in the past about the SF Fed having an unreserved culture. Can you elaborate on that?

Mary Daly:

Sure. So we really are, as I said, a people-first organization. And one of the things we strive to do is create, it’s a term that people use, is psychological safety. So what does it require to have psychological safety? And what does psychological safety give you? What gives you the ability to be your best self, to bring your best ideas, to not be afraid to raise your hand, to not be afraid, importantly, to question authority or to a question the group view. All of that requires feeling safe. And to feel safe, you have to be authentic. If you’re constantly distracted, hiding yourself or trying to fit in by putting a uniform on or some sort of a veil that says, okay, that’s corporate, or Fed, Mary or whoever, that sucks up all your bandwidth. And if your bandwidth is taken on those things, then you can’t bring your best ideas. You can’t feel comfortable enough to raise your hand. And institutions like the Fed, we rely on people being willing to question, willing to say, “Maybe we should do it this way. Why do we do it that way? How can we do it better?”

So it is great for the organization to have this safe space, which is authentic, but it’s also really good for our people because they can feel relaxed. And I think the pandemic, we were on that journey, which I’m very proud of, but the pandemic really helped because we’re all in Zoom and you see people’s families, you see that there’s sometimes in their closet so they can zoom and still be private, that you see that there’s stresses in people’s lives that often kind of bleed in to the day that they’re there for work. And I also saw day in and day out our people show up and give everything they could to serve the American people in this time of crisis. And putting that together, I just think that’s the best example of why authenticity works. It doesn’t mean that you’re constantly thinking about yourself and nobody cares about the work, it means that you’re able to be yourself in a way that you can fully do the work without having to sacrifice who you are.

Jules Terpak:

Awesome. Yeah, just kind of embracing your collection of experiences. I think sometimes, especially for recent college graduates, there’s a lot of comparison of your peers about if I’m doing enough and should I act more like this person? No, just embrace your collection of experiences, bring what you have to the table. But what advice would you give to a job seeker today who wants to find an employer culture that aligns with their values? Sometimes the first job, it’s not always going to be the ideal situation, but how would you advise they go about that?

Mary Daly:

So the first thing that you have to do, I believe, is go and ask yourself, and that’s not going to be done probably by talking to your peers even. It’s really going inside yourself and saying, what are the three most important things in a job for me? And often if you’re, especially when you’re younger, what I hear is people list, pay, a particular job title and a particular position. And that’s not culture, and so why [inaudible 00:20:54] go back and think about what would be important in a culture. Do I want a collaborative culture? Do I want a freeform culture? What do I want? Do I like a little hierarchy? Do I want to work with older people so I can get some training? Or do I just want to be in a, I don’t care what that organization’s like.

And you list those things, and then when you go in for the interview, use your instincts. I would say you can read the materials, you can get a sense before, and make sure you read the materials about the place you’re going to interview, it’s not just to prepare so you can do a good job at the interview, it’s actually, you can learn a lot from what people are saying about themselves, an organization. And then the next thing you can learn is when you go to the interview, see if the people you’ve interviewed with reflect what you read. So if a culture is telling you they’re wonderful through the materials, but you get in there and you’re like, “Nobody seems very happy.” Well, that’s probably a red flag. But if you see, “Oh, people are talking about, just naturally, what I’ve read in the materials, what the organization says it aspires to be,” if they’re energetic and engaged, then you can fit.

And the other thing I would say is that your cultural fit journey will change as you change. What works for you when you’re in your early 20s might be different than what you feel works for you in your late 20s, early 30s as you get older. And so that’s going to be part of it, but you should always keep a few north star things. So for me, I’ll tell you mine, my north star is I need people who are collaborative. I’m a team oriented person and I want everybody on the team to own. And so when I was a young person working here and a much earlier entry level role, that’s how it was. We were team oriented. It was everybody’s in it together, we’re all owners in that process. That was an important cultural tenant for me are. And I want a kind culture. I want a culture where people have each other’s backs. And so for me, those were two things that I’ve carried throughout my entire career. And you should have a couple of those, and then things that fit your lifestyle as you age.

Jules Terpak:

That’s super helpful advice. And now we’re going to get into two lightning round questions before we get into the audience questions, which I’m really excited about. But what are some of your favorite interview questions, or can just be your ideal interview question to ask a candidate so those listening can maybe have that in mind going into interviews soon.

Mary Daly:

Sure. So one thing that I ask, and I don’t know how many people ask it, I do know another President of another reserve bank asks it, and that is, what makes you excited to get up and come to work in the morning? So I ask candidates all the time, what makes you excited? And that helps me understand, one, are they excited and two, what does excite them. It helps me understand whether they’re a good fit for that job. I’ve had people say something and then I move them to a different opportunity because I’m like, “This might not be your job, but that’s definitely your job.”

