Introduction

Thank you, Dean Phillips, it’s a pleasure to be here. A while back, I was asked to speak to a group of educators about the messages to get across to their students about the Federal Reserve. I naturally assumed that textbooks were updated about as frequently as when I was in college—in fact, that they might still be using the same ones.

This was important, because while economic principles haven’t changed, the discussion about the Fed and our role has; with the events of the past seven years, we’re not talking about reserve requirements anymore.1 We’re talking about over a dozen emergency lending programs, a 4 trillion—that’s trillion with a “t”—dollar balance sheet, and a newfound openness to discussing our future policy decisions. We’re talking about breaking new ground in monetary policy.

The good news is that college textbooks have been pretty well updated, and cover a lot of these new developments. But even so, I thought there were broader questions about the Fed’s role in the economy and society that got lost in the details.

I was left with the question: what are the important take-aways about the Fed? The answers are pertinent to anyone studying business or economics today. So with that in mind, I’d like to talk about three fundamental questions regarding the Federal Reserve. First, what’s special about the Fed that makes it so important? Second, what does the Fed actually do? And third, why do the Fed’s policy decisions matter for the economy?

What makes the Fed so important?

Before I proceed, I am obligated to mention that my comments reflect my own views and not necessarily those of anyone else in the Federal Reserve System. With that disclaimer out of the way, let me turn to the first question, what makes the Fed so important? Let’s first establish that it actually is, or at least is viewed by many as being so. [Figure 1] I’ll bet most everyone in this room recognizes both Ben Bernanke and Janet Yellen, which I think makes the point. Whenever the Fed decides—or doesn’t decide—to do something, it’s there in the newspaper, above the fold, main headline.

When there’s a new Chair appointed, when there’s speculation about who that will be, it occupies a front-and-center place in the news cycle, as we saw last year. You all know who the Fed Chair is, but do you know who heads the other financial regulatory agencies? These are important institutions, with critical roles in overseeing our banking system, but few Americans can name their heads, and none moves markets with a single sentence.

What’s different about the Fed? Well, obviously we are unique in that we—and we alone—set monetary policy. The Federal Open Market Committee—the FOMC—gets together every six weeks or so to discuss, debate, and make policy decisions that are incredibly important for the U.S. economy and, by extension, the global economy. But more than that, we’re a unique institution in the federal government, both in function and in structure.

One key difference between us and the Congress, or the President, or a state legislature for that matter, is that we’re not elected. We don’t have to get House or Senate approval for what we do; we don’t have to run it by the President; there’s no one from the Treasury Department at our meetings. This gives us a great deal of autonomy in making monetary policy. Compare that to the process of changing the tax code, which must pass both houses of the Congress and be approved by the President.

Now, obviously we’re overseen by the Congress, and, as a sidebar for those who may have heard otherwise, we are audited! If tomorrow Congress decided to abolish the Fed, they could do that, assuming they got presidential assent. Which I hope they don’t. In part, because I like my job, but mostly because this arrangement allows us to make what we think are the best policy decisions. We don’t have partisan battles to win or the distraction of election cycles, which means we can avoid the short-termism that can interfere with decision-making. Over our history we’ve built an institution staffed with highly experienced, non-partisan experts committed to our public purpose. We’re free to focus not just on immediate results, but on medium- and longer-term outcomes that we truly believe are in the best interests of the country.

When I sit with my colleagues at the boardroom on Constitution Avenue in Washington, D.C., there’s no discussion of politics at all, except to the extent that they shape the federal policies and the economic environment in which we operate. That room is almost a bubble—an oasis of political neutrality in what most people view as the most partisan place in the country. We just discuss the best research and analysis, look at all the information we can gather, and try to come to the best decision.

So my answer to that first question is that what makes the Fed so important is its ability to regularly make decisions that affect the economy…but moreover that it has the freedom to do so by virtue of the unique role bestowed on us by our democratically elected government. That carries a lot of accountability and a need for transparency. The license the American people have given us holds us to a very high standard, and we take that trust and responsibility very seriously.2

What does the Fed do?

On to the second question: what does the Fed actually do?

I don’t want this to sound condescending—if you’ve voluntarily shown up for a talk about the Fed, you’ve probably read all about us in your textbooks and in the news. If you’re here under duress, it means the professor who forced you to come uses those same textbooks. You know that the Fed makes cash available across the country, runs key parts of our payments systems, conducts oversight and regulation of banks and other financial institutions, and, of course, makes monetary policy.

However, despite what you may hear from some commentators, we don’t actually print money. The Bureau of Engraving and Printing in the Treasury does that. So, if we’re not printing money, what does monetary policy do? And why is there that confusion? Well, the simple answer is that we buy and sell securities. In ordinary times, those are mostly short-term Treasury bills. Post-financial crisis, however, has constituted extraordinary times. We shifted to purchasing long-term Treasury and mortgage-backed securities—you know this as “quantitative easing” or “QE.”

