SF Fed Blog

-

Economic Letter Video: The Changing Disparity in Prices Across States

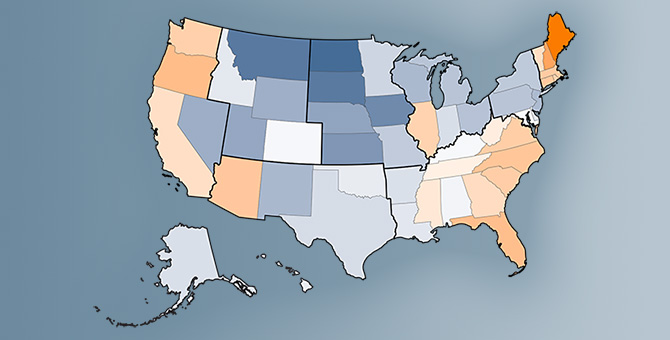

Price differences across U.S. states and regions widened during the pandemic years. In our Economic Letter, “The Changing Disparity in Prices Across States,” we find that states with above average price levels before the pandemic generally saw higher inflation from 2019 to 2022 than states that had below average price levels. Watch our Economic Letter […]

-

Roundtable on AI and Product Development

How are generative artificial intelligence (GenAI) tools being integrated into consumer product companies? Do they improve product development, marketing strategies, and customer service? How do they impact labor productivity? And what other functional enhancements can GenAI provide across an organization? To address these and other business questions, we recently convened a roundtable of executives within […]

-

Advisory Council Observations: February 2025

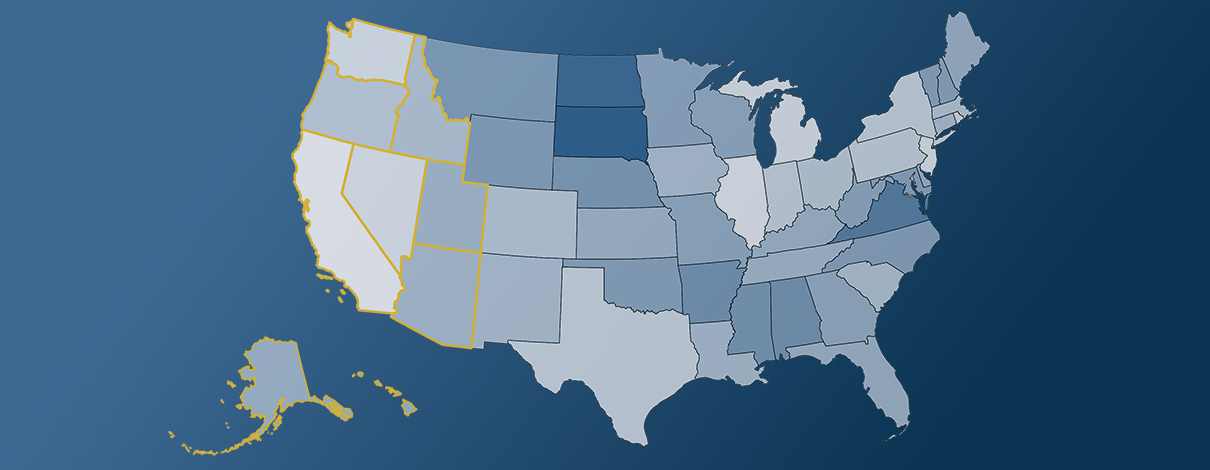

The members of the SF Fed’s Advisory Councils provide valuable perspectives from around the Twelfth District. In this edition of Advisory Council Observations, we share what we learned at our most recent council meetings.

-

Economic Letter Video: Pandemic-Era Demand Squeezed Housing Inventories

Housing prices surged as housing inventories dropped to historically low levels in the first two years following the onset of the pandemic. In our Economic Letter, “Pandemic-Era Demand Squeezed Housing Inventories”, we find that the decline in housing inventories during these years was driven by an exceptionally high demand for housing rather than a low […]

-

Regional Data Page Shows How Economy Varies Across the U.S.

How much variation in labor market conditions and inflation rates is there at the sub-national level? Our Regional Indicators page maps out labor market, price, and earnings data across the country.

-

Economic Letter Countdown: Most Read Topics from 2024

With the new year fast approaching, here’s a countdown of our own to close out 2024. Check out the list of our most widely read FRBSF Economic Letter topics in 2024, featuring research and insights from SF Fed economists.

-

Economic Letter Video: Productivity During and Since the Pandemic

Watch our Economic Letter video with Huiyu Li, research advisor, to learn more about productivity growth and its cyclical patterns.

-

Immigration Surge Has Slowed: Updated Estimates of Net International Migration

Updated analysis using new and revised data suggests that the flow of immigrants into the United States slowed in late 2024. Despite this drop, recent immigration flows remain three times the historical average.