Jules Terpak:

A very timely question for right now is, if you could share one thing with today’s college students who might be concerned about the current state of the economy as they get ready to graduate, what would it be?

Mary Daly:

The world today is not the world tomorrow. So you’ve got to keep this in your mind. It’s so easy to think the state we’re living in is the future state. And so you’ve got to have in your mind that the world’s constantly evolving and that what’s challenging right now will be easier later. And while it is challenging, you’re still making progress. You don’t have to sit in stasis waiting for it to get better, you can make progress on your goals even when the economy isn’t where you want it to be because it’s going to get there. And when it gets there, you want to be ready.

Jules Terpak:

That’s super helpful. And now we’re going to get into the audience’s questions, which I’m very excited about. There’s a ton of great questions here. The first one is, how do you approach making tough policy decisions?

Mary Daly:

We’re voraciously curious. I actually have a sticker about this where I say, we’re curious, we’re confident, we’re humble. So here’s how I approach making tough decisions. We have voracious curiosity, so that’s evidence, talking to people, models, data, history, put it all together, rigorous, rigorous evidence about how can we do our best work. Then we make the decision, because we have to, eight times a year we’re making a policy decision at the FOMC. And then right after we’ve made the decision, we start again humbly saying, what could we have done better? What do we need to learn? What would give us better information? How will we continue to make progress? So that kind of constant cycle of holding yourself to evidence, taking the decision and then being humble enough to say, what else do I need to learn? How else could I get a better decision out of our process? That cycle is how I make policy decisions, whether they’re hard or easy, but it’s a critical win [inaudible 00:25:45].

Jules Terpak:

Okay, awesome. And then there’s a lot of different conversations going around right now around the education system, even like graduate degrees, someone asked, “Are graduate degrees recommended for working at the SF Fed, particularly for economics related roles?”

Mary Daly:

So if you want to do economics in research, then a PhD is required. But we have new graduates, just graduated from college who come in as research assistants and do that kind of work. We have a lot of people who come in and work in our supervision and credit, that’s bank supervision, come in as… They do economics, but they’re doing it in that capacity, they actually turn into bank examiners and things of that sort. So you do not have to have a graduate degree to work at the Fed. We have almost 2,000 employees here at the San Francisco Fed spread out over, we have four locations and the San Francisco head office that employ people. And there are opportunities up and down the spectrum of skills and up and down the spectrum of degrees and importantly, over a broad span of interest. So you’re interested in people and culture, HR, we have a place. You’re interested in economics, we have a place, finance, auditing, you name it, we’ve got it.

Jules Terpak:

Someone asked, what do you consider to be the main idea or principles behind economics?

Mary Daly:

Human behavior the principle of economics is understanding, at a more aggregate level, how humans organize themselves and respond to incentives. And so if I know how people respond to incentives and organize themselves, I know a lot about how the economy operates.

Jules Terpak:

Awesome. And then with being a CEO, how do you manage a busy life? I’m sure a lot of these college students are wondering that. Their lives are busy, busy with classes, work, everything. How do you manage with all of that?

Mary Daly:

With intention. So I mean, really, seriously, you have to be intentional about your life. And so I have a wife, I’ve been together 32 years, and we are… I want to prioritize that. I want to prioritize my home. I want to be a member of my community, so I have to prioritize my community. I have a big job, so I’m managing what I do. And really that prioritization matters. So each year I go through an exercise, I would offer this up to you, of saying, “what are the three most important things in each of my roles, family, community, work, that I want to accomplish this year?” And you have to be good at letting things go that aren’t on that list. Really focus on the things that are important to you and your life will be a full fabric then. It’ll be like a beautiful painting at the end with all kinds of little colors. But if you don’t prioritize, you’re so scattered, you’ll never feel like the colors are very rich on any one part of the painting.

Jules Terpak:

Yeah, that’s awesome. Making it clear what you want your focuses to be. And do you have advice for young people trying to find their passions who are struggling right now with that?

Mary Daly:

Stop listening to other people. That’s my advice. Just let yourself go and experience things, and then don’t necessarily use other people as your sounding board about what you’re interested in. So if you haven’t found your passion, you just need to look more. And I don’t mean to look hard or you’re looking hard. Just look more, just expand your horizons. Try things that you think, “I didn’t even think I would be interested in that.” And then let yourself be okay having that journey be slower than other people.

That’s why I say stop talking to people about that. Not in general, keep talking to people, but don’t talk to people about that. Because I do think all of us, we’re human, we get caught up in comparisons with each other. And if you compare with each other, you’re unlikely to find your own path and you’re unlikely to find what really moves you. So if your friend is doing something you think might be interesting, you could always talk to the person and try it, but you’re going to learn the most about yourself by actually jumping right in and trying things and then deciding, “I don’t really like that” or “I really love that and I had no idea I would.”