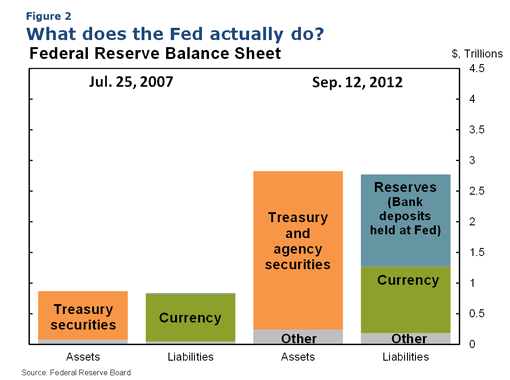

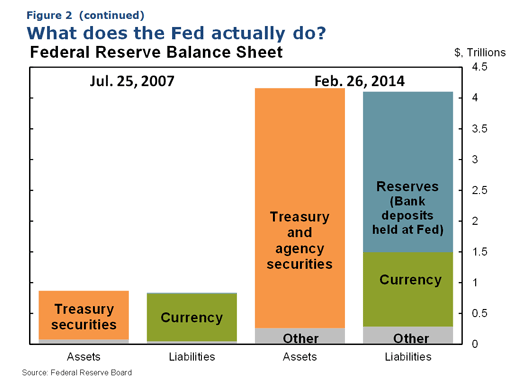

How do we pay for these securities that we are buying? If you look at this slide here [Figure 2A / Figure 2B], it shows the asset and liability sides of the Federal Reserve’s balance sheet. I’ll start with how the balance sheet appeared in July 2007, on the eve of the financial crisis. At that time, we owned a little over $850 billion of assets. As you can see, our asset holdings of Treasury securities are largely balanced out on the liability side of the ledger by the amount of currency in circulation, which is treated as a liability of the Federal Reserve. In addition, there’s a relatively small amount of reserves, which are deposits that banks keep in their accounts at the Fed. As things go, that’s all pretty boring.

In normal times, monetary policy is conducted by making small changes to the amount of reserves that banks hold with us by buying or selling some of our Treasury bills. This shift in the supply of reserves affects the interest rate that banks pay each other. Thus, we “set” short-term interest rates by making small changes in the supply of reserves.

With the financial crisis, however, our balance sheet got a lot more interesting…and a lot bigger. Early on, we increased reserves to drive short-term interest rates close to zero. But we didn’t stop there. Take our asset purchase program, for example. When we buy these Treasury and mortgage-backed securities, what we’re doing is purchasing them on the open market and then crediting the bank accounts of the institutions we bought them from with reserves in their Fed accounts. But those reserves did not exist a moment before we made that transaction. A rudimentary analogy would be: your personal bank account is at zero, but you go into a store anyway, and at checkout, you have the power to say, “The money has been paid.”

The Federal Reserve has a monopoly on this ability to generate bank reserves out of thin air. Likewise, we can extinguish them when we wish. We have the unique capability to conduct open-market operations and fundamentally change the amount of liquidity in the financial system. This, in turn, affects the prices of assets, which affects financial conditions, which affects the economy.

I said earlier that a lot of the discussion has changed because of the current environment, and this is one area that’s very different from its historical precedent. Because we’re making these asset purchases, we’ve added colossally to both sides of our balance sheet. When we make purchases that enlarge the asset side, the additional reserves we create for financial institutions expands the liability side. You can see this in the second set of bars in Figure 2. In normal times, our balance sheet doesn’t change much, because moving assets by a few billion dollars had a sizable effect on interest rates. Since the recession, it’s been a different story. The first two rounds of asset purchases expanded our balance sheet to about $2.8 trillion, as of September 2012. Since then, the QE3 program has expanded it to just over $4 trillion. Which demonstrates the extent to which these last several years have been extraordinary times for monetary policy.

So the answer to the second question, what does the Fed actually do, is that, yes, we move cash around, we oversee and regulate financial institutions; but what’s truly special is that we have this incredible ability to generate reserves in the banking system, thereby affecting interest rates.

Why do the Fed’s policy decisions matter for the economy?

That leads directly to the third question, why does the Fed matter for the economy? And though it wasn’t by design, we did get two natural experiments that illustrated the power of monetary policy in the past year.

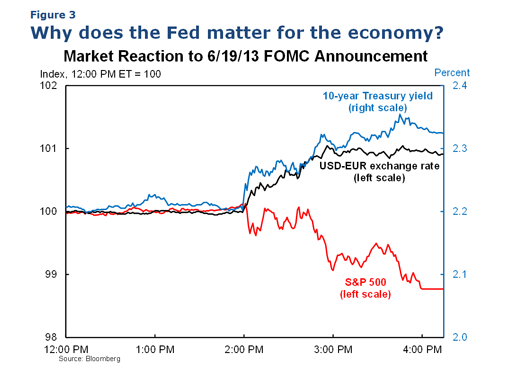

Financial markets pay close attention to the public announcement that comes out after each FOMC meeting, because it contains important information about the future path of interest rates, the relative returns to investments in stocks and bonds, the likely value of the U.S. dollar, and so on. So the day of the FOMC statement can be a day of major movements in financial markets.