Jules Terpak:

So good. And then the last question we have, it’s a bit of a lengthier one, so I’ll try to read it quickly. But as a product manager in FinTech, I’m curious about your attitude to technology. Can you elaborate a bit about the place of technology in the financial sector and how to adapt it faster and less painful? Maybe you can share some of the last big tech transformations which were made in the SF Fed.

Mary Daly:

So it’s funny. The question is… Most of what we do is technology in the financial system. Checks and things have been moving away for a long time. All these payment platforms are in technology. The Fed’s about to launch, in the summer, something called FedNow, which is a real-time gross settlements system, which is basically instant payments rails, and that’s all built on technology platforms. So basically one of the biggest groups in our Bank, in the San Francisco Fed, is technology, information technology services. They do everything from your local desktop delivery, that’s a small fraction of their overall business, to doing applications that run the payment systems and the banking supervision systems for the country. So technology is not something that’s foreign to us. We do a lot of technology transfer projects and technology transformation projects. One of the biggest ones coming up for us is this process called FedNow. That’s a huge technology project that the Federal Reserve System is taking on and in the Federal Reserve Bank of San Francisco is helping with.

Jules Terpak:

Okay. I’m really interested to keep up with that. Mary, thank you so much for your time and wisdom. And for everyone in the audience, I hope that this was helpful to you. I’ve learned so much. Mary, I’d like to give you an opportunity to share anything else that you want to say to the audience. If not, we can wrap things up today.

Mary Daly:

So the last thing I would like to say is that I know it’s somewhat frightening when you come out, and especially when you’re coming out in an economy that seems a bit disrupted, but you all are resilient. You came through the pandemic. I mean, you’ve got that superpower of resilience and you’ve already demonstrated that. So that’s your fallback. The world looks scary. What generation’s going to be better to manage it than you all? So I just think you’ve got this and if you need any help, we’re here to do it.

Jules Terpak:

I agree. Thank you so much Mary, and thank you everyone for being here today.

Mary Daly:

Thank you.

Sunny Zhang:

Yes. Thank you all again for joining us. And everyone, please join me in the chat to thank Mary for sharing her wonderful insights and experience, and to thank Jules for moderating. If you have a moment, just take 30 seconds to help fill out our feedback serving in the chat so we can continue to bring awesome events like get like this to you in the future, and follow Handshake and the SF Fed on Instagram for more event announcements in the future as well. And that is all we have for you today. So thank you so much and have a wonderful rest of your day.

Jules Terpak:

Thank you everyone. Have a great day. Thank you.

Mary Daly:

Thank you.

Summary

Watch President Daly’s fireside chat co-hosted by Handshake, a network of university and employer partners for students, and moderated by TikTok digital culture content creator, Jules Terpak. Their conversation covers Mary’s experiences early in her career, key career information, industry tips, and more.

Sign up for notifications on Mary C. Daly’s speeches, remarks, and fireside chats.

About the Speaker

Mary C. Daly is president and CEO of the Federal Reserve Bank of San Francisco and helps set American monetary policy as a Federal Open Market Committee participant. Since taking office in 2018, she has committed to making the SF Fed a more community-engaged bank that is transparent and responsive to the people it serves. Read Mary C. Daly’s full bio.

Related

In her commencement address to graduates at Utah Valley University, President Mary C. Daly reflects on her career journey at the San Francisco Fed—from her first days as an economist to the cover letter she wrote to become president—and how embracing her uniqueness is a key component of her success.

3D Public Servants: The Courage to Be Human

President Mary Daly reflects on the need for public servants to be vulnerable and fully human to help solve the most pressing issues of our time.

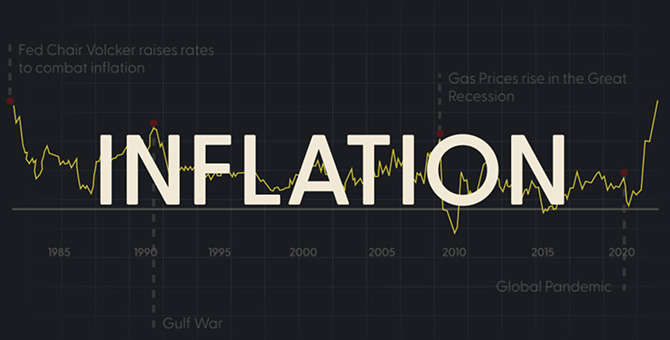

Ask the SF Fed: Inflation and the Economy

Watch our live discussion on Inflation and the Economy with Sylvain Leduc, EVP and Director of Research at the San Francisco Federal Reserve.

What was the Fed’s February 2023 policy decision? And how does it affect you? FOMC Rewind breaks it down.

How is the Fed working to lower inflation? The first video in our 60-Second Explainer series provides a quick review of how higher interest rates can help bring inflation down.