Let’s look at a specific example of a market reaction to monetary policy. Figure 3 shows what happened after the June FOMC meeting last year. The black line shows the value of the U.S. dollar against the euro as the day progressed, the red line shows the level of the S&P 500 stock market index, and the blue line is the yield on a 10-year U.S. Treasury note. Markets were pretty flat that day up until the FOMC announcement came out at 2 p.m. eastern time. At the press conference following the announcement, then-Chairman Bernanke expressed optimism about economic conditions and said that QE could get scaled back, or “tapered,” later that year. This set off what has been termed the “taper tantrum” that roiled financial markets. Investors had clearly been expecting tapering to occur much later.

What effect did this have? You can see that the statement had an immediate impact, albeit a small one, if you look at 2 p.m. As the day progressed, the market response intensified. The 10-year Treasury yield went up about 13 basis points that day, rising another 20 over the next few days, which translates into higher mortgage rates and higher interest rates for longer-term lending. So the market’s response brought long-term interest rates up substantially. Economic theory tells us that if interest rates are higher, then the return on bonds is higher, which raises the opportunity costs of investing in the stock market… and, accordingly, the stock market fell, dropping about 1 ¼ percent by the end of the day and almost 5 percent by the following Monday. Similarly, theory tells us that when the return to holding U.S. bonds rises, the foreign exchange value of the dollar should rise. That’s exactly what happened, with the dollar rising nearly 1 percent against the euro that afternoon.

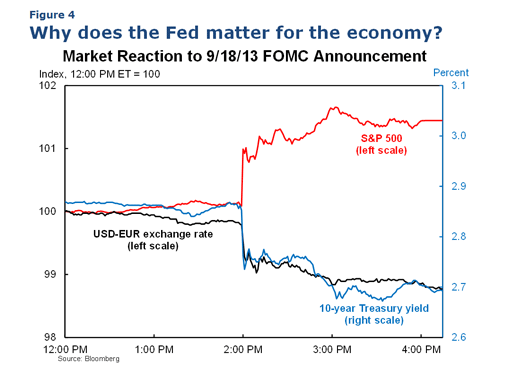

The market reaction to the FOMC statement on September 18 is a direct contrast. This slide [Figure 4] shows a tick-by-tick—again, it’s all looking relatively normal, up until 2 p.m. eastern time, when up on the Fed website pops the FOMC statement announcing that… nothing’s changing. For most organizations, saying it’s business as usual wouldn’t have much of an effect. But this time, many market participants thought we were going to start cutting back on our asset purchases. This is a real-life example of how important expectations of monetary policy are, because this announcement—that things were staying the same—was news. Because they expected us to begin the taper, market participants saw not changing anything as essentially an easing of monetary policy.

If you look at the chart, you’ll see the response in the markets was immediate, and the reverse of what happened on June 19. The Treasury yield went down; the exchange rate dropped; and the S&P went up.

By the way, this is a great example of economic theory playing out in practice exactly as it’s supposed to. Economists like it when this happens because we can counter witticisms like, “An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.” In this case, what happened was exactly what economists tell us monetary policy should do.

So, how do these movements in asset prices affect the economy? The theory behind these reactions follows the basic logic you’ve all been taught in class: If the stock market is higher, people feel wealthier and that makes them more willing to spend. Lower interest rates mean a greater appetite for making long-term investments, whether it’s individuals buying cars or businesses investing. A weaker dollar, all else being equal, makes our exports cheaper and imports more expensive, which also helps increase spending on U.S. goods and services.

That’s the theory. How can an empirical economist say for certain that the Fed’s policies are working? We find that by looking at the areas of the economy that are doing the best. The answer—along with the answer to the question: Why does the Fed matter to the economy?—is that the rebounding sectors are the interest-sensitive ones. Auto sales are pretty close to where they were before the financial crisis. Home sales and construction—though they’re nowhere near as strong as right before the crash—are the areas of the economy that have improved most. If you look at sectors that aren’t sensitive to interest rates, like services, or non-durable goods, they’re still relatively depressed. They’ve come back from the lows they hit, but haven’t recovered in the same way as interest-sensitive sectors have.3

This gets to the heart of question three, why the Fed matters to the economy: because monetary policy affects the way people behave—the way they spend and save and invest—from individuals to corporations.

Conclusion

To sum up: the Federal Reserve has been given unique license by the government and the American people to make critical public policy decisions. We make monetary policy to steer the country through both ordinary and extraordinary economic times, using the best tools at our disposal. And the policy decisions we make fundamentally alter the way people and businesses make decisions.

Thank you.

End Notes

1. Williams (2011).

2. Williams (2011).

3. See Williams (2014) and Cúrdia (2014) for evidence and discussion.

References

Cúrdia, Vasco. 2014. FedViews. Federal Reserve Bank of San Francisco, February 13.

Williams, John C. 2011. “Economics Instruction and the Brave New World of Monetary Policy.” FRBSF Economic Letter 2011-17 (June 6).

Williams, John C. 2014. “Monetary Policy at the Zero Lower Bound.” Working paper, Hutchins Center on Fiscal & Monetary Policy at Brookings.